Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi there, @ckdusek00.

Thank you for adding a post!

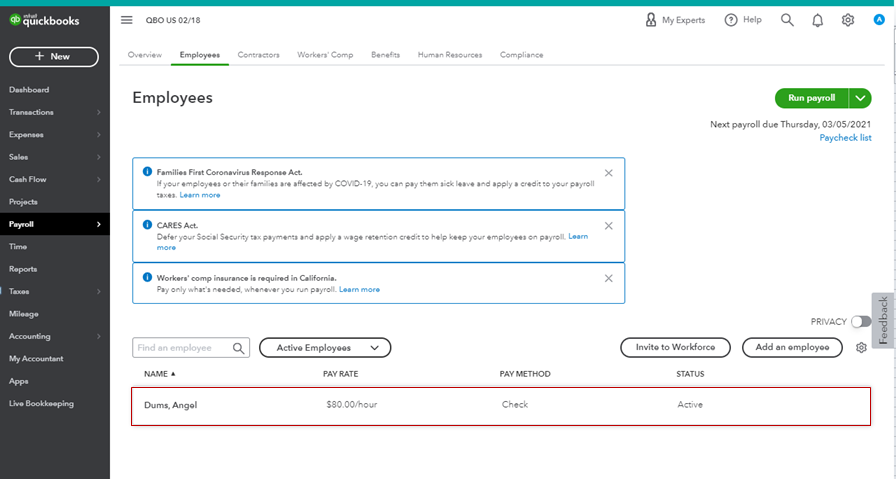

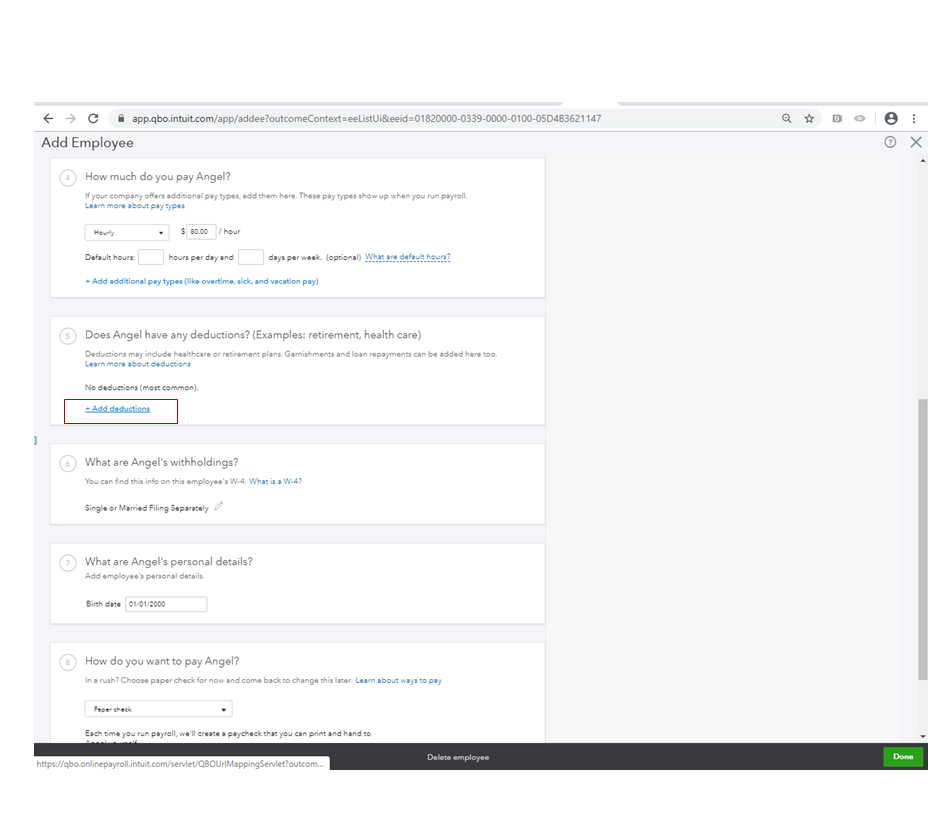

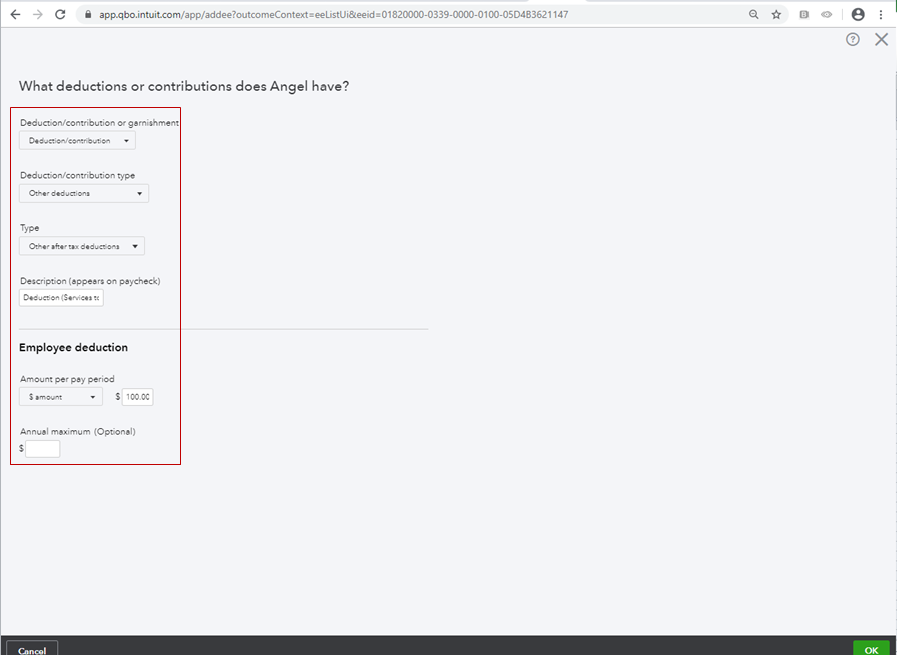

You can create a deduction item for the service/s. Then add it to your employee's paycheck. I'm here to guide you with the detailed process.

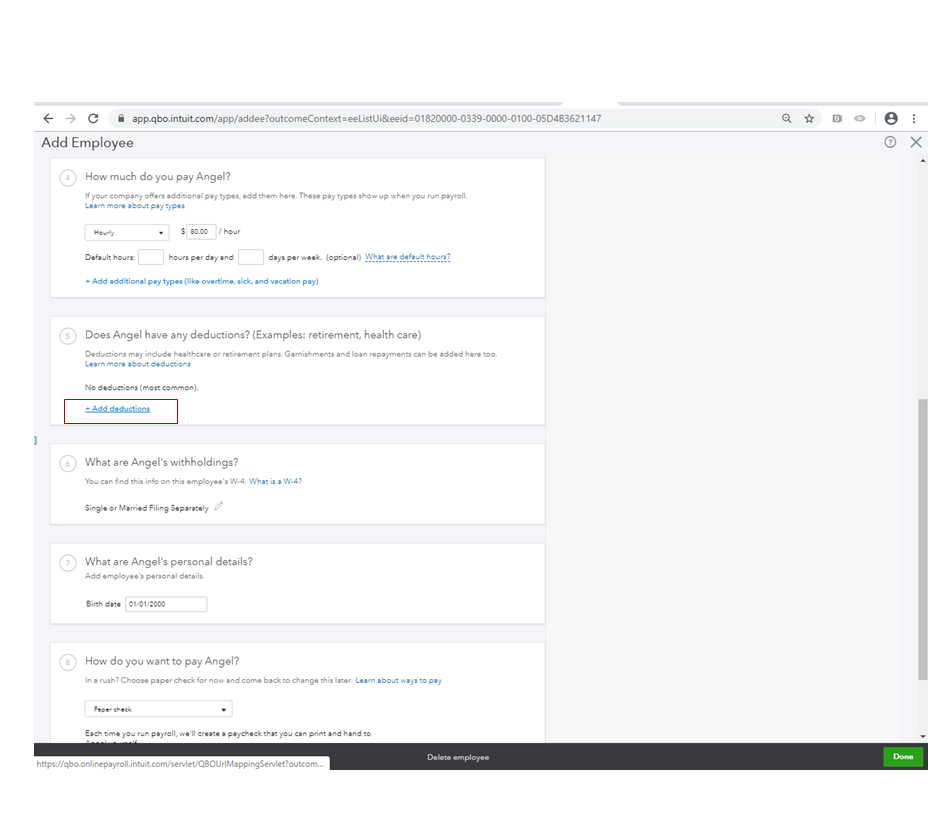

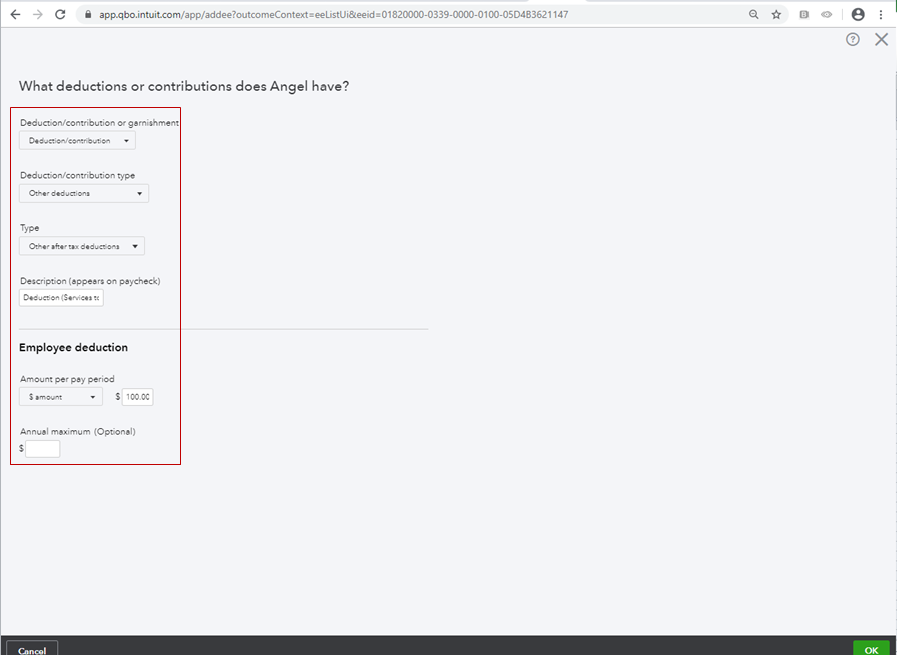

Here's how to create the deduction item:

When recording your paycheck, the deduction is calculated automatically. If you want to update the amount, select the pencil icon, then enter the amount under the Current column.

You can also check out this article for more tips about adding or editing a deduction and contribution in QuickBooks Payroll.

Moreover, you may review the details from our help articles for more resources while working with QuickBooks and payroll checks.

If you have any follow-up questions about recording the employee's repayment, please let me know by adding a comment below. I'm more than happy to help. Have a good one!

Hi there, @ckdusek00.

Thank you for adding a post!

You can create a deduction item for the service/s. Then add it to your employee's paycheck. I'm here to guide you with the detailed process.

Here's how to create the deduction item:

When recording your paycheck, the deduction is calculated automatically. If you want to update the amount, select the pencil icon, then enter the amount under the Current column.

You can also check out this article for more tips about adding or editing a deduction and contribution in QuickBooks Payroll.

Moreover, you may review the details from our help articles for more resources while working with QuickBooks and payroll checks.

If you have any follow-up questions about recording the employee's repayment, please let me know by adding a comment below. I'm more than happy to help. Have a good one!

Thank you, @Angelyn_T !!

This was exactly what I was needing.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here