Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello there, karncie.

This can be done through payroll processing. We can now proceed to add the repayment payroll item to the employee's profile since you're done setting up the 401k in payroll.

Doing this will automatically display and calculate the 401k when creating paychecks. These are the steps that will walk you through the process:

Once done, it'll automatically show up in the payroll report. And now, you can export the payroll report to Excel if you wish to.

Visit again if you have other questions. I'll be around to help.

How can I get the loan payback amount to be tracked and show up on the Excel

Deferred Compensation Report (for 401(k)& more)?

I run a report after every payroll and use this form to upload it to the company we use for 401k contributions.

Thanks for getting back to us, karncie.

I can walk you through the steps on how to show the 401 (K) on the report. Here's how:

If you want to set up and pay scheduled or custom liabilities, you can check this article: Set up and pay scheduled or custom (unscheduled) liabilities.

If you have other concerns, please let us know. The QuickBooks Community team is up 24/7 to help you out.

This still does not list my loan repayment on the report. I have a column for Loan Repayment that shows zero even though a payment has been made by my employee (through payroll) in repayment of a loan taken out our the 401(k).

Somehow, when I set up the loan repayment deduction, I must need to check something when setting it up to have it tracked and thus reported on the excel spreadsheet.

This is how I get to the report I need to use for my 401(k) upload:

Reports

Employees & Payroll

More Payroll Reports id Excel

Deferred Compensation Report (for 401(k) & More)

Hello, @karncie.

I'm happy to assist you in any way that I can.

Let's check the 401k set up to ensure that there weren't any missed steps.

Follow these steps to create a deduction payroll item for a 401(k) loan repayment:

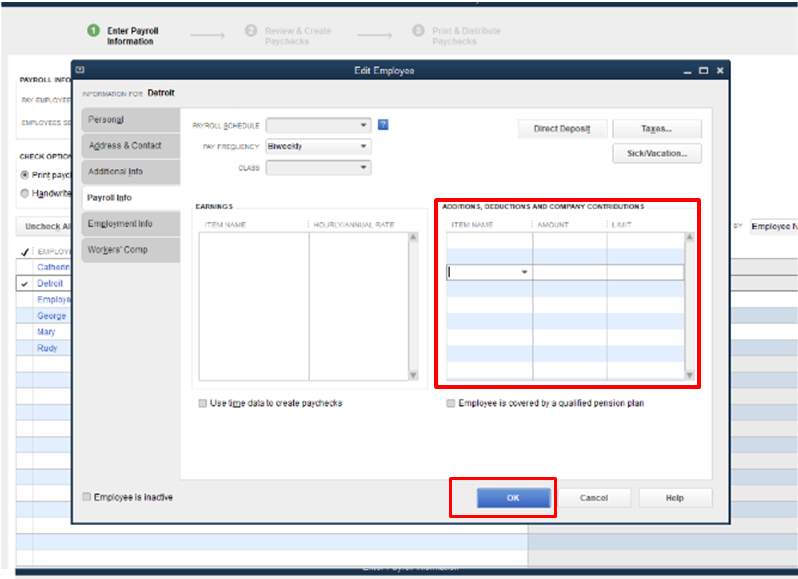

After this item has been set up, you'll need to add the repayment payroll item to the employee profile. This will ensure that it shows in the report.

QuickBooks Desktop will automatically display and calculate the 401(k) loan repayment item and amount specified in the Preview Paycheck window. If necessary, you may manually change the default amount on the paycheck detail. If you've entered a limit, QuickBooks Desktop will stop deducting when the limit is reached.

I'd also suggest setting up the Loan Manger in QuickBooks. This feature assists with keeping track of the 401k loans or any other employee loans. There is also the Payroll Summary report that has the information needed.

If you have any further questions, I'm just a click away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here