Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I managed to figure out why the number has doubled. There were two pay periods in a single week. I still can't figure out how the $385 originated. I'm not sure where to look.

Hi there, lukaszb802,

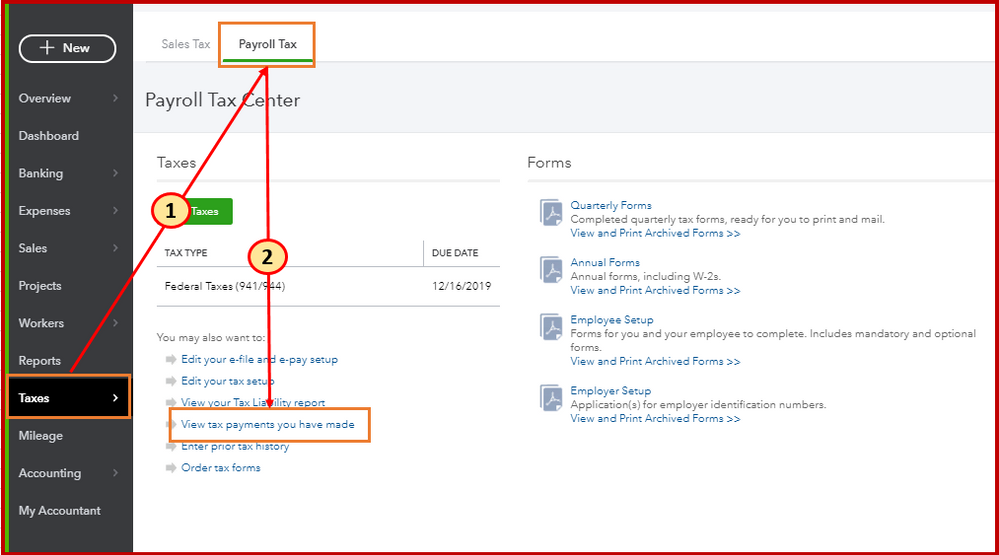

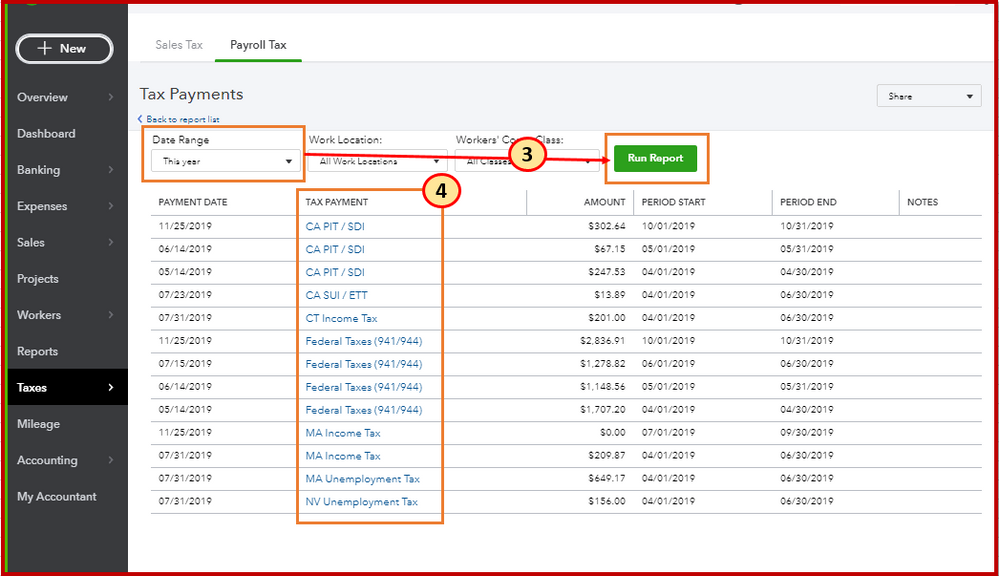

There's a place where you can see all tax payments you've made through EFTPS via QuickBooks.

That being said, please follow the steps listed below for your guidance:

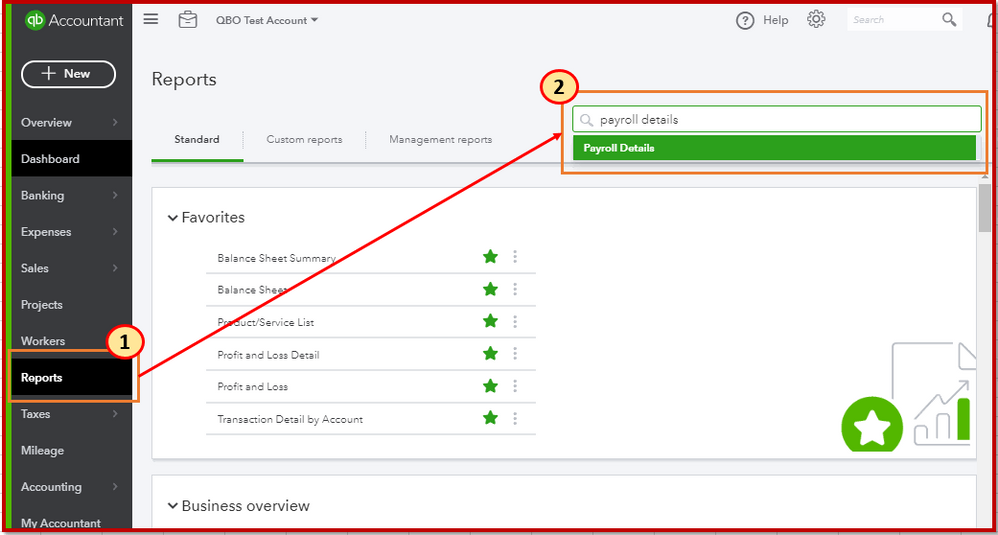

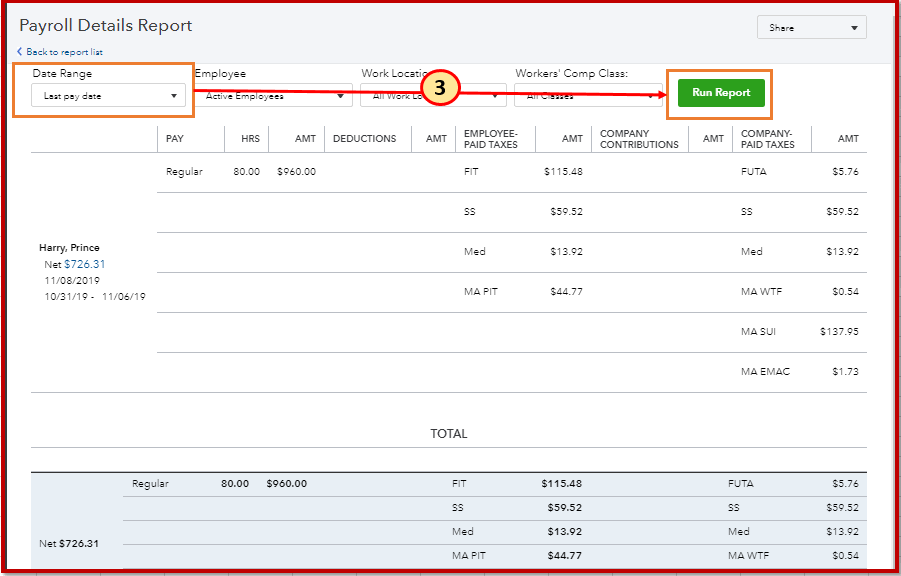

You can then pull up the Payroll Details report to see detailed info of your employee's payroll. Let me show you how:

I've added this article, See Tax Payments And Forms to view taxes you've paid and forms you've filed in the system.

Don't hesitate to reply for any help at any point in time. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here