Glad to have you back here in the Community, @Bosslady30907.

I'm here to ensure that you'll be able to file your GA UI taxes in QuickBooks Online successfully.

You'll need to make sure that the primary state of your employees is GA. This way, the system will no longer ask for completion of the SC tax set up. You can also set up the SC to " Do Not Withhold" so no taxes are withheld on this state.

To do that:

- Go to the Payroll menu, then select Employees.

- Click the employee's name.

- Choose the Edit employee.

- In the section What are employee's withholdings?, select Edit.

- In the section for the secondary state, choose Do Not Withhold from the Filing status drop-down, and zero out Additional amount.

- Hit Done.

In case you need help with updating a work location in QBO, you can open this link: Changing a primary state.

After that, I'd recommend reaching out to our Customer Care Team. They'll be able to opt-out of the SC fee so you can file the GA UI successfully.

Here's how to reach them:

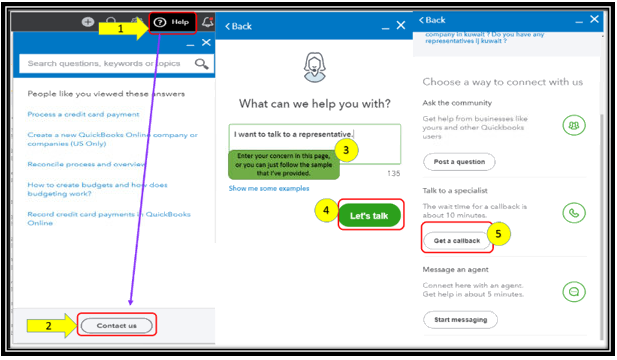

- Click on Help at the top menu bar.

- Select on the Contact Us button.

- Enter a brief description of the issue in the What can we help you with? box.

- Press on Let's talk.

- Select on Get a callback.

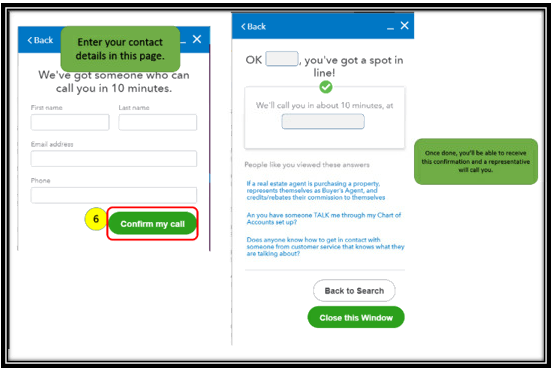

- Key in your contact details, then tap on Confirm my call.

I'm also adding here some links about the state reciprocity agreements for your employees:

Stay in touch if you still have questions about managing taxes and forms. I’m more than happy to answer them for you. Take care!