Welcome to the Online Community, tctray.

To ensure I can provide the best solution, I need additional information about your concern. Are you trying to enter a prior 940 payment or edit the amount?

If you haven’t run payroll and want to record the payment, let’s go to the Payroll Tax Center to accomplish this task. Here’s how:

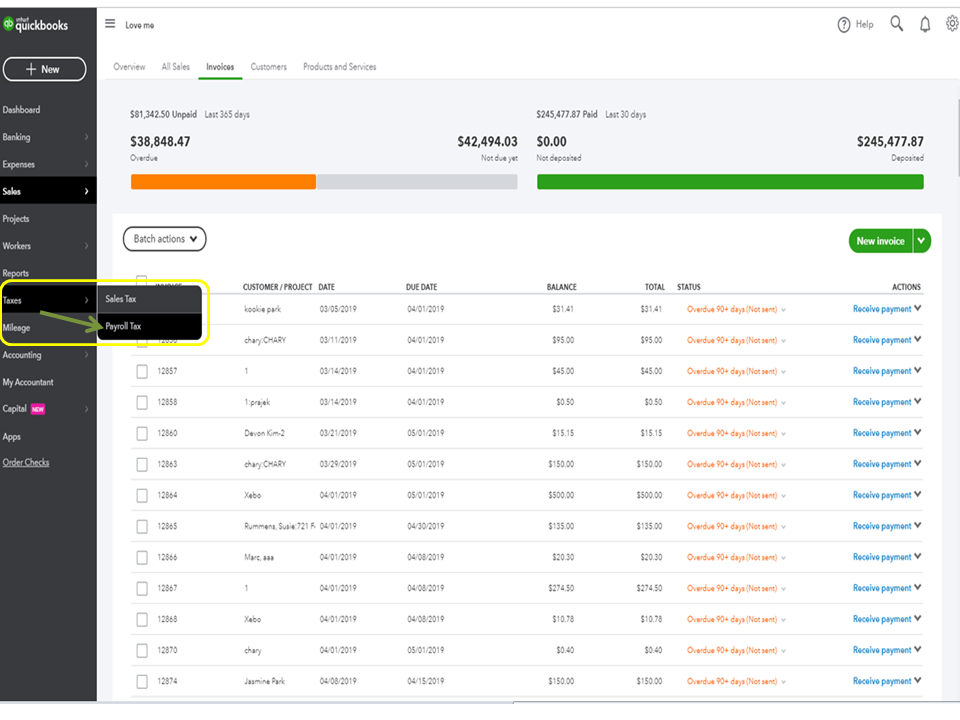

- Tap the Tax menu on the left panel to choose Payroll Tax.

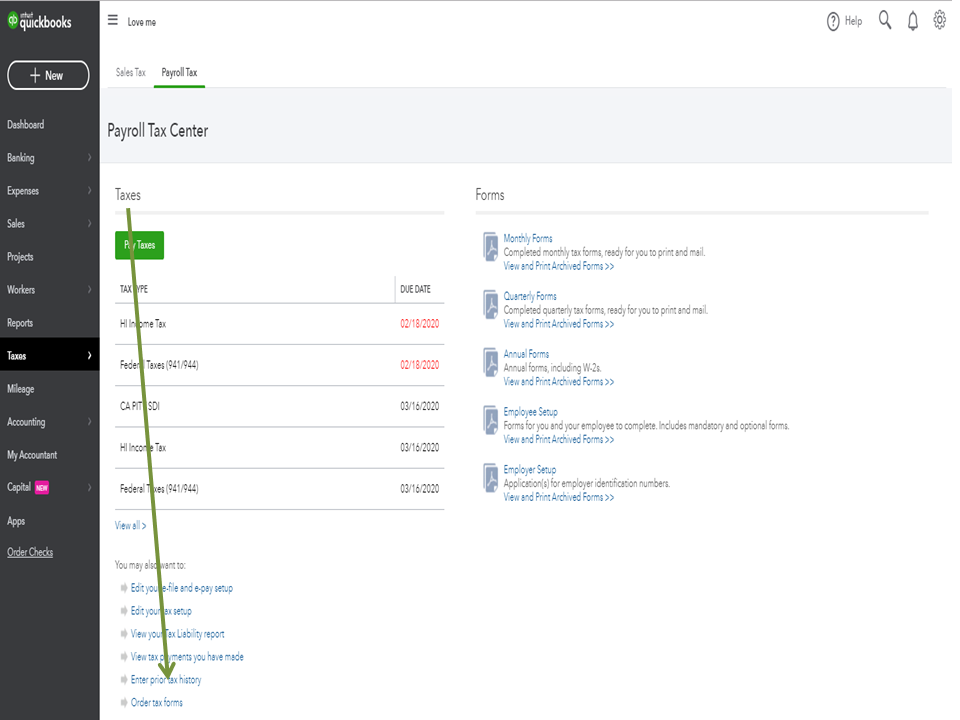

- Click the Enter prior tax history link under Taxes.

- This will take you to the Prior Tax Payments page.

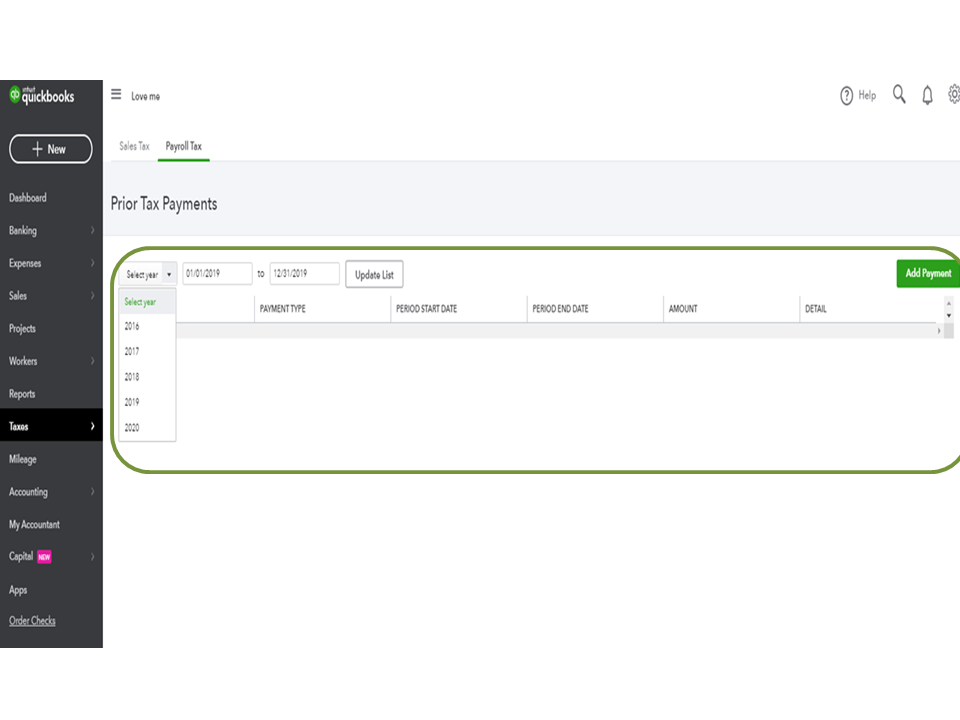

- From there, choose the correct year from the Select year drop-down and then tap the Add Payment button.

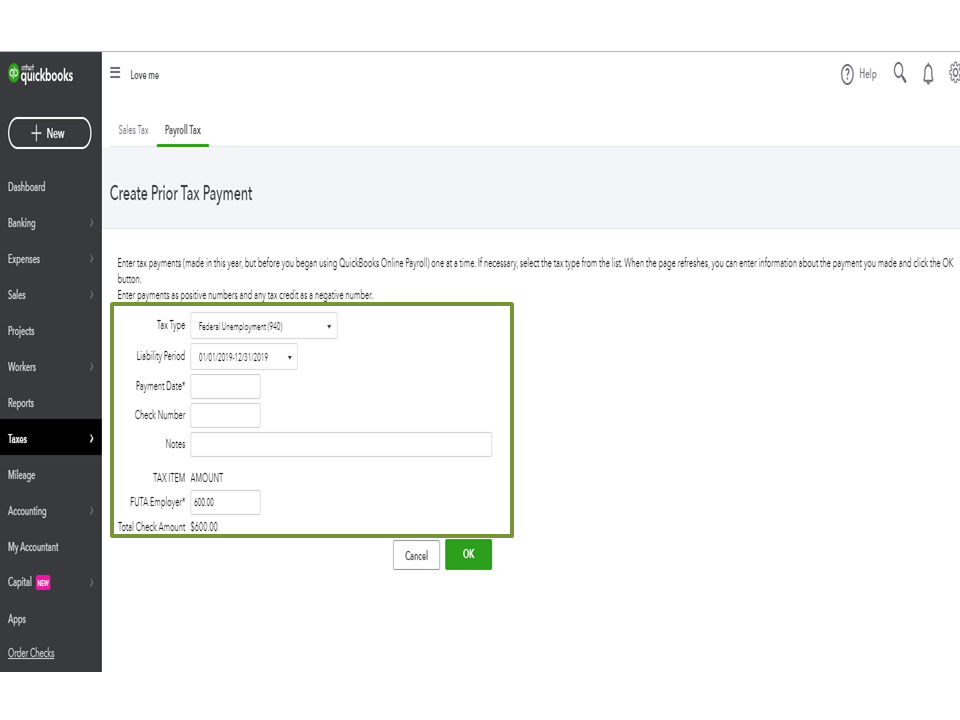

- On the Create Prior Tax Payment page, choose Federal Unemployment (940) from the Tax Type drop-down.

- Then, select the liability period and fill in the remaining field boxes.

- Press OK to save the changes.

However, if you’ve already processed payroll, I recommend reaching out to our Payroll Support Team. They have tools to help you process the payroll correction.

To contact them, follow the steps below:

- Choose the Help menu in the upper right hand to open the Search window.

- From there, scroll down to click the Contact us link.

- Type the issue/topic in the field box and then press the Let’s talk button.

- Select how you want to reach out to our support team: Start messaging or Get a callback.

The following article provides an overview of recording prior tax payments in QBO. It also contains instructions on how to input them in QBO.

Stay in touch if you need further assistance while working in QBO. Please know I’m always here ready to help and make sure you’re taken care of. Enjoy the rest of the day.