Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a client that wants the employee to be paid set amount (1200, 1000, 900, etc) after taxes. They are paid by salary. Is there a way to accomplish this in Quickbooks Online.

We're pleased to have you here today, @ZN1.

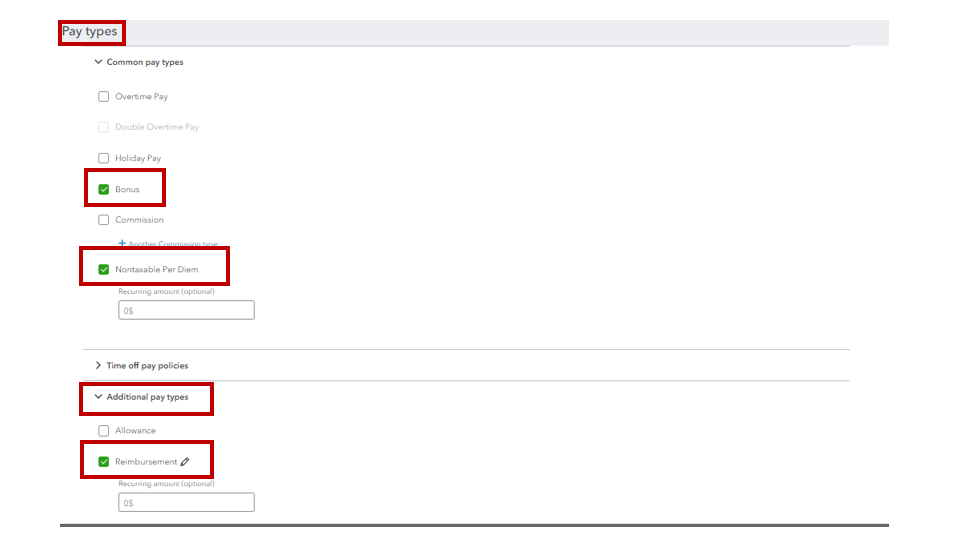

We recognize the urgency of this matter, and the Community Team's priority is to provide compact and concise information to help you get through this situation. Reading your post, you may want to check all the supported pay types and deductions available in QuickBooks Online (QBO).Please be aware that it's the program's basis on whether it's taxable, not taxable, or not. An example is adding a new pay item as Nontaxable Per Diem in your employee setup. However, please note that it still needs approval, and it will depend on the reason why you're adding it. If you wish to continue with this method, we'll write down the steps:

If you're unsure of the steps we've mentioned, it's best to consult your accountant so they can provide another way to handle this type of situation. If you don't have an accountant, we can help you find one. Feel free to visit this page to find an accountant for your business: Find a QuickBooks ProAdvisor.

In case you're still not sure what to choose and that you don't want it to be included in your taxes, you can also consider writing a check for that specific employee. See this page for more details: Create and record checks in QuickBooks Online.

Furthermore, we've got these articles to help you manage employees, invite them to view their paystub, and ensure your data stays accurate inside the program:

Please don't hesitate to comment below if you need further assistance with this, @ZN1. We are aiming to improve your experience using QuickBooks. You can also visit the Community space anytime if you have additional questions or a task you'd like to accomplish inside the program. We've got you covered. Take care, and have a nice day!

I do want the net amount taxed. It is like the after the fact payroll in the Desktop. You put in the net amount you want and desktop creates the gross amount and taxes to get the net amount you want.

Hello ZN1,

I'm here to help achieve your goal of creating payroll checks with the taxable net amount.

We can create a paycheck with a specific net amount as a bonus check. You can follow the steps I'll laid out below as your guide:

Whenever you have concerns about managing your employees and their paychecks, you can pin these articles as your guidance:

You can always post in the forum if you have other payroll concerns.

If you set it up as bonus only that means the tax rates will be ridiculous. Is there no way to do this on a normal payroll check?

Hello, zencandi.

Thank you for reaching out to the Community. Let me share some insights about paying an employee bonus in QuickBooks Online and their tax implications. It's important to note that bonuses are categorized as supplemental wages, which means that they are subject to federal income tax, Social Security tax, and Medicare tax.

Depending on your state, you may also be subject to state and local taxes. It's always a good idea to factor in these taxes when budgeting for your bonus payments or calculating your take-home pay.

However, If you're looking for a way to avoid adding taxes to your employees' paychecks, there's a workaround, set up your employee payroll and mark the Reimbursement or Nontaxable Per Diem under Additional pay types. These are considered nontaxable, so you won't need to worry about adding any extra taxes.

You can also check this article to learn more about paying a bonus check to the employee: Pay an employee bonus.

I've also included an article that you can read to help track your employee and payroll expenses in QuickBooks: Run payroll reports.

I'm happy to answer any other questions regarding taxes or finances. Don't hesitate to reach out. Have a great day!

You can use a gross-up payroll calculator to determine what gross pay will produce the desired net pay.

https://www.surepayroll.com/resources/calculator/payroll/gross-pay

Did you find a solution to this?

I would like an answer to this as well.

Hi there, @justjane320.

If you want to pay your employee an exact net pay amount, you can create a gross-up paycheck in QuickBooks Payroll. You can create the gross-up as a separate bonus check. I'll show you how:

For more information and detailed steps on how to create a paycheck with a net pay amount, check out this article: Gross up a paycheck.

Additionally, you might want to take a look at this article on how to check out your payroll totals, including details on employee taxes and contributions: Create a payroll summary report in QuickBooks.

For more queries about creating a payroll check, ping me back to this thread. We ensure that you are assisted well.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here