Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, spaLOGICng LLC.

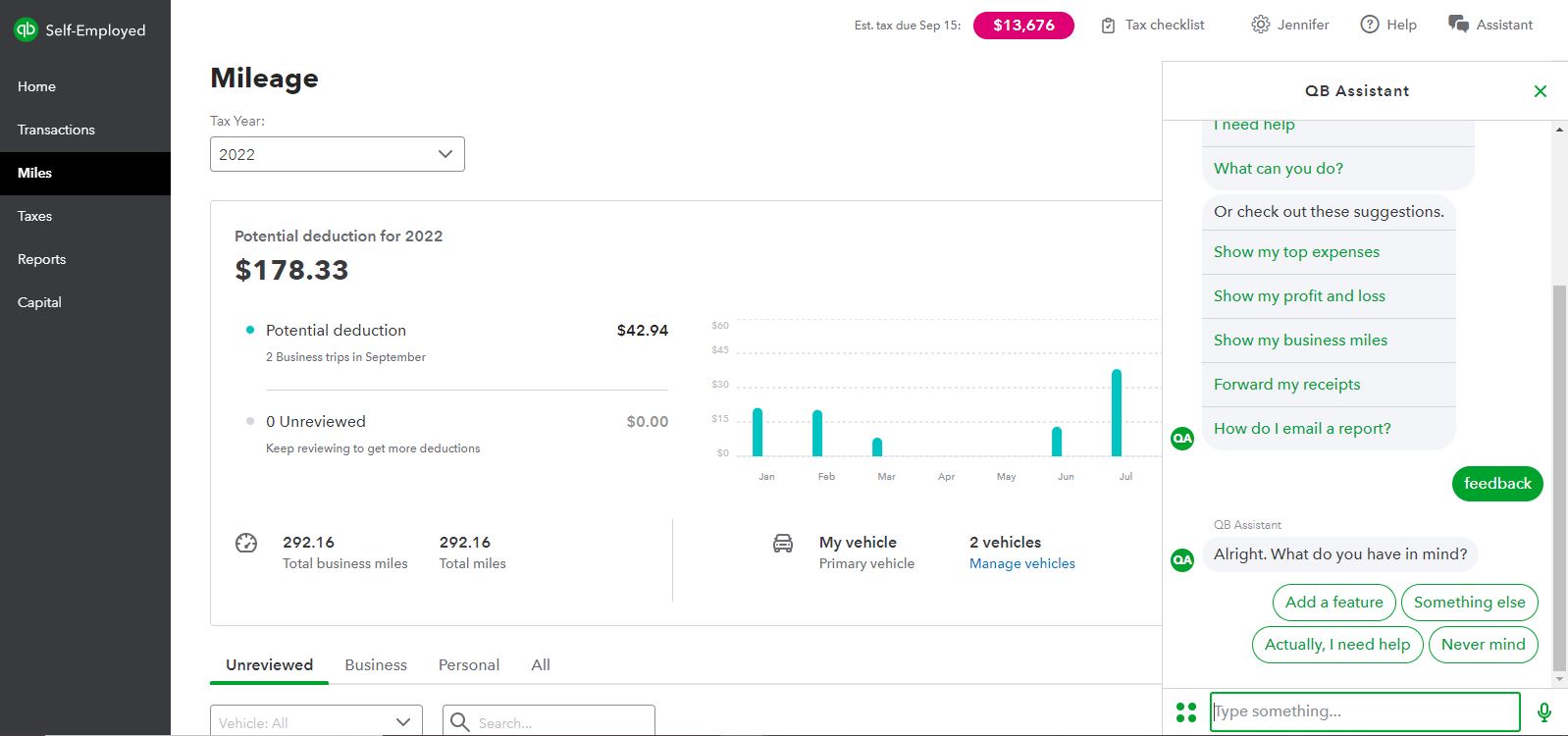

I appreciate your time in sharing your thoughts with the current mileage tracking system. I'll show you the steps to help you upload your miles from a CSV file.

We can use the Import Trips function to add your trips from the CSV file. Here's how:

The source doesn't matter as long as you have a downloaded CSV file. It might take a while for the system to import your trips, so check your email from time to time for the update or progress.

Also, we're constantly updating our Self-Employed program. Our developers are looking for ways to enhance your experience, including the mileage tracking system.

If you'd like a different option in tracking your miles automatically, we can send feedback to our developers. They'll review your input and might consider adding Gridwise to the mileage tracking system.

Here's how to send your feedback:

If you'd like to know more about tracking your miles manually, you can check this article: Manually track mileage in QuickBooks Self-Employed.

I'd also like to ask the issues you have with the current tracking system. This way, I'll be able to lay down some solutions to ensure you'll be tracking your miles automatically and properly.

In the meantime, you can check one of these articles for solutions in fixing the issues in the current mileage system:

Ready to manage your estimated taxes in the Self-Employed program? You might find this article helpful: Pay federal estimated quarterly taxes in QuickBooks Self-Employed.

Please let me know if you have other questions in managing your miles. Do you have concerns regarding your deductions or estimated taxes? Lay down the details below and I'll help you manage them.

Hello @spaLOGICng LLC,

Thank you for posting here in the Community. I'm here to help you upload your Miles data into QuickBooks Self-Employed.

QuickBooks Self-Employed now uses Google API (Application programming interfaces) for Mileage. As of now, we only have the importing trips available via Google and this has been improved unlike before.

Unfortunately, the option for MileIQ has been removed. As a workaround, you can add them manually into the system using the Add trip option from the Miles section.

In case you need the steps, here's how:

Moving forward, I encourage you to use Google in tracking work trips. This way, you'll be able to instantly upload data without entering each trip into QuickBooks.

Having the ability to bring over data without entering them manually is beneficial to all users. As we assess this, you can also submit your suggestions to our product engineers.

QuickBooks users take part in the improvements of the product. Please follow these steps:

I've attached a link you can use to learn more about how to track mileage, as well as categorize vehicle expenses in QuickBooks: Learn how QuickBooks Self-Employed calculates mileage deductions.

Let me know if you have any questions or clarifications about tracking mileage. I'll keep an eye on this thread. Take care always.

Hi,

Thanks for your reply. Unfortunately Google Trips is not a reliable means to track miles for Rideshare. I have also tried to get Google Trips before for this purpose and had nothing but problems, from A to Z. Furthermore, I have opted to use Waze because Google has been giving me undesirable routes.

MileIQ is not reliable.

QuickBooks Mileage Tracker is not reliable.

I use Gridwise to track miles. It is the most reliable. They let me download a CSV and I can format it to QuickBooks, but now you have discontinued the manual CSV Upload.

Lastly, it is too laborious to manually enter trips into the QuickBooks Portal.

That said, I will just disregard the mileage tracker for taxes and use Microsoft Access to maintain my mileage.

Thanks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here