Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'll provide a few information about holiday entry and guide you on how to set this up, J_Daniel.

Holiday premium pay is equal to an employee's rate of basic pay. Normally, employees who work on a holiday receive their rate of basic pay, plus holiday premium pay, for each hour of holiday work. Therefore, this makes it a paid time off and increases an employee's paycheck for those who are receiving salaries.

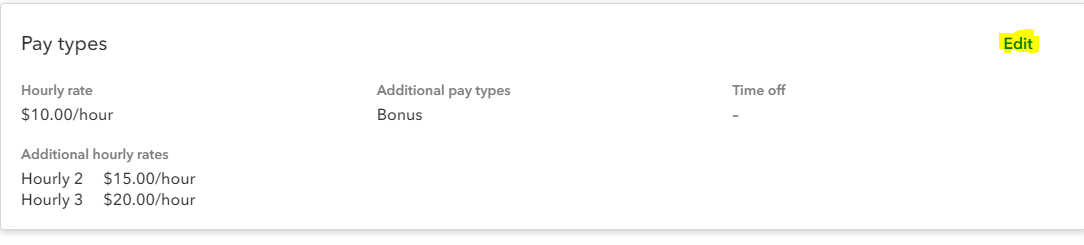

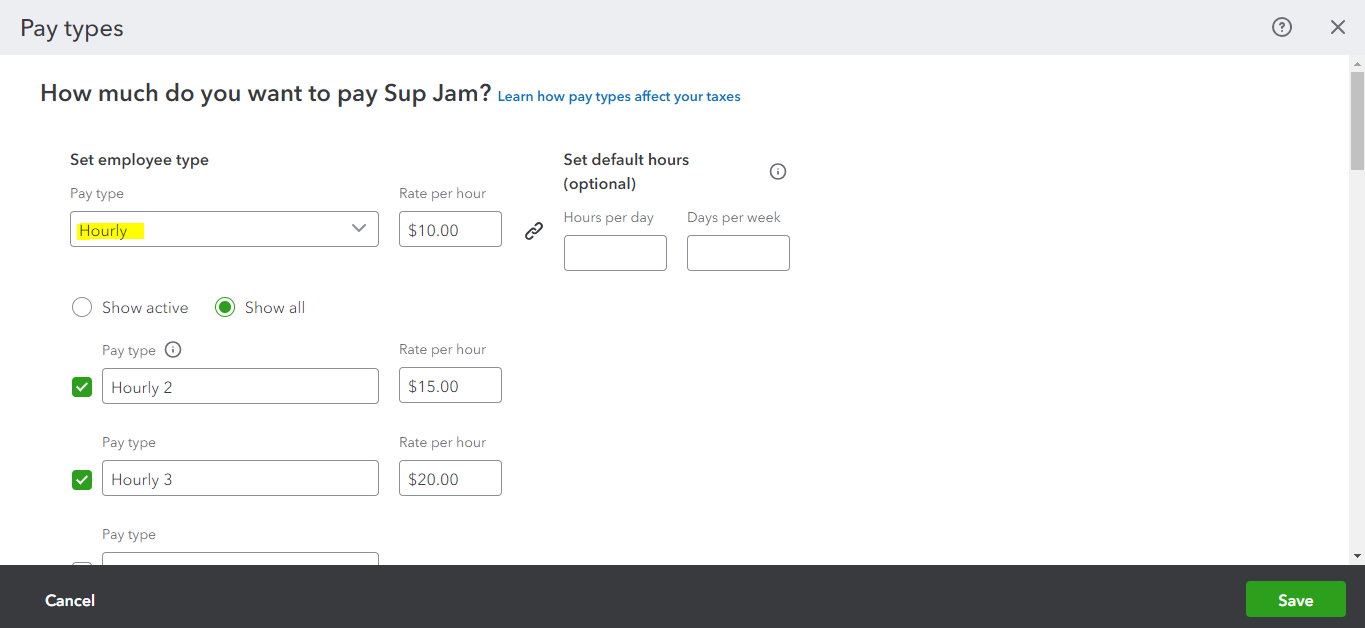

You can set up a holiday pay type so you can pay your employees for that particular entry. However, all of this will still depend on the policy. You'll want to reach out to your accountant if you need more guidance regarding this matter. To set up a holiday pay, follow the steps outlined below:

On top of that, learn from this article how you can send a scheduled or unscheduled payroll so you can pay for your employees: Create And Run Your Payroll.

Please get back to us if you have any questions about holiday pay. The Community is always here to assist all your needs 24/7.

Appreciate the reply. Ended up calling support Monday as more hand-holding was needed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here