I have the information you need regarding the ability to file taxes without paying them, info2062. Allow me to discuss it here for clarification.

Please know that you'll need to pay your payroll taxes before you can file your tax forms in QuickBooks Online. Hence, you'll want to manually file your forms directly to the Internal Revenue Service and your respective agencies. You can generate the Payroll Tax Liability report for the details of your local tax obligations.

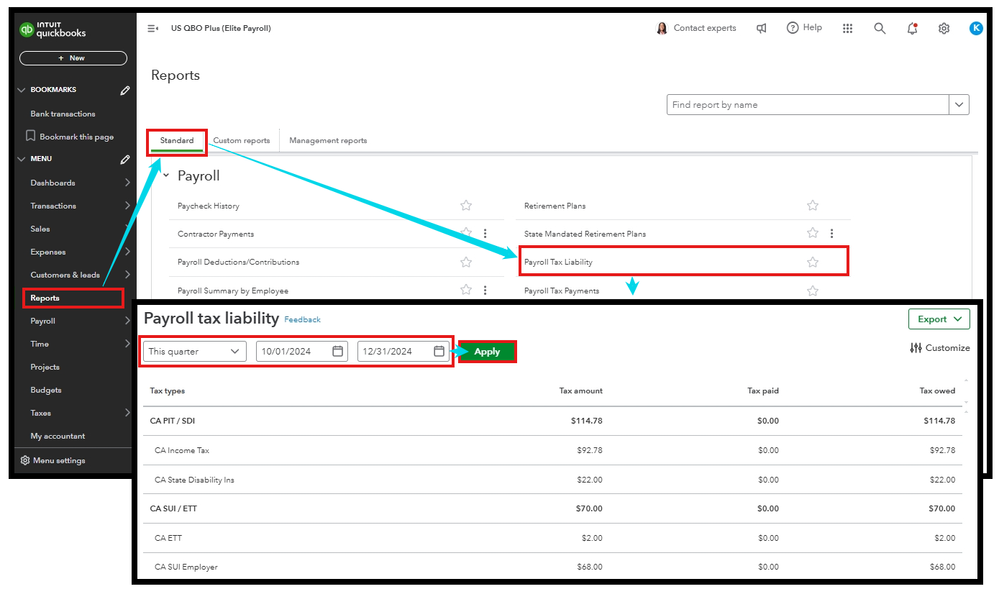

Here's how:

- Select Reports, then the Standard tab.

- Scroll down to the Payroll section, then locate and open the Payroll Tax Liability report. You can also utilize the Find report by name field.

- Choose the appropriate date range and click Apply.

Additionally, you'll want to refer to this article for guidance on documenting tax payments made manually outside QuickBooks: Record tax payments made outside of QuickBooks Online Payroll.

On the other hand, access your past tax forms and payments by following the steps from this material: View your previously filed tax forms and payments.

We'll continue to monitor this thread, so please don't hesitate to leave your tax payments-related queries here. We're always ready to provide the data and resources you need.