Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I need to obtain payroll numbers for the state of TN, I understand there are no withholding taxes, but there is unemployment.

I started setting it up through Intuit, and I was referred to CorpNet. What is CorpNet? Do they help with obtaining the numbers instantly (as opposed to waiting with the state)?

It looks like Intuit allows me to start running payroll without obtaining the TN numbers - what issues does that pose with the state specifically? Will it still calculate the accrued unemployment taxes?

Just curious how the process works overall.

Good day to you, @globetreader569. I understand how important it is to set up your employer's account numbers. I'd like to provide some insights about your concerns regarding obtaining payroll state numbers for accurate tax payments and form filings.

To start, please note that you'll have to reach out to the Tennessee state agency to get an Employer Number. Check out this link to learn how: https://www.tn.gov/workforce/employers/tax-and-insurance-redirect/unemployment-insurance-tax.html. You may also refer to this article to access your state agency websites: Access state agency websites for payroll.

Moreover, CorpNet is a third-party service to help you with starting a business, registering for payroll taxes, and maintaining business compliance across the United States. That said, you'll want to contact them to see if they support obtaining your employer's state numbers instantly. Simply go to the Where Can I Go To Talk To CorpNet Support? section from this link: Register for State Payroll Taxes.

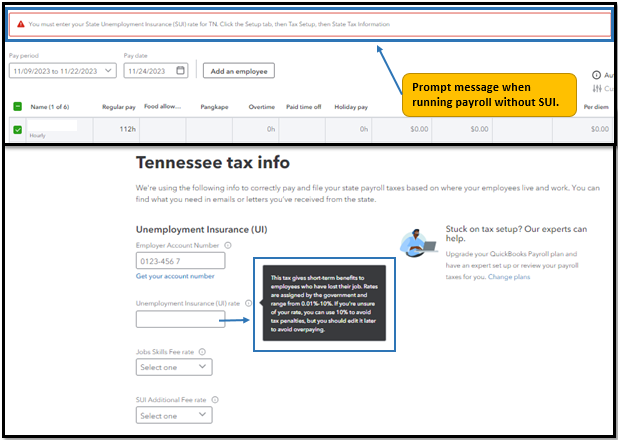

Lastly, you're correct that you can still run payroll without the Tennessee Employer Account Number. However, you'll need to set up a default State Unemployment Insurance (SUI) rate. If you're unsure of your rate, you can use 10% to avoid tax penalties, but you should edit it later to avoid overpaying.

Here's how:

Additionally, you can visit this article to provide a detailed breakdown of your employees' wages, deductions, and tax information for a specific period: Run payroll reports.

If you have further questions or concerns about setting up your employer account numbers in QBO, please don't hesitate to let me know. We are available 24/7 to answer all of them. Have a great day ahead!

Does CorpNet assist with obtaining the TN employer number?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here