Thanks for checking in with us and providing us in-depth details of your payroll concern, siri0726.

With regard to what pay type to apply for your employees, it would be best to contact your accountant or tax advisor. They'll provide you detailed information about this one and how it will affect your payroll taxes.

Once they provided you the pay type, just follow the steps below on how to create the employee's paycheck:

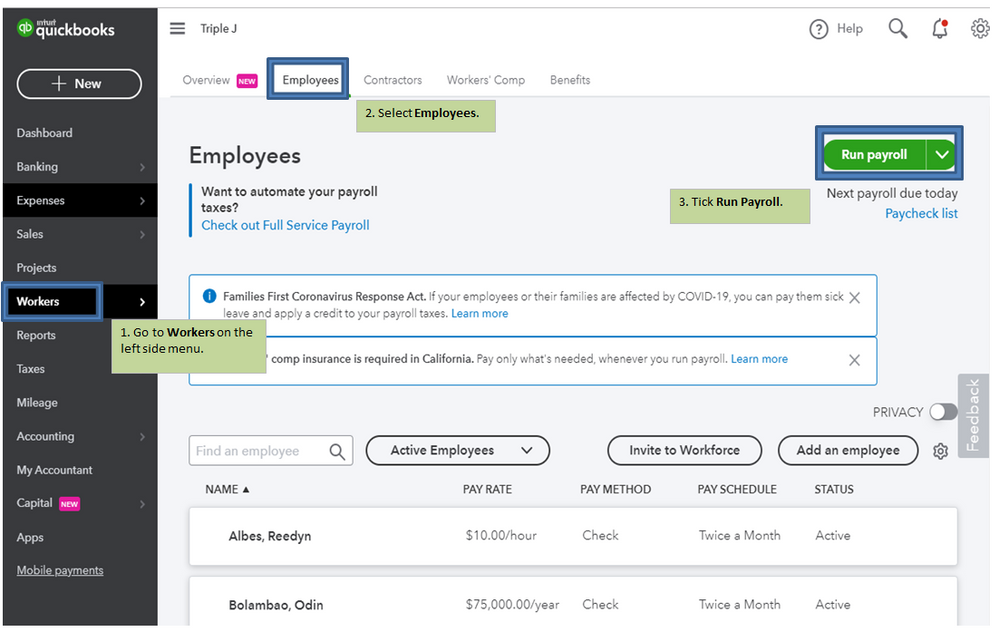

- Go to Workers on the left side menu.

- Select Employees.

- Tick Run Payroll.

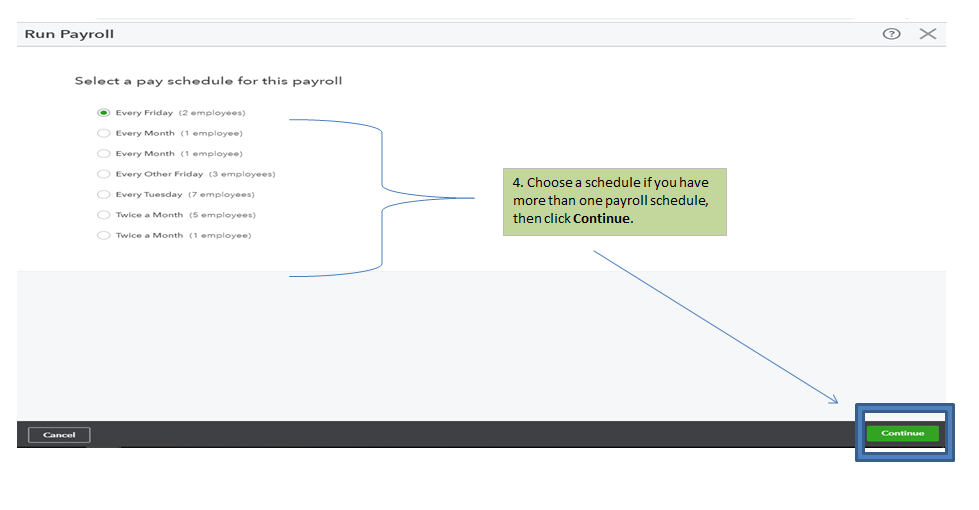

- Choose a schedule if you have more than one payroll schedule, then click Continue.

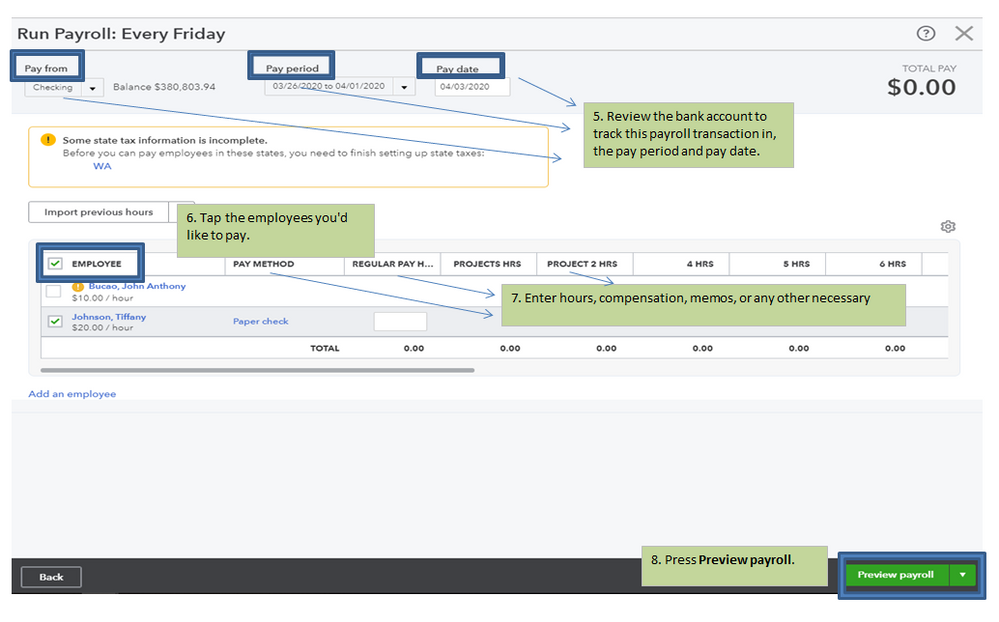

- Review the bank account to track this payroll transaction in, the pay period and pay date.

- Tap the employees you'd like to pay.

- Enter hours, compensation, memos, or any other necessary paycheck information.

- Press Preview payroll.

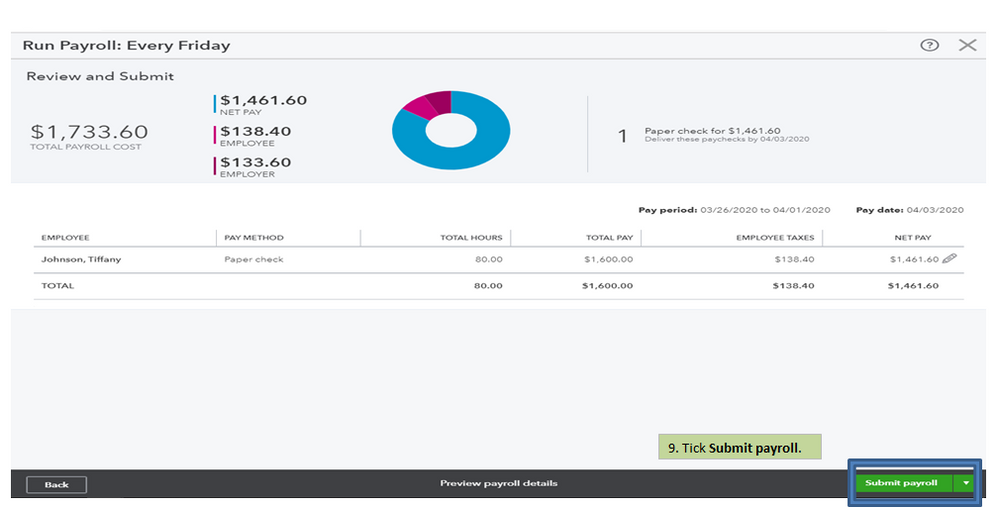

- Tick Submit payroll.

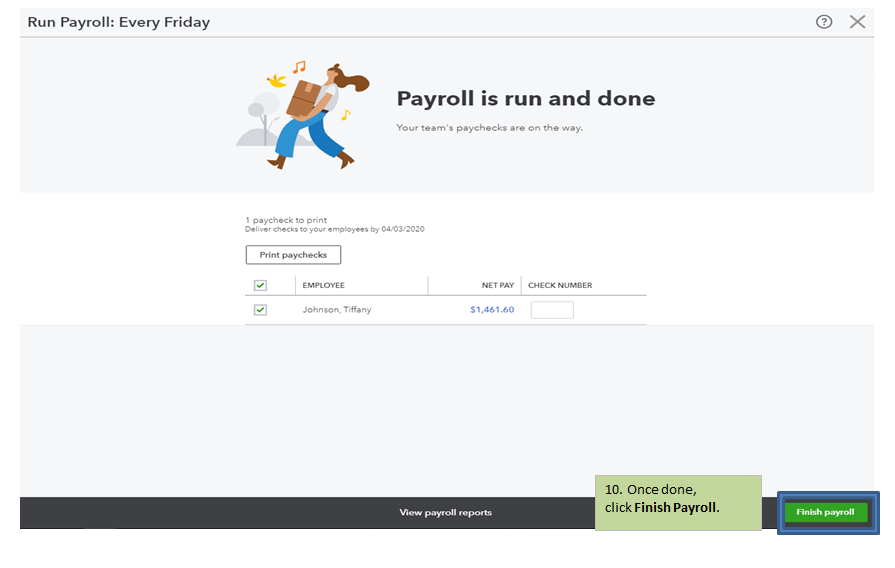

- Once done, click Finish Payroll.

For more details about this one, check out this article: Create paychecks in online payroll.

I have a link here that provides you with articles about managing employee's payroll: Pay employees, enter timesheets, and send payroll forms.

Keep me in the loop if you need a hand with running payroll reports or any QBO related. Wishing you and your business continued success. Keeps safe always.