Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIs there any downfall to deleting old pay rates under each employees pay earnings section? We have union guys that change pay rates with each new contract & instead of keeping all their old rates, I'd like to just have current rates attached to each employee. The payroll item list still has all the rates, I just want to remove from each employee individually. I just don't know if it would affect anything from past reports or history.

Thank you for turning to the Community about your payroll concern, April44. Let me shed some light on deleting pay rates.

Removing the mentioned payroll items in each employee's Earnings section has no effect on your previous reports or history. After you do that from the desktop program, you won't have a record of them anymore.

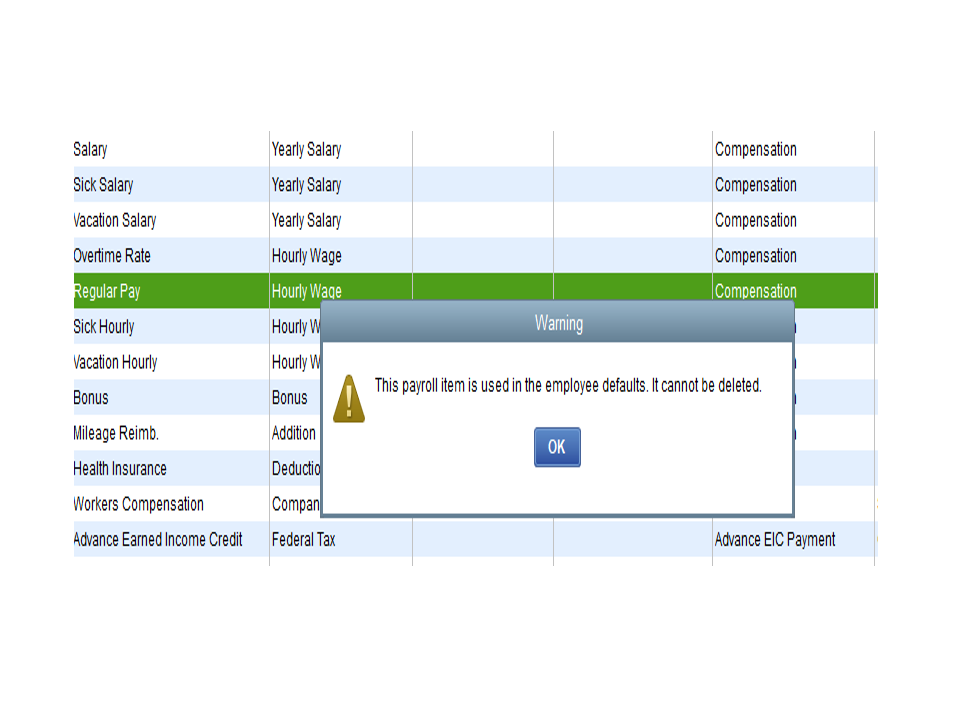

When you delete your pay rates from the Payroll Item List, you'll receive a message that you're unable to complete the action (used on the paychecks).

In addition, the following link offers a list of topics that will help you deal with tax notice concerns, process payroll, and so on: QuickBooks Desktop Payroll.

Stay in touch if you have other payroll concerns or questions about the product. I'd be glad to respond to them. Have a great rest of the day.

So is there any downside to deleting from each employees earning section? The benefit will be that I only see the few rates that apply right now & not the 20 rates that applied to him in the past. I am trying to clean up our records now that I took over for someone else. My only hesitation is from your comment "After you do that from the desktop program, you won't have a record of them anymore."

Thanks for following up with the Community, April44.

Deleting old pay rates for employees shouldn't affect any reports or historical data in your books. At the same time, I'd highly recommend performing a backup of your company file before making any changes. This way, if anything happens that you didn't want or expect, you can easily restore the backup.

Here's how to perform a back up:

I'd also recommend working with an accounting professional to properly identify what will happen when you delete certain data from your books. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

I've included a detailed resource about backing up company files which may come in handy moving forward: Back up your company file

I'll be here to help if there's any additional questions. Have a lovely day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here