Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

An employee was overpaid Covid Paid Sick Leave on the 12/31/20 payroll. I already filed the 941. Do I need to adjust anything for 2020? Can I deduct it with the employee approval from the next paycheck even though it is in a new calendar year and quarter?

Hi ME51.

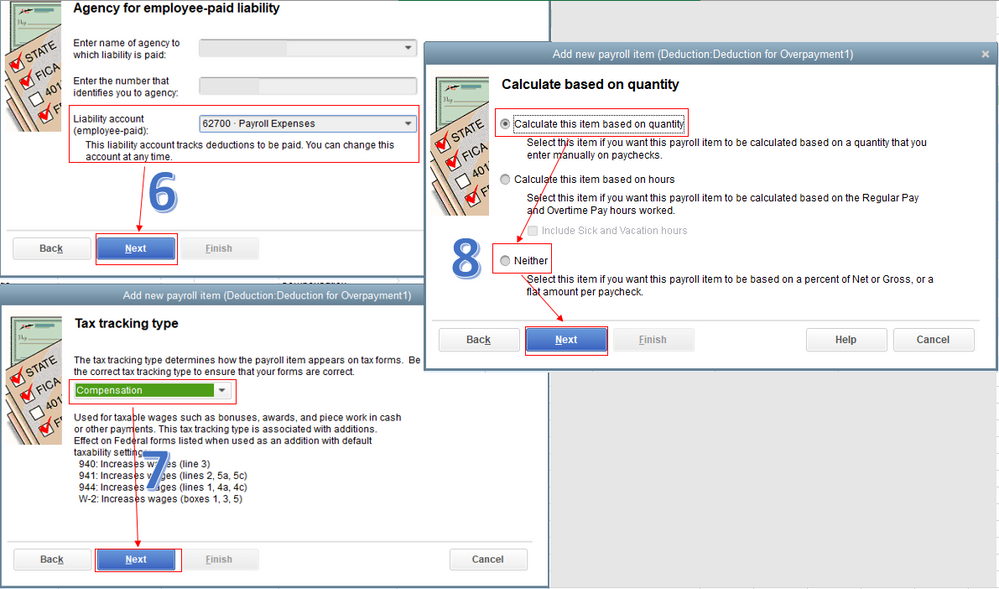

Thanks for dropping by, I'm happy to show you how you can process the employee overpayment. Follow these steps below to create a deduction payroll item. This way, you can add it to the paycheck to reduce employee's wages for the overpayment and correct year-to-date (YTD) taxes. Let me guide you how.

Second, let's add the deduction payroll item, the overpayment amount, and the hours to your employee's paycheck. Here's how:

See the screenshot below to show you the last four steps. For detailed instructions, see the QuickBooks Desktop Payroll including Basic payroll, Enhanced payroll and Assisted payroll section through this article: Reduce Paycheck Wages For An Employee Who Has Been Overpaid.

Once done, you'll have to record the repayment from your employee by entering a bank deposit. This ensures your books are accurate. If you have any other questions, feel free to post here anytime. Thanks for dropping by and I hope you have a nice weekend.

Am I adding this payroll item deduction to the paycheck that had the overpayment on it which was 12/31/2020?

Thanks for the quick reply, @ME51.

Yes, you can add that payroll item deduction to the paycheck 12/31/2020 that had the overpayment.

Once done, don't forget to process a bank deposit, as my colleague mentioned above. As always, you can access the Deposit Detail report to review all the recorded bank deposits.

See the sample screenshot below for reference:

Also, I've attached some articles that might help you handle the Chart of Accounts, deposits, paychecks, and other relevant matters.

Let me know in the comment section if you have other follow-up questions. I'm cheering to help further.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here