Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

This has been a total JOKE. This went into effect 09/01/2019 and it was months before we could even set up employee details. Now they can't file because there saying I didn't provide information. Tell me where I can enter my company account number!!! NOWHERE!!! This is an epic fail and black mark on this software and company.

Hi deereborn,

It's important that you'll be able to successfully file your MA PFML.

You'll want to make sure that you've correctly set up your taxes under the State and Federal taxes section.

Here's how:

Here's an article for more information: Massachusetts Paid Family Leave.

If you need help with QuickBooks, feel free to let us know.

my screen looks nothing like this! I don't have the options you are referring to.

Thanks for coming back to us, @deereborn,

You can enter your account number from the payroll item list page. Let me walk you through how.

Once you're done, try filing again. The details about the Massachusetts Paid Family Leave is found in this article.

You can also visit our page about the product & industry news for future reference.

If you have other questions or concerns, please let me know. I'd be glad to help. Happy weekend.

It's like your showing me a picture from a completely different program. I don't have "Lists". Now you suspended my payroll service on PAYDAY. Why punish my employees? harm my business. I've have always made every single payment, I have Excellent business credit. Give me a break!! give me a grace period. My credit card payment was being applied the same day you suspended my account, all you had to do was run the card again or CALL me. I'm seriously thinking about canceling my subscription, How do you think my employees feel right now?

Thanks for getting back, deereborn.

I would like to make sure I'm able to provide the exact information you need. That said, I may need a bit more details to help me better understand your concern.

I'd also appreciate any additional information such as screenshots to give me a clearer view of the situation and further assist you.

I'll keep an eye out for your response. Thank you for reaching out. Take care!

It looks like your screenshot is from QB Online and the other screenshot (from a QB team member) is from QB Desktop. These 2 programs could not be more different.

Shiella, you are giving QB Desktop screenshots when the person asking the question is on QB Online. You are confusing him.

Hi there, @deereborn.

Please allow me to join the thread and help you with setting up your company account number in QuickBooks.

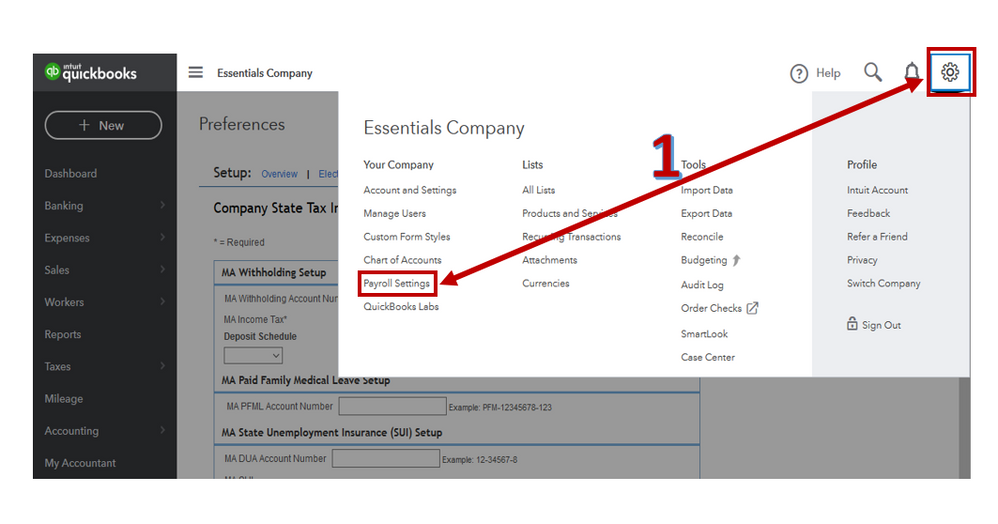

Let me complete the steps provided by my colleague above to help you set up your MA PFML.

Here's how:

Once done, you can file your MA PFML. I've also attached an article that will guide you about Massachusetts Paid Family Leave.

That should do it. I'm just a post away if you have other questions about Taxes. I'm always here to help you. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here