Organizing your transactions properly can make a big difference in your books' accuracy, Ivy Admissions. I'll share some ways to prevent the blending of expenditures.

Most of the time, this situation happens if there are transactions accidentally edited or recorded to the contractors' accounts. As a result, it gets difficult to keep track of your company and payroll expenses. This slightest of errors could impact your business in general.

To rectify the problem, we'll have to manually review each payment and ensure that they're linked to the correct category. Here's how to do it:

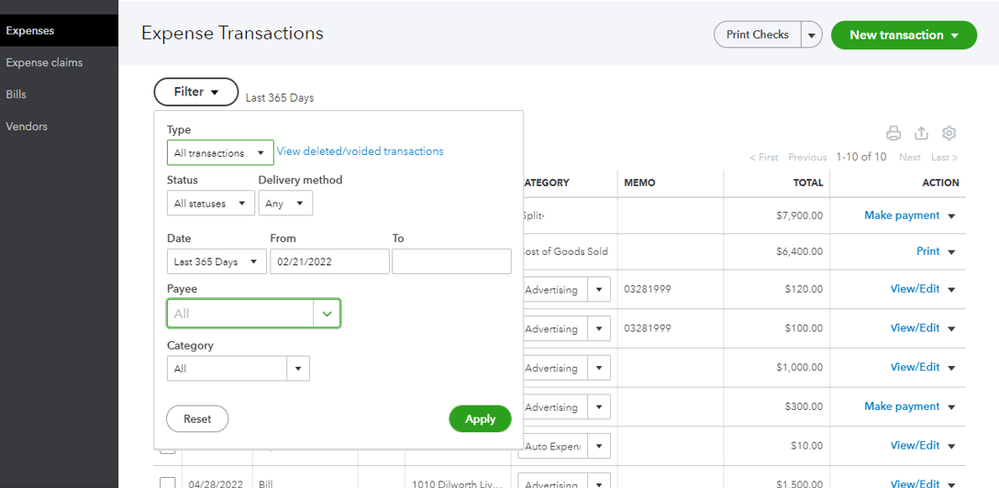

- Head to the Expenses menu.

- Select the Expenses tab.

- Click the Filter button, then select a contractor in the Payee drop-down menu.

- Open the transaction and check the content and accounts affected.

- Make the necessary changes, then hit Save and done.

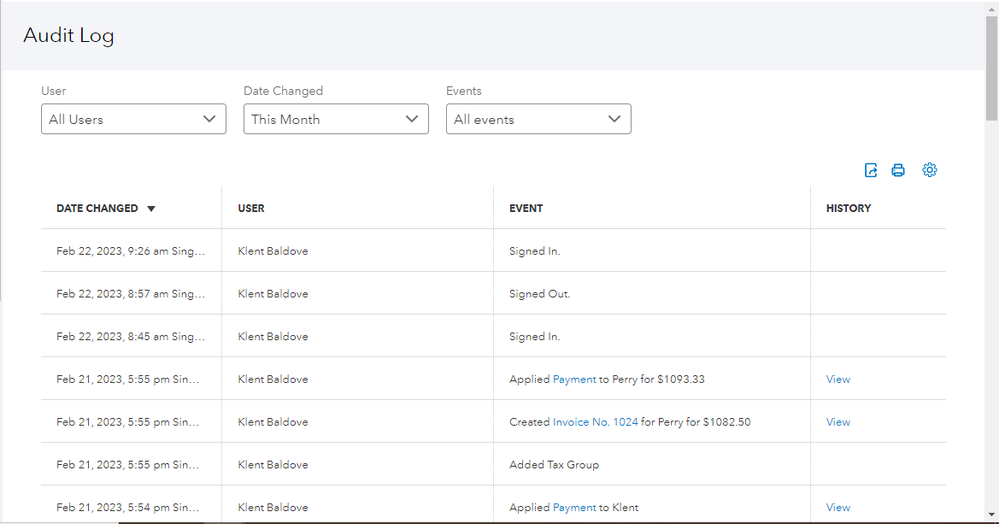

To streamline the review process, use the audit log as a reference. This contains all the activities in your account such as user sign-ins, changes to settings, transaction modifications, and payroll submissions.

- Go to the Gear icon.

- Choose Audit Log, then click Filter.

- Utilize the fields on the panel to choose a user, date, or event to narrow the results.

- Select Apply.

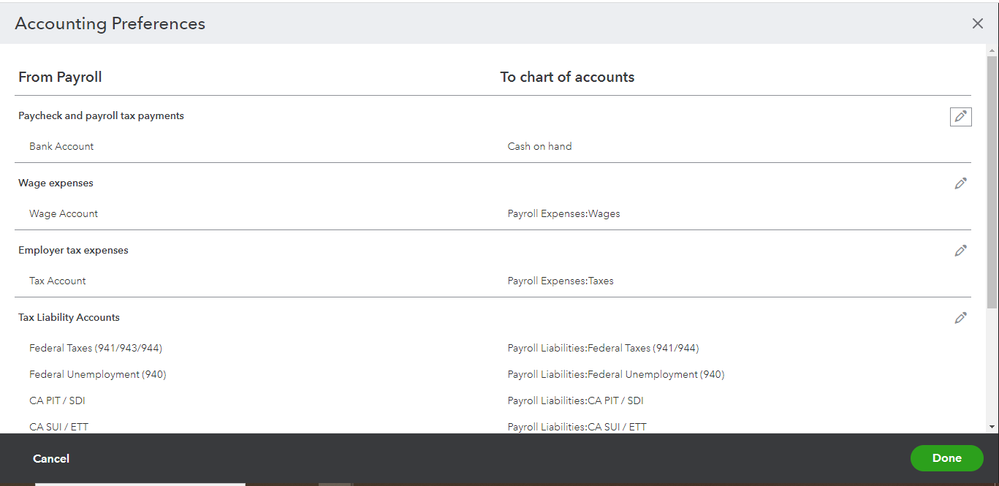

In addition to that, let's verify that your payroll settings are mapped to the accounts. This way, your pay runs and vendor transactions won't be combined.

- Click the Gear icon.

- Select Payroll settings.

- Scroll over to the Accounting tab.

- Adjust the mapping as needed.

- Tap Save, then Done.

Finally, here's an article that you can read to learn how to handle enterprise spendings made with employee/personal funds: Mixing business and personal finances.

Let me know if you need a hand in managing your vendors and workers. I'll also hear you out if you have concerns about other areas of QuickBooks Online. Thanks for visiting us, Ivy Admissions!