I understand your desire to set up manual payroll in QuickBooks, Abdo_2024. Let's work together to sort this out so you can start recording payroll transactions.

Before you set up manual payroll, let's update your version of QuickBooks. Updating provides bug fixes, features, and enhancements that can help optimize performance and accuracy for payroll and accounting. I want to make sure you get off on the best footing.

It's also possible that you have an existing payroll service key in your company file. This is why you can't see or select the option to set up manual payroll. Clearing out old service keys often resolves the issue and allows manual payroll to be enabled.

Follow these steps on how to do it:

- Go to the Employees menu and select Payroll Center.

- Press CTRL + K on your keyboard altogether.

- Click Remove and and click Yes.

After that, follow these steps on how to finally set up manual payroll:

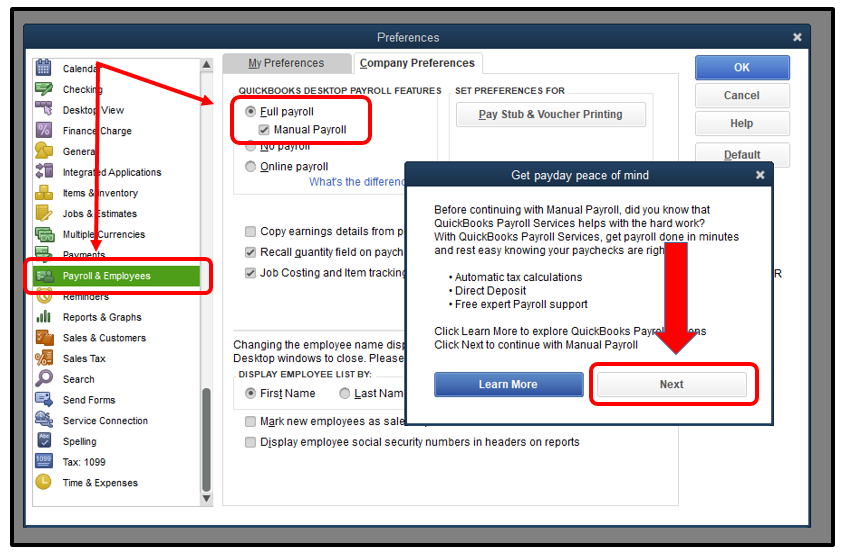

- Go to the Edit menu and select Preferences.

- Select Payroll & Employees, then select the Company Preferences tab.

- In the QuickBooks Desktop Payroll Features section, select the Full payroll and the Manual Payroll checkboxes.

- In the Get payday peace of mind window, select Next and then Activate in the confirmation screen.

- Select OK to apply the changes.

- Click OK to exit out of the preferences window.

Please note that when using this feature, you'll need to calculate and enter payroll taxes, as well as file your tax forms yourself.

Please don't hesitate to ask me any questions if you need help understanding tax rates, filing due dates, or anything else related to do-it-yourself payroll taxes and compliance. I want to make sure you feel fully prepared before switching to manual processing. Just say the word if you need guidance, Abdo_2024.