Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have an employee who receives $200 each month as a health insurance allowance (his health insurance is covered by his wife). This is a taxable allowance. In QB Online, this allowance has been set up as an "additional pay type" in order for it to be included in the tax calculations. The difficulty I am having is with the calculations for the company contribution to the employee's 403(b) plan. Our policy is to provide 6 percent of an employee's salary to the 403(b) plan. For example, if an employee's annual salary is $60,000, the calculation would be 60,000 divided by 26 (employee's are paid every two weeks) = $2,307.69 x 6% = $138.46. That is the contribution the employer makes to the 403(b) plan. However, in QB Online, it includes the $200 monthly allowance as part of the employer contribution to the 403(b) plan. So, once a month, the calculation is $2,307.69 + $200 = $2,507.69 x 6% = $150.46. There seems to be no way to change this since the employer contribution is set up as a flat amount of 6 percent of the gross salary. Any suggestions? I've spent hours on the phone with Intuit but there does not seem to be a fix. According to Intuit, the health insurance allowance cannot be moved to employer contributions. I am truly sorry that I had to migrate to QB Online because QB Desktop was no longer supporting payroll functions. Setting up and working with payroll (especially payroll items) was so much easier in Desktop. Right now, I am resigned to the fact that we will be making a slightly larger contribution to is 403(b) plan especially since it is less than $150 a year and, thankfully, we are a very small organization so I am not faced with this dilemma for multiple employees. Thanks for any help. Nancy

I have an idea of how you can do this in QuickBooks, NK-919.

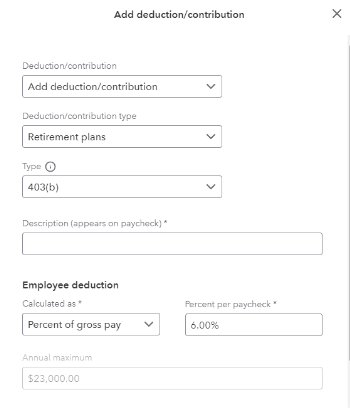

But before we start, may I ask how you set up your employee's health insurance? I've tried this and set it up under Allowances under Pay Types. But it's not adding up as a contribution to 403 (b). Please see the screenshot below:

On the other hand, you'll have to set up 403 (b) as a Percentage of gross pay instead of the flat amount, so it will accurately calculate the amount. To do so, follow the steps outlined below:

Furthermore, learn the list of payroll reports that you can use with QuickBooks Online (QBO) to help you generate the right data for your employees. I've added this article for more information: Run Payroll Reports.

You can always let me know if you have any concerns when running payroll I'm always here to help.

Thanks for your response.

The health insurance allowance is set up under "common pay types" as an allowance with a recurring amount of $200. Since the allowance is only paid once a month, I simply edit the other paycheck to delete it. The employee does make a tax deferred contribution to the 403(b) plan. That is set up as a flat amount. The employer contribution to the 403(b) plan is set up as a percentage of gross pay at 6 percent. Although the health insurance allowance is taxable income to the employee, it should not be added to his salary (annual yearly salary) when the 6 percent calculation is made.

Nancy

Thanks for your response.

I've tried to respond with limited success!

The health insurance allowance is set up under "common pay types" as an allowance with a recurring amount of $200. Although it is only paid once a month, I simply deduct the amount on other paychecks.

The employer contribution to the 403(b) plan is set up as a percentage of gross salary at 6 percent. The employee does make a tax deferred contribution each paycheck which is set up as a flat amount.

The health insurance allowance is a taxable amount to the employee but should not be included in the calculation for the employer contribution to the 403(b) plan.

Nancy

Thanks for getting back to us, @NK-919. Let me direct you to the appropriate contact to assist with your 403(b) contribution matter in QuickBooks Online (QBO).

As the health insurance allowance is added as a pay type, it will be included in the total gross pay during the payroll run. Consequently, it's also included in the 403(b) contribution since you've configured it as six percent of the gross pay.

To ensure the health insurance is not applied to your 403(b) contribution, I recommend seeking advice from a tax specialist regarding alternative methods of recording it in QBO.

Furthermore, I'm providing a list of payroll reports that can offer valuable insights into employee wages, taxes, and contributions whenever needed: Run payroll reports.

Feel free to visit the Community anytime if you require further assistance regarding the 403(b) contribution in QBO. We're here to offer support. Stay safe, and have a wonderful day ahead!

Thanks for your response. I've spent hours on the phone with QB Online support - with both payroll specialists and tax specialists - and, unfortunately, no one has been able to resolve this issue.

Nancy

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here