Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

The previous bookkeeper did not have the correct rate in for FL-Unemployment for the first qtr. She paid the correct amount and entered the amount she paid, which left an over payment for the first qtr. The rate was corrected in the 2nd qtr. and it looks like the system did a catch up on the first payroll in May. When I filed second qtr. I paid the correct amount, but the system still thinks we have a payroll liability for the 2nd qtr. It will not let me remove the liability payment. Why did the system not correct the liability if there was an over payment from the first qtr. and how do I remove it? Every time I delete what it thinks we still owe, the system puts another liability check right back in the pay liabilities.

Hi there, @rgonzalez2.

Thanks for visiting the Community for assistance. When you update your SUI rate, QuickBooks will automatically recalculate any payments you've made at the incorrect rate.

Most likely, it will result in an overpayment or underpayment for the quarter. You can create a Payroll Detail Review report to verify that the tax amounts are calculating correctly based on the wage limit and tax rate. Here's how:

Then, customize it to display the affected date, employees, and tax items. Here's how:

From the report, determine if you want to decrease or increase the wage base, tax amount, and income subject to tax, and by what amount. Here's how:

Then, follow the steps to adjust your payroll liability outlined in this help article: Adjust payroll liabilities in QuickBooks Desktop.

For proper guidance, I'd recommend you consult your state agency or tax professionals.

Let me know if you have more questions. We're always delighted to help.

That's not the problem, they system still thinks we owe for the 2nd QTR, and no matter what I do, it keeps producing a liability for that amount. We overpaid in the first quarter, and paid the correct amount for the second QTR. Should I change the payment in QB for the first QTR?

I appreciate you getting back to us and sharing some updates about the issue, @rgonzalez2,

There are a few things we need to check to accurately record an overpayment in QuickBooks Desktop Payroll. Factors such as, where the payment is made, how is it recorded in the system, is there a liability adjustment created by the previous bookkeeper and if a credit is issued by the agency, requires different approach to resolve the excess tax payment.

The liability amount in the Payroll Center is derived from the transactions or paychecks created during a specific quarter. If one creates a payment within the program, the tax payable amount reflected on the check should be the same as the total FL-Unemployment accumulated for that period.

If the amount calculated by QuickBooks is incorrect, you will need to create a liability adjustment to show that there was an overpayment made. That is the only time the system will auto-apply the excess fund to the next quarter's liability to offset it.

However, for payments processed outside the program, they will not directly sync in the program since the state agency isn't directly connected to our database. If you want to show the overpayment, you need to manually create a transaction for the credit. The steps are listed here: Apply your payroll liability overpayment as a credit.

If you need someone to help you check for any adjustments and make corrections over the phone, I recommend contacting our Support Team. They can do a live viewing session with you to help remove the alerts and apply the credit correctly.

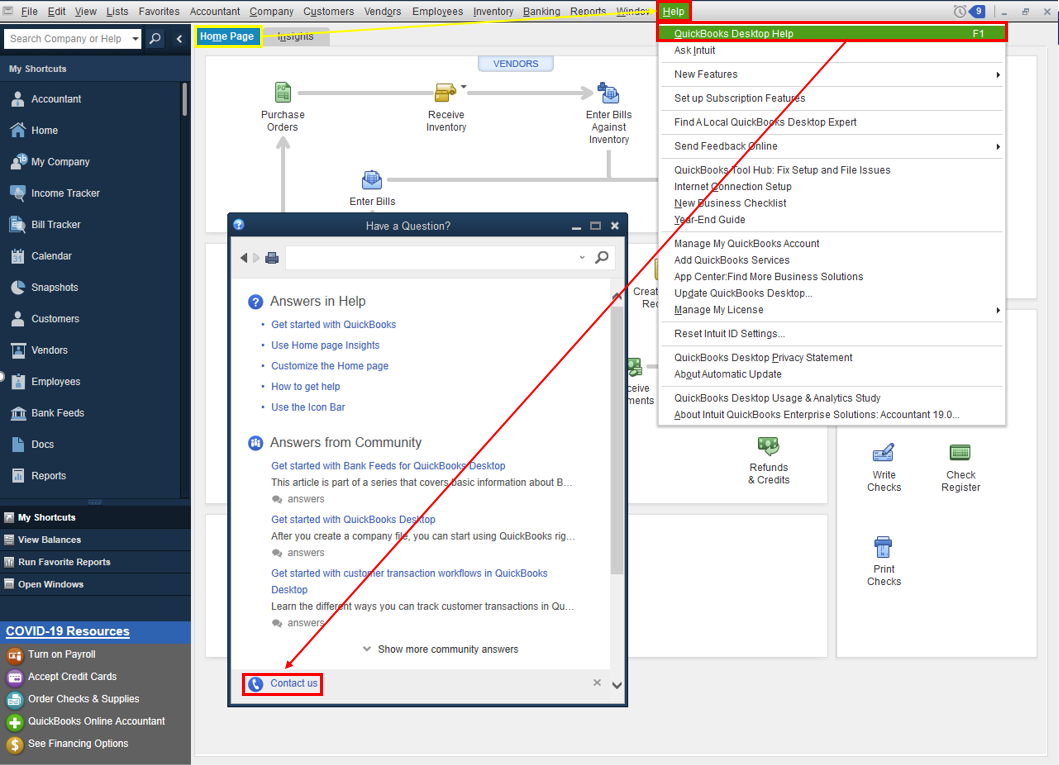

Another option to contact us is through the web. Here's how:

Let me know how it goes. If you want me to check this one personally, feel free to share some screenshots of the activity created by the previous bookkeeper. I'd love to help you out further, so your payroll is error-free. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here