Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi There, Last year I tried to work with QB online, and I was also entering the information on QB desktop to keep it up-date in case I did not like QB Online, which I ended up cancelling. The issue is the following: For some reason QB desktop did not calculate the withholdings correctly and I missed to adjust the federal deduction by $3.00 for one employee to match the deduction in QB Online (the paycheck was for the correct amount since it was done in QB Online). I sent the payment of the taxes to the IRS for $994.65 when it should've been $991.65, this was for Q1 of 2022 and I had already cancelled the QB Online subscription so I did from QB desktop. When I realized the error, I made the correction to the employee paycheck. When I went to complete the return in mid April It showed the overpayment and I selected to apply to the next return. But in May (don't remember why) I adjusted the payment to the IRS from the check window to reduce the $3.00 previously overpaid. and thought the issue was corrected. In July when I issued the next payment to the IRS and reviewed my liabilities , I had a $3.00 balance due so I went ahead and processed a check. In August the IRS sent me a $3.00 check for the overpayment. This I deposit through the "refund deposit taxes and liabilities" for the period beginning 4/1/22 to the federal withholding account. Now it is showing that I have an overdue balance for Q2. I spent hours with two different agents from QB payroll and we tried any possible way including adjusting the liabilities, but it just creates another issue. Unfortunately both agents just left me on hold until the call just dropped and no one called me back. If some knows how I can get rid of this alert, please I need help.

I appreciate the detailed information you've shared, @garciahvac.

Let's get rid of the overdue status of your payroll liabilities so you can get back to working order.

There are several reasons why scheduled liabilities show as overdue in QuickBooks Desktop. Here's a list of them:

To fix them, you can follow the steps in this article depending on the cause you've experienced: Fix overdue or red scheduled liabilities in QuickBooks Desktop.

In addition, I also suggest seeking help from your accountant to guide you on which correct period you should apply the refund. If you don't have an accountant, you can find one through this link: Find-a-ProAdvisor website.

Feel free to come back to this post if you have other concerns or follow-up questions about your payroll liabilities. I'll be right here to help.

Thank you for your reply. I have tried every way possible. If I adjust the liabilities to reduce it or try to pay it, the alert goes off but it creates a credit. I tried on the check window to enter the $3.00 liabilities tab and enter negative expenses tab and it creates a credit. I already tried the steps for the liabilities overpaid in one period and underpaid in another. I overpaid for the month of March and underpaid for the month of April, but now the amount overdue is not the $3.00 but the full amount for federal, Social Security and Medicare for the month of March. Is there a way to adjust it without affecting the liabilities?

I appreciate you for trying the steps shared by my colleague, garciahvac.

When you create an adjustment, the account affected is the liability account. If you don't want to use the said account, I'd suggest reaching out to your accountant so they can guide you on the best alternative account to use. You can find one through this link: Find-a-ProAdvisor website.

Also, if you run into issues on running the Payroll Liability Balance report, you can check this reference: Fix a discrepancy on Payroll Liability Balances report in QuickBooks Desktop Payroll.

Keep me posted whenever you have concerns about managing your QuickBooks file.

Thank your for following up and for taking the time to read my post. I think I figured how to get rid of the alert.

Let me guide you on how you can clear the overdue payment without affecting your liabilities, garciahvac.

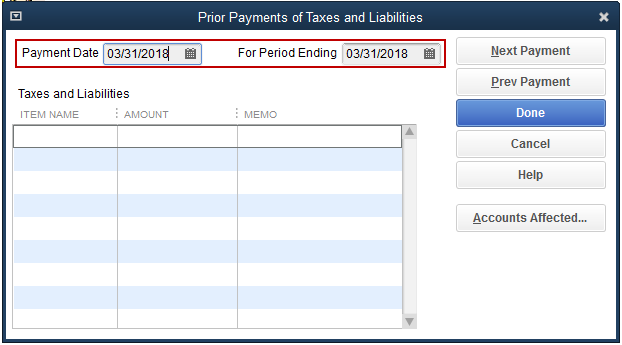

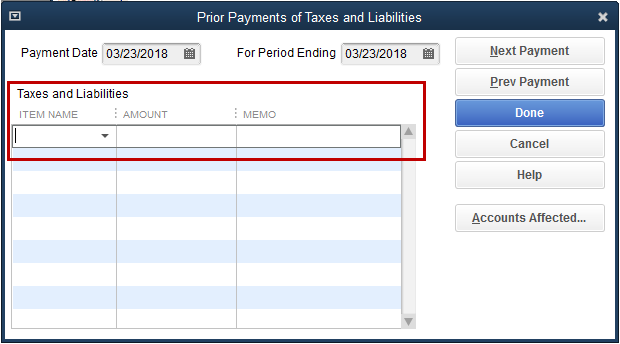

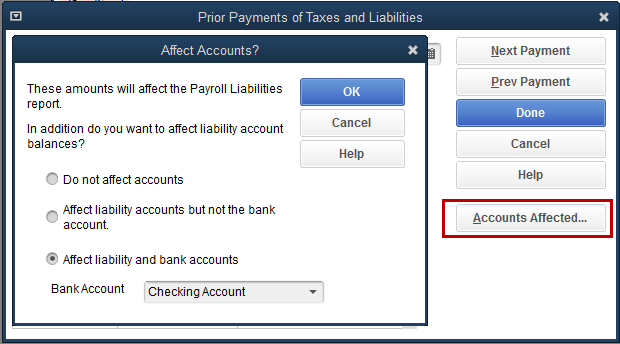

We can enter historical tax payments outside the Payroll Setup Window and select the Do not affect accounts option for prior payments won't show in the bank register. To do so, you can follow the steps outlined below:

Additionally, QuickBooks provides selected reports for your payroll and employee so you can manage and keep track of your employees' expenses. Learn how to customize these reports to get the data you need most. I've added this article for more details: Customize Payroll And Employee Reports.

Please get back to us if you have any questions about overpayment. We're here to make sure everything is covered.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here