Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We want to do our Simple IRA Company Match Quarterly. I cannot get it to show up under "Pay Liabilities". I have set it up and I have gone it to set the schedule to quarterly, but it still will not show up for me to pay. I cannot figure out what I have done wrong?

Great to see you here, @abrannon13,

Welcome and thanks for checking this with us today. I can share some insights on how to add your Simple IRA Company Match in the Payroll Liabilities window.

Before anything else, let's make sure your payroll item is using the correct liability account. Please follow the steps below:

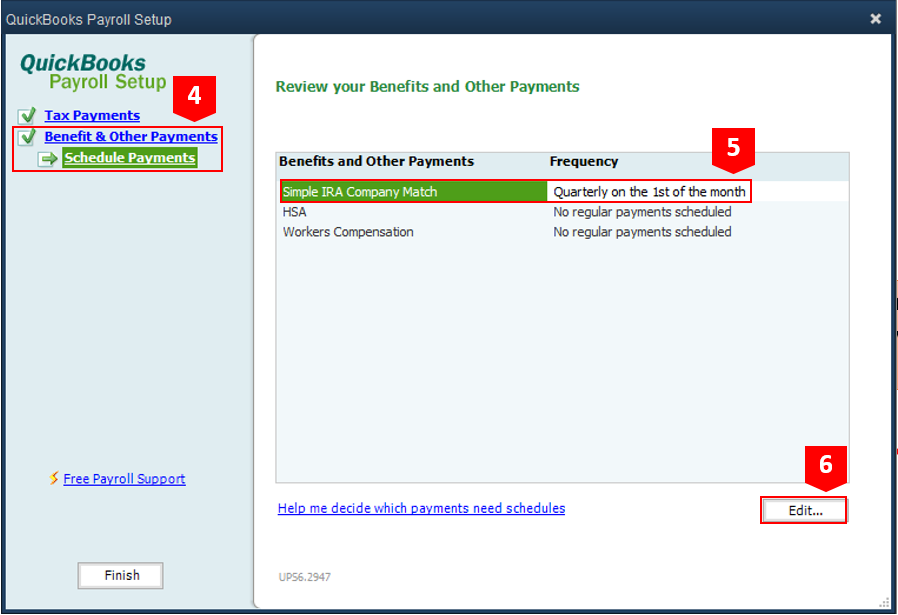

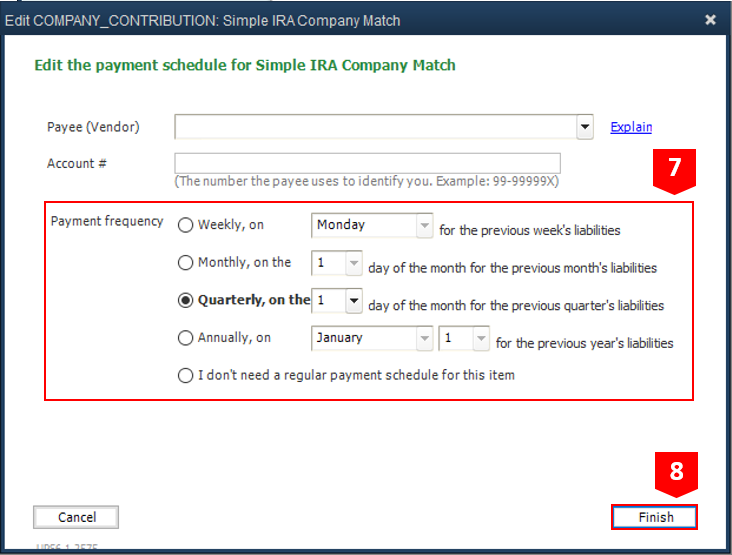

Once done, let's open the Payroll Setup and see if the company contribution has the correct schedule. Here's how:

That should rectify the issue, @abrannon13. I've attached here a related article to guide you with the process: https://community.intuit.com/articles/1763392

Please update me on how it goes. I'm here if you need further assistance with QuickBooks Payroll. Have a great day!

That is exactly how I set it up on Monday. I set it up for Quarterly on the 2nd day of the month. Still not showing up for the 1st quarter under "pay liabilities"

That is exactly how I set it up, but it is still not showing up under"pay liabilities".

Hello abrannon13,

Thank you for posting here in the Community. It would be my pleasure to help figure out why it's not showing on the Pay Liabilities section in QuickBooks Desktop.

There are several possible reasons why your Simple IRA liability isn't populating in the QuickBooks system. Since you've already tried checking the liability account and the payment frequency, you can perform some additional troubleshooting.

You can start by making sure the Simple IRA payroll item is reflecting on your employee paychecks from the first quarter. I also recommend checking the Payroll Liability Balances report for any overpayments showing as a negative amount.

Here's how to run the report:

If it's not showing on the paychecks, what you can do is perform some adjustment on your payroll liabilities. For the detailed steps, I'm adding the article I recommend on this:

Please be sure to let me know how this goes, and I'll be more than happy to guide with correcting the liabilities. The Community is always ready to assist you.

this was exactly what i was missing and needed.....

THANK YOU

You are most welcome, @jerold3095,

I appreciate the time you've given to drop a positive feedback here in our forums and sharing what resolution works for you.

I'm glad you came across our discussion and had your issue resolved through the solutions outlined here. Should you need further help, please let me know by clicking the Reply button below or starting a new Community post.

You've got a bunch of awesome people who can help you with QuickBooks. I'm also here to lend you a hand. Have a great day!

This is an awesome answer! I am just setting all this up to run 10/1/21 and feel that I'll be successful.

However, my question is shouldn't I create separate payroll liability accounts for employee and employer simple contributions? Or can they both go into the same payroll liability account? Thank you!

Hi there, Whoadeb.

I'm here to share insights about creating a tax liability account for employees and simple contributions for employers.

A simple IRA or 401 (k) plan is a tax retirement account offered by the employer to their employee. It is a salary reduction contribution made to a retirement savings plan. The employee can get that fund after their retirement.

You can create another liability account and ensure they're associated with the correct payroll item for Simple IRA.

However, it would be best to consult your accountant for guidance. This is to ensure that everything is accurate.

For your reference, read through these helpful articles to learn more: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.).

I'll be right here to share some more information about QuickBooks tasks if you need any. Just leave a comment below to notify me. Have a nice day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here