Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowOur company offers a few different Aflac insurance policies, some are voluntary and fully employee paid, some are automatically enrolled and fully employer paid. How do I set up these payroll deductions, for both the employee and for employer tracking purposes, in Quickbooks Desktop Enterprise? The policy costs will need to be tracked through payroll, but the company also pays a monthly payment for all policies directly to Alfac, so the two transactions need to offset each other as well so it does not appear as if we are double paying. Thank you!

Hi there, @lpenney18.

You can set up a payroll item for your Aflac insurance for both employee and employer. Let me guide you through the steps.

Before we start, please know that deductions that fall under the cafeteria plan reduce the employer's share of taxes because the wage reduction is not subject to Social Security, Medicare, and federal unemployment taxes (FUTA).

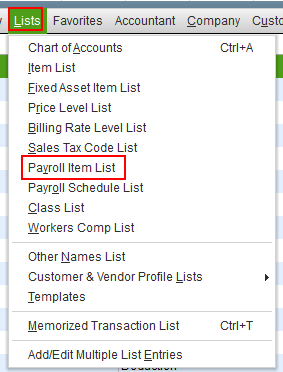

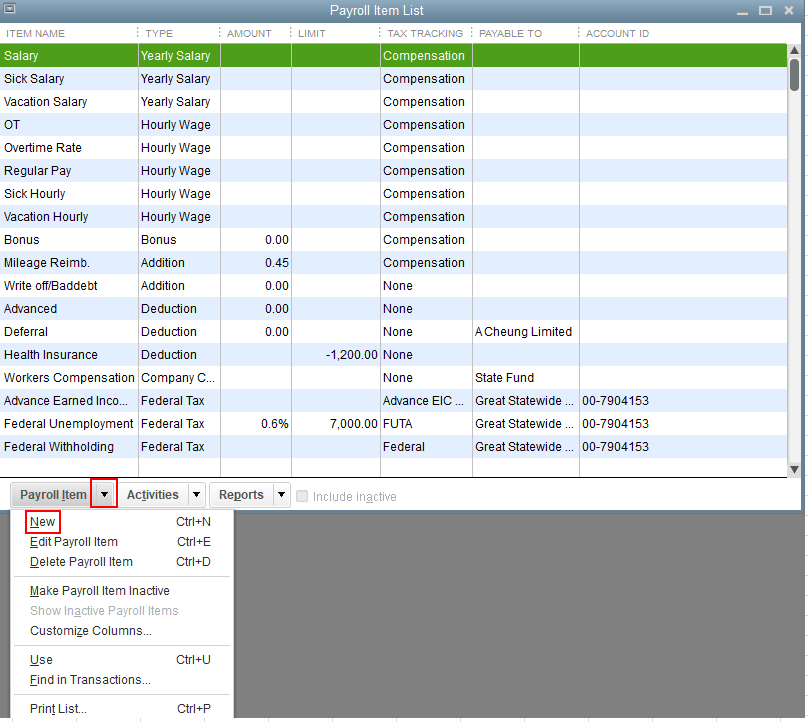

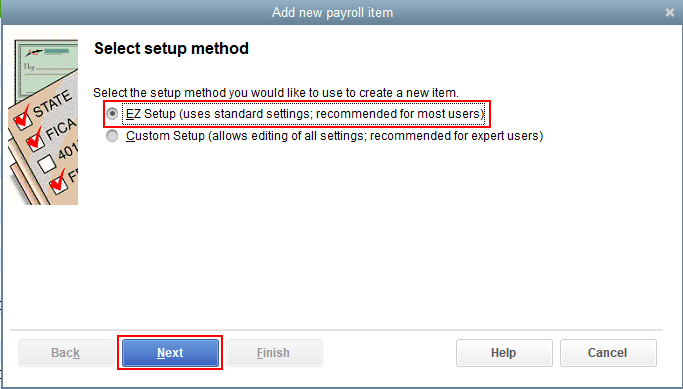

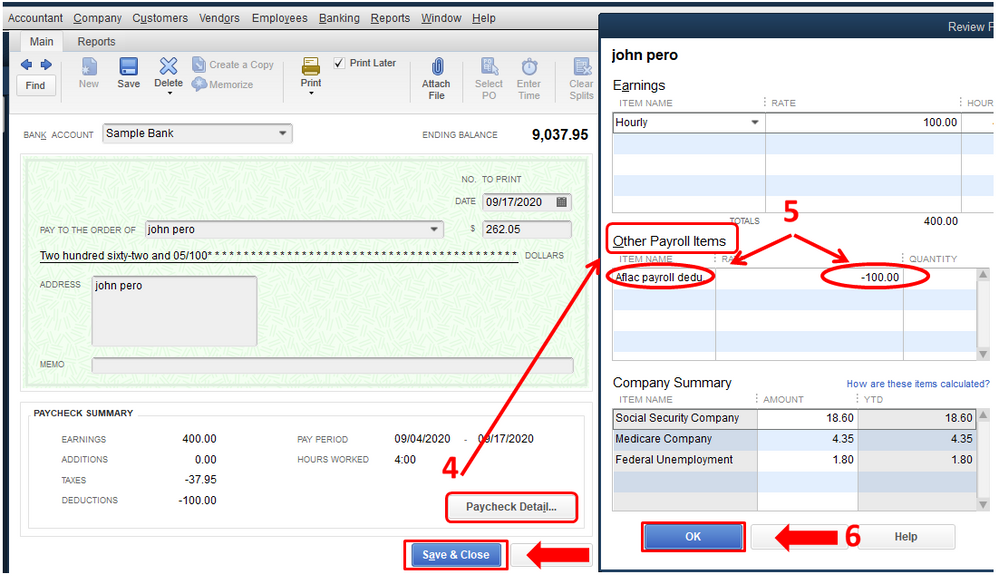

For your employee, you can set up a payroll item for Insurance Benefits deduction using the EZ setup. Here's how:

Once done, you can set up a payroll item for Company Contributions to the employer side. Since it's just for recording for purposes, the company contributions for the insurance won't be included in your employee's paycheck. To set up, you can follow the steps 1 to 3 and select Other Additions.

I'm adding these articles for more details:

Please post a reply below if you have other concerns with your payroll transactions in QuickBooks Desktop. I'll be more than happy to assist you again. Have a great day and take care always.

Thank you! This is really helpful, but I have more questions. How can I have this included in the 125 plan? That is the ultimate goal, but as of right now these policies are already set up in our payroll but it was done incorrectly. If I set these up per your instructions should I then delete the items already set up that were incorrect, or will this mess up payroll reports?

Thanks for getting back to this thread, @lpenney18.

Yes, you need to follow the steps provided above to properly set up your payroll deductions. This will also affect your payroll reports, however, you can still correct it by editing your paychecks or creating some liability adjustments.

Just repeat these steps to correct all of your incorrect paychecks.

Also, you can check out this article if you need further guidance on how you can edit your payroll item on your paychecks: How to change incorrect payroll items used on paychecks.

Please take note that if you do a payroll liability adjustment, you must inform your employees and create a reimbursement if necessary.

Additionally, you can run the Payroll Summary report in QuickBooks Desktop to check if the amount in the payroll item and wage base is correct. Here's how:

I'm always here to help if you have any other payroll concerns or questions. Just tag my name in the comment section and I'll get back to you as soon as I can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here