I'm here to help and guide you in recreating the bonus check, mariniaellett.

In QuickBooks Online, we can run payroll for the paycheck you've accidentally deleted. I'll show you how:

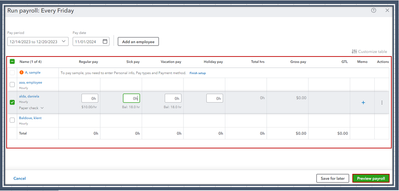

- Go to Payroll, then Employees.

- From the Run payroll ▼ dropdown, select Bonus only.

- Choose how you’d like to enter the bonus:

- As a net: The employee gets the exact bonus amount. Taxes are still calculated but it’ll be an company-paid tax.

- As a gross: We’ll figure out the net amount for you.

- Choose the employee, then enter the Bonus amount.

- Below the list of employees, select Edit ✎ next to Payroll options.

- Add the payroll options you want. Then select Apply.

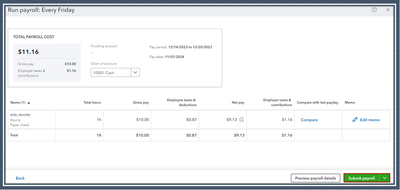

- Click preview and submit payroll.

- If you’ve selected As net pay, the pay stub includes Employee Taxes Paid by Employer in the pay section.

For more detailed guidance, please see this article: Pay an Employee Bonus.

Don't hesitate to leave a comment below if you have other payroll concerns or additional questions about bonus checks, mariniaellett. I'll get back to help you the best that I can.