Hi there, Lisa.

I'm here to help you with accounting for the paper checks issued outside of QuickBooks Online (QBO).

Since your account is no longer on hold, you can run payroll within the software by changing the payment method from Direct Deposit to Paper Check for your employees. If you have created paper checks outside of QBO, you can create them within the software to reflect the employees' earnings and withheld tax amounts in their W-2s. Please follow these steps:

- In your QBO account, go to Payroll.

- Select Employees, then select your employee.

- Payment method, select Edit.

- From the Payment method drop-down, select Paper check.

- When finished, select Save.

- Run payroll again.

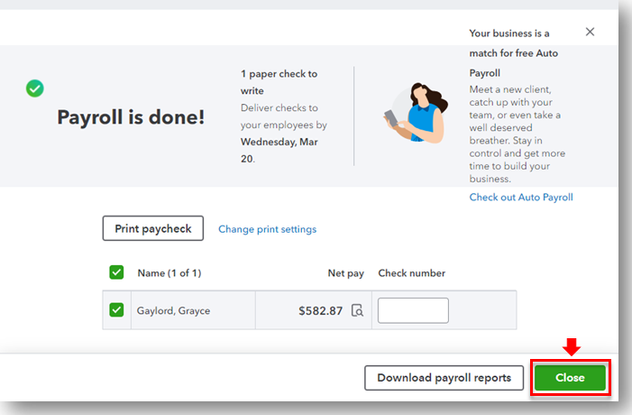

Make sure you choose the correct pay schedule and period to reflect the time you've issued the paper checks. After you've processed the payroll, skip printing the check and choose Close. I've added a screenshot for visual reference:

Moreover, you can invite your employees to QuickBooks Workforce, where they can view their paycheck details and total pay for the year. You can check out this article as a guide: View your pay stubs, time off, and year-to-date pay in QuickBooks Workforce.

If you need further assistance creating the paychecks in QBO to ensure that the employee W-2s are correct, we'll be here in the Community to help. We're committed to offering ongoing support. Have a great day!