Hi there, LMHHRGV. I'm here to help you cancel your scheduled payment.

Beforehand, please note that you can only cancel a payment if it hasn't been processed yet. Federal tax payments can be deleted two business days before their scheduled payment dates, before 5 pm PST.

On the other hand, some states taxes have different lead times for processing tax payments. Others may take up to five business days. If the lead time for your state is five business days, delete the payment five business days prior to the payment date, before 5 pm PST.

There's also a few other things you want to be aware of:

- You can delete a payment if it was manually recorded (non-electronic).

- You can delete payments if they haven't been electronically processed yet.

You won't be able to delete them if:

- The payment is in process or already processed electronically.

- The form, along with the payment, was already transmitted or accepted by the agency.

- The payment was rejected due to insufficient funds (NSF).

Here's how to delete the schedule if you manually record the tax payment:

-

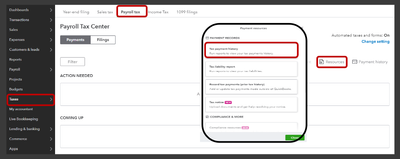

- Go to the Taxes menu and select the Payroll tax tab.

- Choose Resources, then Tax payment history.

- Click the name of the tax payment. Change the date range if necessary.

- From the drop-down list for View and Print Form, tap Delete. If you don't have the option, the payment is already processed.

- Hit Yes to confirm.

If you pay taxes automatically or initiate payments using QuickBooks, you may need to contact us to check if it can be canceled or deleted.

Additionally, I've added these resources that can help manage tax payments:

Please know that we're here to provide you with continuous assistance and support throughout this process. Don't hesitate to reach out if you need further help. We're committed to helping you every step of the way.