I want to share with you the details of adding a pay type, denise1972.

In QuickBooks Online Payroll, we have a specific setup for health insurance and retirement plans. This is to determine how the pay type impacts the federal taxes and forms.

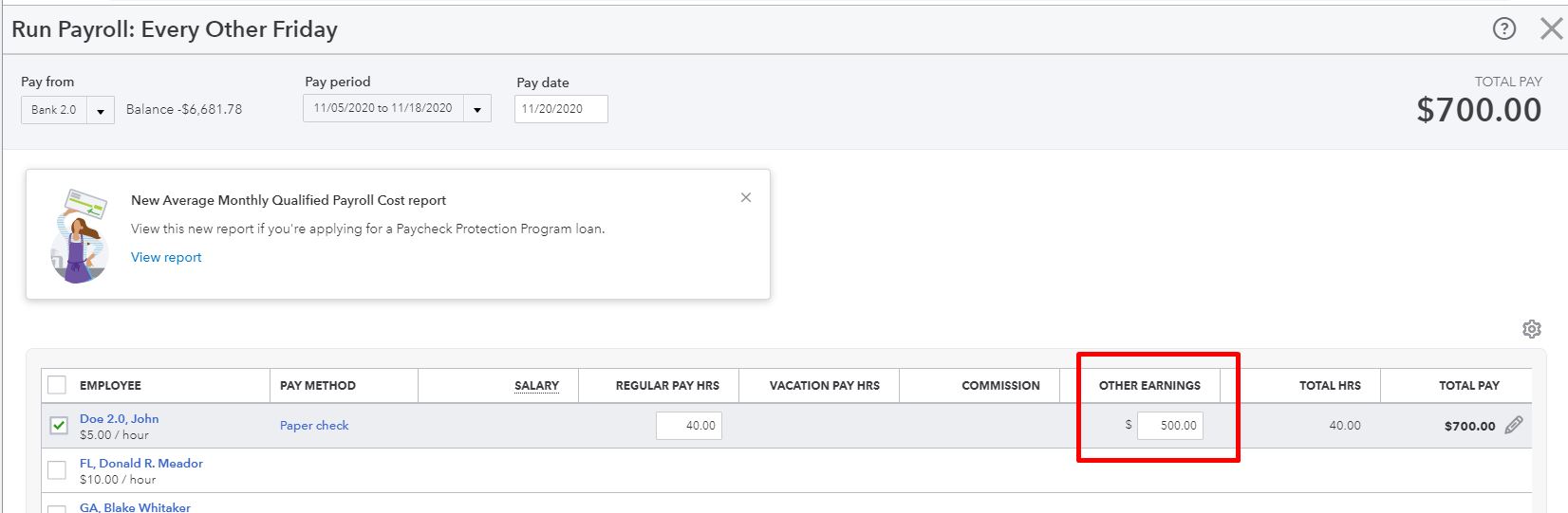

If you're adding the fixed amount of $500 separate from the regular wages, you can use the Other Earnings option. Before doing so, please consult with your accountant or tax advisor for advice.

To add the pay type, you can follow these steps:

- Go to Payroll > Employees.

- Click the employee's name.

- Under the Employee details tab, select the pencil icon next to Pay.

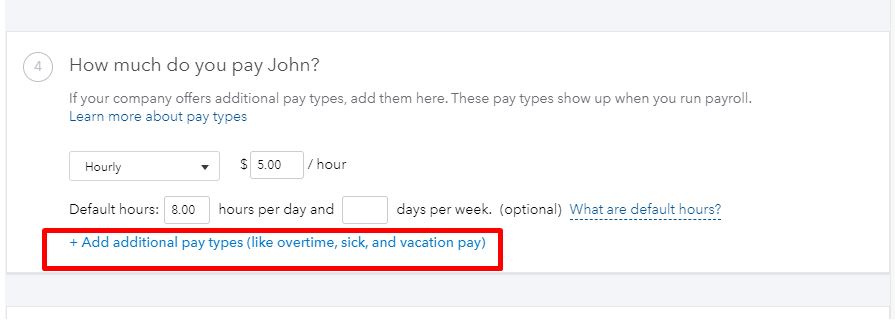

- Scroll down to How much do you pay (employee's name)? section and click the + Add additional pay types (like overtime, sick, and vacation pay) link.

- Select the Add other earnings type link and enter the pay type name. Note: You can leave $0.00 in the Recurring amount field.

- Hit Done.

Once added, you can enter the $500 when you run payroll for the employee. Here's a sample screenshot of the Run payroll page:

To learn more about the pay types, you can read this article: Supported pay types and deductions explained.

Feel free to add a reply if you have more questions with QuickBooks Online Payroll. I'd be happy to answer them. Take care and stay safe.