Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I recently switched from QB Desktop to QBO. My payroll set up seemed to go smoothly, I only had to adjust a few starting balances. I ran my first payroll last Friday and QBO assigned new accounts for all of my tax liabilities and expenses accounts, and also my employee repayment account. I can work around it, even though it's frustrating. What I can't figure out is why the 941 taxes due are only calculating at $2.76 owed - when it's closer to $8200. Where does the Payroll Tax Center > Upcoming payment section pull the data from? The payroll reports are showing the correct amount so I don't understand why it didn't transfer to the liability section. Also, I've lost the reminders for the garnishments payment and the retirement amounts.

Thank you for dropping by the Community today, bamliam1.

I can see how important it is for a business to have accurate calculations on payroll taxes. This ensures your taxes and forms are in order.

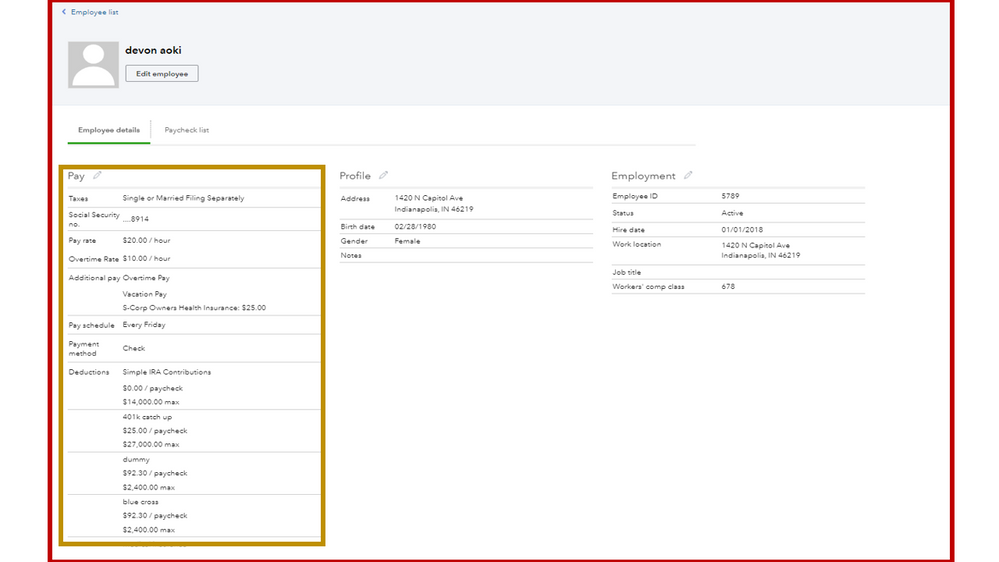

Let me provide some information why your 941 taxes computation showed a lower amount. QuickBooks calculates your federal withholding based on the factors below.

To rectify the issue, review each of your worker’s profiles and make sure that the information recorded is correct. I’m here to ensure the process is a breeze for you.

Here’s how:

For more details, you can read through this article: Edit or change employee info in payroll. It includes instructions on how to do the process in each payroll version.

Also, the amount shown in the Upcoming payment section is pulled from the paychecks created. Since the payroll reports displayed the correct amount, I suggest contacting our Payroll Support Team.

One of your specialists will review your payroll setup in a secure space. Then assist in applying the permanent fix, including the reminder for your garnishments and retirement accounts.

To get acclimated to the payroll processes in the online version, I’m adding a link where you can access our self-help articles: QBO guide. You’ll see topics about taxes, reports, account management, and other payroll-related activities.

Stay in touch if you have any clarifications about your taxes calculation. I’ll get back to answer them for you. Have a great rest of your day.

Thank you - I figured it out on my own. The prior tax history payments didn't transfer from Desktop to QBO correctly. The pay period dates were overwritten to match the pay date of the Liability. I've gone in and corrected all payments and now I'm showing the correct liability.

There really should be a better support system for transferring from Desktop to QBO. Even if it's only a checklist to help out new users of QBO.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here