Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy question is similar. I have salaried employees but just hired an hourly worker. How do I submit her hours so that she can get paid for the hours she worked? She will work different hours each month (We pay monthly).

Thank you for adding your first post today, stephan and pmaynard. I can guide you in creating an additional pay type for your employees in QuickBooks Online (QBO).

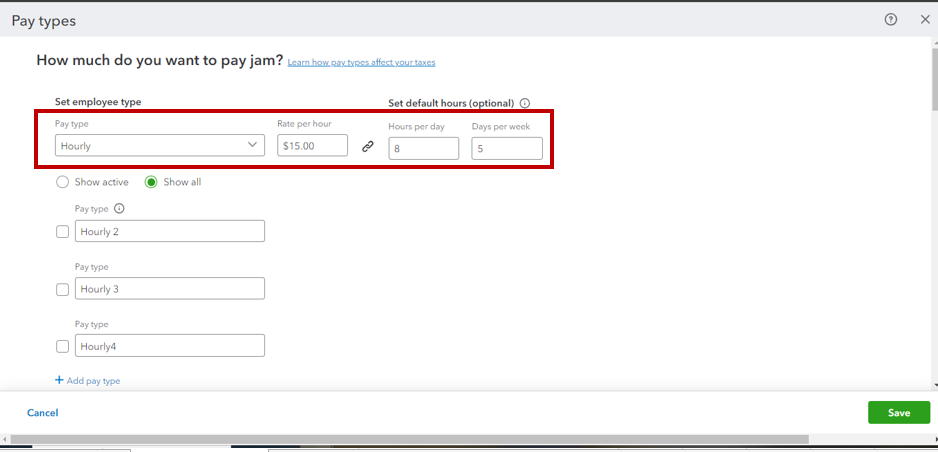

Creating a base salary with an additional hourly rate is not available. However, you can pay your salaried employee, then set an hourly rate from your employee's profile so you can manually switch the type every time you run their paycheck.

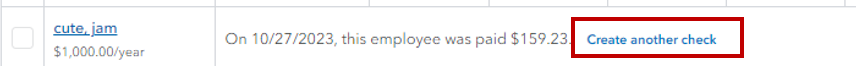

Now that we have added the worker's hourly rate, you can utilize that pay type in generating an unscheduled paycheck to compensate them for the number of hours they have worked.

I'm attaching this article to learn more about creating a scheduled and unscheduled payroll in our system: Create and run your payroll.

Additionally, you can expand your knowledge on setting up additional pay types by checking out this link: Add or change pay types.

When you're ready to settle your employees' taxes, utilize the resources from this material as your guide: Pay and file payroll taxes and forms in QuickBooks Online Payroll.

Please let me know in the comment section below if you have follow-up questions while setting up pay types for your employees in QuickBooks. I'm just a few clicks away to help you again. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here