Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I properly add in a repayment to an employee for buying something for the company with their own money? And then correctly account for this on the chart of accounts/ P&L?

Thanks!

Solved! Go to Solution.

Hey there, bspeed,

I can help you repay your employee's business-related expenses.

You can create a non-taxable reimbursement item then add assign the correct expense account for the repayment. Once done, you can now add the item to your employee's paycheck. Let me guide you through the process:

Step 1: Add a new payroll item.

Step 2: Add the item to your employee'c paycheck.

That should get things done for you, bspeed. Please check out this article to know more about adding a non-taxable reimbursement payroll item: Create a non-taxable reimbursement payroll item in QuickBooks Desktop Payroll

Please let me know if you have any questions. I'm always here to help you whenever you needed help. Have a good day!

I do it the same as any other purchase...

If you want to be able to run Reports on what you paid each of them, then set them up as a Vendor (even if they're already in as an Employee) and when you repay them (Cash or Check), use the correct Expense Account for whatever the purchase was for. For a reminder you can put something like "Reimbursement: [Item(s)]" in the Memo field. (Notes like that help the Accountant too when they see the same name it two places.)

If the amounts are small (your choice as to what is "small" in your business), just pay them Cash and enter the Store/Vendor and Expense Account as if you went out and bought it. If the "Business" is buying something, it just needs the Vendor, Amount and Expense Acct be tracked properly. It doesn't matter who's hands actually carried the cash to the store.

Only caveat if they're in as a Vendor and Employee, don't mix them up.

Hey there, bspeed,

I can help you repay your employee's business-related expenses.

You can create a non-taxable reimbursement item then add assign the correct expense account for the repayment. Once done, you can now add the item to your employee's paycheck. Let me guide you through the process:

Step 1: Add a new payroll item.

Step 2: Add the item to your employee'c paycheck.

That should get things done for you, bspeed. Please check out this article to know more about adding a non-taxable reimbursement payroll item: Create a non-taxable reimbursement payroll item in QuickBooks Desktop Payroll

Please let me know if you have any questions. I'm always here to help you whenever you needed help. Have a good day!

@Anonymous

Please learn from thins input; they want and need to track What it is. The concept of "reimbursement" is a Process; not the Accounting. If they need to track reimbursement of Office Supplies and Stamps, that is not just one Reimbursement. That's the problem with your Payroll answer.

You don't set up Employees also as vendors, @Pete_Mc At least, not in the US; that makes it look like they are running their own Business. We need the reimbursement to the Employee name as Payee to show as Employee name, since it has to fall under the terms of An Accountable Plan per the IRS.

Enter a Check Expense to the Employee Name as payee, and list everything here that you "bought" from them as reimbursement. I bring printer paper and stamps to the office, you enter the two split details in the check to repay me. Or, the "check expense" to show you paid me from Petty cash. Make sure to get their receipts.

In Desktop, the Employee Center, these are shown as Non-payroll Transactions.

Hi: What do you mean by'We need the reimbursement to the Employee name as Payee to show as Employee name, since it has to fall under the terms of An Accountable Plan per the IRS.'

Do you mean I can include the employees reimbursement within their bi weekly paycheck? Or do you mean something else by Payee?

I was about to create an 'Other Name' list to reimbursment my employee.

So is the Payroll one right?

Thanks.

This is how I use to do it in Desktop but we recently converted to Online. How do you see these non-payroll transitions in online? When I look for them under the employee, the only thing I can see is their paycheck. I'm having trouble finding them outside of that.

Thank you!

Thanks for bringing up this concern to the Community, 34406.

When converting from QuickBooks Desktop (QBDT) to QuickBooks Online (QBO), most of your payroll data doesn't transfer to QBO. Paychecks created from QBDT will be converted as regular checks. There will be a lump sum import of the current year's paycheck information and may need to enter a prior payroll for the past year-to-date payroll info for each employee.

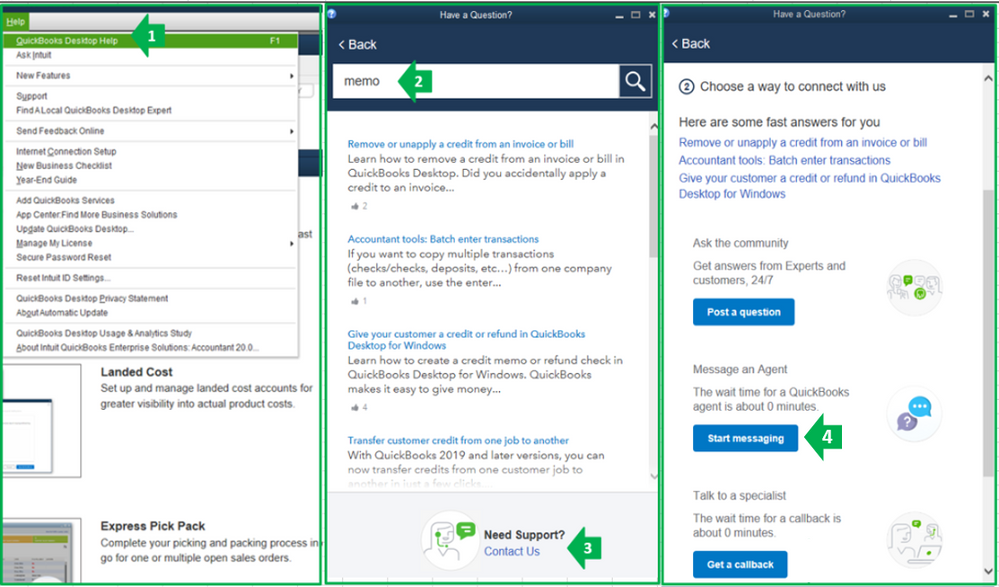

With this, you'll need help from our QuickBooks Care Team. They can open your account and help add the historical paychecks for you. Here's how:

Please take note our operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Learn more about what can and cannot be imported when switching from QuickBooks Desktop to QuickBooks Online: What to expect when you switch from QuickBooks Desktop to QuickBooks Online.

Since you're new to the Online Payroll version, let me share this Getting Started Guide to easily navigate the feature: Get Started With Payroll.

Get back to me if you need further help while working with W2's or anything about QuickBooks. Have a nice day.

Can this reimbursement be attached to a specific customer job? Currently Per Diem paid this way is being prorated across all jobs the employee worked on during the pay period. This is incorrect. Said employee traveled to the Smith job. He is paid a Per Diem (as a Cost of Goods) for each day at the job site. This job cost needs to appear in a Job Costs report for the Smith job only even though the employee worked on several other customers during the pay period. I am using Premier Contractor Edition. This should not be an unusual situation for this industry. Help would be greatly appreciated.

Thanks for bringing this to the Community, .

In QuickBooks Desktop (QBDT) attaching a job is not possible unless you use the billable hours.

While this feature is unavailable, please know that we'll take this question as a suggestion. In the meantime, you are welcome to share your ideas about this option with our developers by following the steps below.

Also, I want you to get in the loop about the latest news and product developments in QuickBooks. That said, I encourage you to visit our Firm of the future site. To narrow down your search, you can go to the Product & Industry News tab.

If I can be of help while working in QuickBooks, please let me know. I'll be here to help. Have a good one!

what if they want me to use our Company Credit card to buy something as reimbursement to them for an expense. They have a different expense/ bill already entered set up as a vendor. How do I reduce that amount and account for the credit card purchase? Example: Employee is set up as vendor and the company owes them 60.00 in an expense in QB. Normally I would just cut a check for the 60.00 to pay him back. But He asked me to purchase something with the company card for 50. now I only owe him 10.00. How do I reflect that on the expense/ Bill that was already entered for 60.00

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here