Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Can you add a column to the available columns on the Payroll Item List? We have a variety of classes set up within our company. I have set up the classes to be assigned per earnings item which is working fine. The Other Payroll Items and the Company Summary sections on the pay stubs have no field for the class, and I can't figure out how to add it. I thought maybe I could add a class to the individual payroll items. We don't want any items to show up as unclassified on the Profit & Loss reports. Any one know a way to handle this? Thanks.

Let's send feedback or product recommendations to help improve the features and your experience in QuickBooks Desktop (QBDT), @BHGSBookkeeper.

For the time being, you can add columns on the Payroll Item List window, but only the default/available ones (right-click on the window and select Customize Columns to see the available columns) in the QBDT system. Adding a custom column, like Class, isn't an option. Please see the screenshot below for your reference.

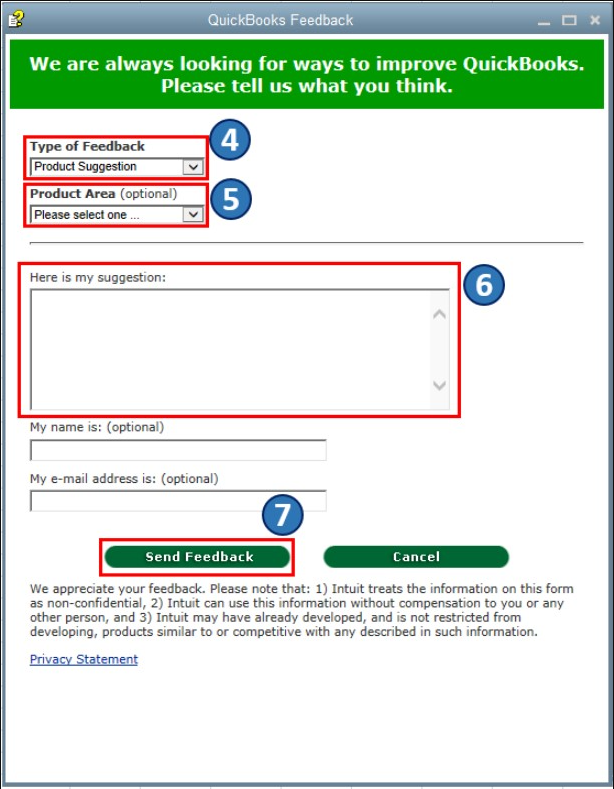

On the other hand, I can see how the benefit of being able to add a custom column in the Payroll Item List window would aid you in managing your payroll data with QBDT. With this, I would encourage you to send suggestions or product recommendations. We'll take them as opportunities to improve the various features of our products. Here's how:

Also, you may want to check out one of our Help pages as your reference to guide you in managing your business's growth and transactions using QBDT: QuickBooks Learn and Support. It includes help articles, Community discussions with other users, and video tutorials, to name a few.

Please don't hesitate to let me know in the comments if you have other feature concerns or questions about managing customer and vendor transactions in QBDT. I'm always around to help. Take care, and I wish you continued success, @BHGSBookkeeper.

Thanks for the detailed response! So, is there no way to get these items our of non-classified?

Hello there, @BHGSBookkeeper.

I understand how beneficial this feature working for you and your business. However, we're unable to get the items non-classified.

In the meantime, you can follow the suggestions given by my colleague and also send feedback to add this feature in future updates.

I've added this link that you can check to help manage your QuickBooks: QuickBooks Q&A.

Let me know if you have other questions in QuickBooks. I'm always here to help. Take care.

I would like to know how to set up what columns are "available" on the "enter payroll" window for quick review purposes, rather than having to open each employee to double check data entry. How are these columns activated for this window???

Welcome to the thread, Trudi.

I'm here to share information about the columns available on the Enter Payroll Information window.

The columns showing on the Enter Payroll Information window depends on what you've added on the Show/Hide Columns window.

To customize what columns to display on the Enter Payroll Information window, here's what you'll need to do:

If you ever want to view useful information about your business and employees in the future, you can always run payroll reports. You can refer to this article for more guidance: Run payroll reports.

Feel free to reach out to me if you require further assistance when processing payroll. I am always available to help you out in any way I can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here