Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHello there, @realtybymonica. Welcome to the Community.

I can see the urgency of getting your new TX Unemployment rate updated. Let me help route you to the best support who can investigate this matter and provide the appropriate fix so you can keep your SUI tax liability accurate in QuickBooks Online Payroll (QBOP).

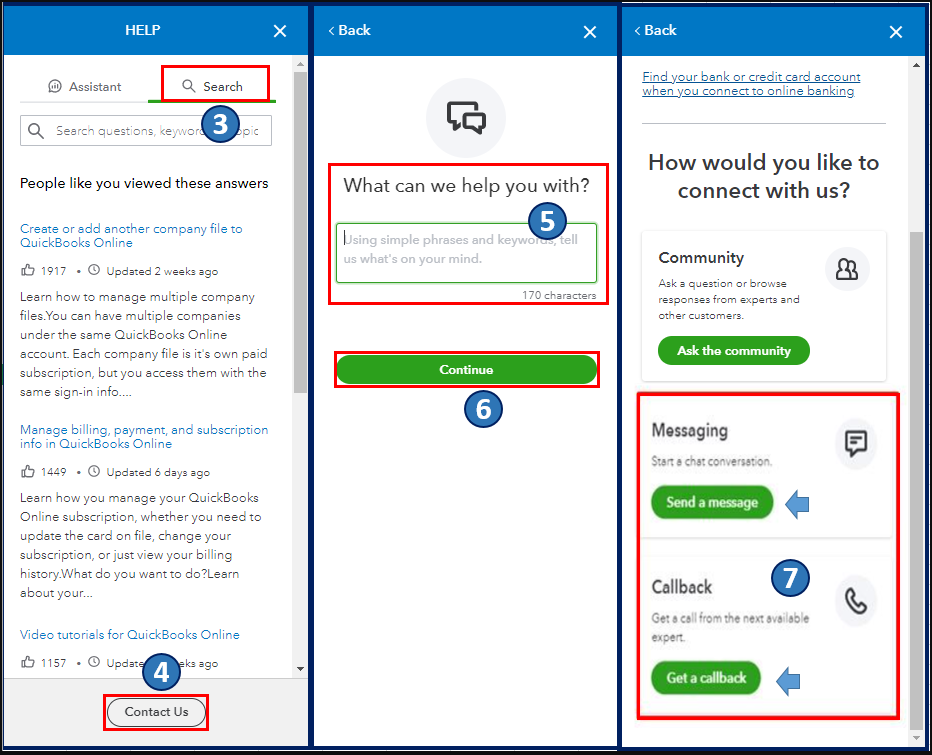

There's a need to configure your payroll account to update your new State Unemployment Insurance (SUI) rate. Since the Community is a public forum, and we'll need to collect some personal information to pull up your account, I encourage you to reach out to our Payroll Care team. They have the tools to update your new rate so you can get back to business in no time. To do this, here's how:

Additionally, a variety of payroll and employee reports can help you manage your account and keep track of employee expenses in QBOP. You may want to check out this article as your reference to guide you in customizing them to get the data you need: Run payroll reports in QuickBooks Online Payroll.

If you have other payroll or taxes concerns in QBOP, please don't hesitate to let me know in the comments below. I'm always ready to help. Take care, @realtybymonica.

I don't understand why you would need more information when the error is a state-wide issue. Can't you just adjust the minimum amount for all Texas QB users? I mean, this person is not the only person running into this problem. Any business qualifying for the lowest possible tax rate is going to have this issue. Seems handling it on a case-by-case basis is counter-intuitive.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here