Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the Intuit Community forum, lthrasher77.

I'm glad to help enter the country address in QuickBooks Online Payroll.

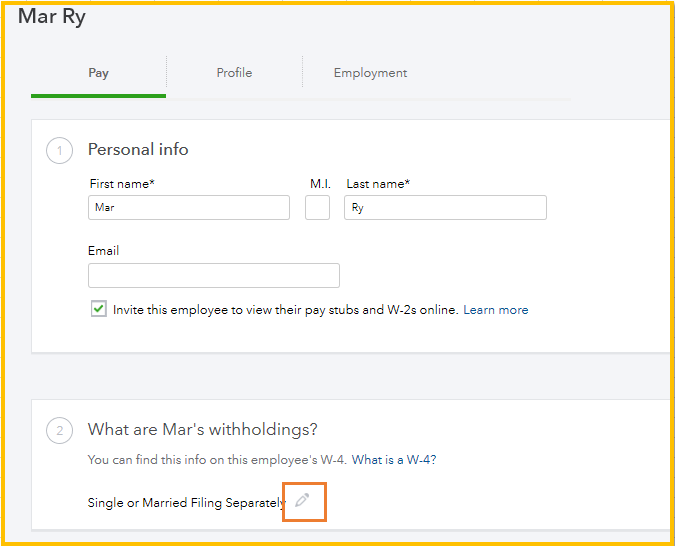

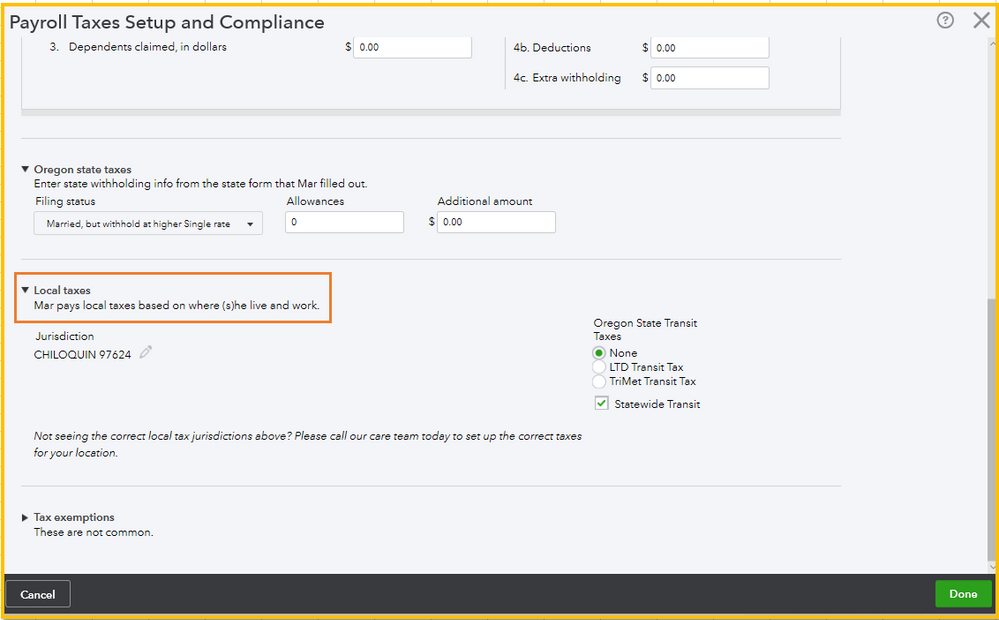

You're almost there. After entering the employee's W-4 information, scroll down to see the Local taxes section. The system will automatically fill in the information for you. You have the option to see the details.

Let me show you how:

QBOP calculates local taxes based on your IRS filing address. Your address determines the local tax jurisdiction: the city, county, and regional agencies where you'll owe payroll taxes.

Check out the Local tax setup and support: Main hub page to see each article on how to enter your jurisdiction for your employee and company.

To get started with payroll, this link will guide you through for more details: Set up and start using your new Payroll.

Let me know if there's anything else you need, and I'm always around to help you out.

I set up my new employee to get payroll checks and she is. However, her name does not appear on my W-2 report and I need to change her address!

HELP!

Polly Dulin

Assisted payroll

Allow me to share some information regarding an employee not showing on W-2 and help you with changing their address, pdulin.

As an insight, the available preview information includes year-to-date wages for any payroll transmitted through September 30 regardless of the payroll check date.

Hence, this is why they're not showing on W-2 report. But don't worry, they'll still receive a W-2 year-end. Check out this article for more details: Get answers to your W-2 questions.

On the other hand, you can follow the steps below to change the address:

Check out these article for future references. These will provide you lists of voluntary deductions as well as taxability types:

Supported pay types and deductions explained.

Set up voluntary payroll deductions in online payroll.

Feel free to drop by again if there's anything else I can help you with. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here