Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWho else filed their quarterly WA Cares quarterly filing and found out you collected too much because QuickBooks calculated the premium based on gross wages including tips? Not sure how to correct this but should be fun considering QuickBooks said don’t worry we got you only to not have us.

Let me share some insights about Washington Paid Family and Medical Leave insurance premium, MMM Consulting.

Washington Paid Family Leave does not include any tipped wages. If you have any tipped employees or income, they will require payroll adjustments to ensure the tipped income is not included in the reported wages. We'll need to review first if the rate entered is correct to avoid wrong calculations. Here's how:

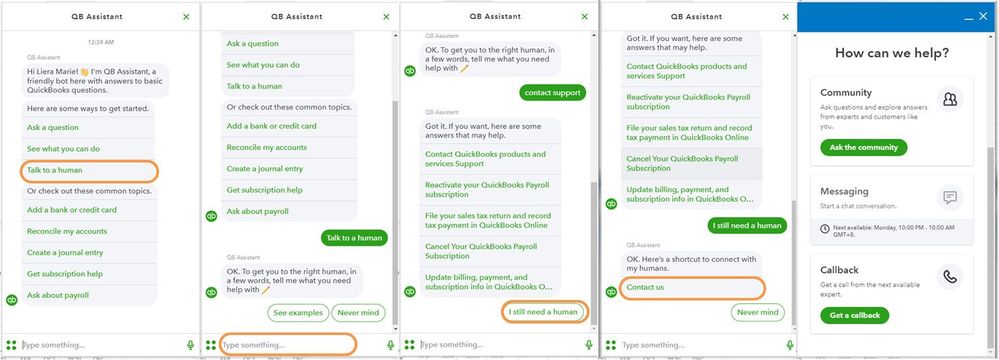

If the set up is right, please contact our Payroll Support Team to help you with payroll adjustments. They will help you ensure the tipped income is not included in the reported wages. Here's how to reach them:

You can reach out to them through this link and ensure to review their Support hours to know when agents are available: QuickBooks Online Support. You can also check this resource for more details: Set up your Washington Paid Family and Medical Leave insurance premiums.

Once everything is settled, you can confidently run your payroll in the future.

Let me know if there’s anything else I can help you in managing your taxes or your account. I’m only a few clicks away from you. You have a good one.

Agreed shouldn’t include tips. However, the PFML premium works just fine. However the new Cares should act the same but does not. In the settings QB has a hard coded rate. I can’t adjust the rate that is set in there at .58%. QB said as an online Payroll I needed to do nothing it would work. So when it didn’t I am a little confused. You think if QB can have PFML calculate correctly then the Cares tax would be no different.

I understand your confusion regarding the FMLA premium and the Cares tax calculations in QuickBooks (QB) Online Payroll, MMM Consulting. I'll point you in the right direction to address this concern right away.

In this case, it's important to note that certain tax rates and settings in QBO are hard-coded and cannot be adjusted by users. To make the necessary adjustments, I'd suggest contacting our Payroll Support Team. They have the necessary tools to check your account and ensure that the Care tax is calculated correctly. You follow the steps provided by my colleague above on how to reach them.

I've added this article to learn more about managing paid family and medical leave in Washington and Washington Cares Fund payroll tax in QuickBooks:

Don't hesitate to post here in the Community for further assistance. I'm always here to help and ensure that your payroll calculations are accurate. Take care.

Just spent two hours on the phone and giving documentation from the state's website that Cares doesn't include tips and wages but they said it wasn't clear enough and can't escalate it. So frustrating that the tax promise is smoke and mirrors. Not sure what to do other than to switch to a product that has actual support.

I just spent over an hour on the phone with Intuit Payroll Support and she could do NOTHING! I showed her clear as day the issue and documentation. She kept saying that Intuit cannot make any changes until they get verification from the state of the tax rules for the WA Cares tax. IT SHOULD USE THE EXACT SAME GROSS WAGES AS THE PFML DOES. That is not complicated so FIX IT Intuit. You are fraudulently collecting too much tax from the employees. When I filed the PFML and WA Care data on SAW, it calculated correctly and I paid the correct tax due.

I know it’s still not fixed on my account either. I am checking in today to see if there has been any movement with resolution. So strange it’s taking so long to fix.

I completely understand how crucial it is to exclude tips in the Washington Care tax, especially when it comes to reporting, sharidcox.

Reported tips are considered tax exempt in Washington Care tax. Since they are included, I recommend contacting our QuickBooks Payroll Support for assistance with making payroll adjustments. They will guide you through the process and help ensure that the tipped income is not included in the reported wages.

I've included the steps to contact support below.

I appreciate your patience as we work through this. If you have any other concerns or questions about managing your payroll, please don't hesitate to add a comment below. I'll be glad to help you out.

As my post stated, I already called into Payroll Support and she told me that she could do nothing, had no update on correction of this Intuit error and no timeline. The Desktop version does it correctly so maybe have your team refer to your other QB platform for the correct handling of this.

This took me a bit to dig into but here's the authoritative guidance and website. So I won't go on hold right now instead I'll provide this and hope one of you is successful or QBO figures this out.

From the site below definition with authoritative guidance:

What are gross wages? – Washington State's Paid Family and Medical Leave

In Paid Family and Medical Leave, wages are generally referred to as gross wages without tips. Wages are defined in statute (RCW 50A.05.010) as the remuneration paid by an employer to an employee (up to the Social Security cap for premium assessment).

Below is the authoritative law for what wages count for Wa Cares.

You are absolutely correct and this is exactly what I have QB. Thank you for providing it here so beautifully.

Gave not have

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here