Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Based on information from the IRS. Amounts deferred under a Section 125 Cafeteria Plan are not considered compensation so should not be included to calculate employee Simple IRA withholding or the company match. When I created the Simple IRA items (employee and company match) in Quickbooks, it calculates the withholding and company match on the gross payroll instead of medicare wages (after pre-tax health insurance). I'm more concerned about the company match. Can someone please give me some guidance on this. Thanks!

Welcome to the Community, @Bbenoit.

Let's make sure that the Federal Withholding for your employee Simple IRA is unchecked. And remove the Simple IRA Co. Match from the employee information. This way, they'll not calculate on the gross pay when running payroll. Let me guide you through the steps.

First off, you can go to the Payroll Item List to uncheck the Federal Withholding for Simple IRA Emp. Here's how:

Then, let's remove the Simple IRA Co. Match from the employee information.

After following the steps above, both employee Simple IRA withholding and company match won't calculate when running payroll.

You can read these articles for additional information:

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day.

We need a percentage for withholding and company match? Also, wages could change because of hours worked, bonuses, etc.

Hey there, @Bbenoit.

Thanks for reaching back out to the Community.

At this time, the option to use a percentage instead of an amount when calculating a company match isn't available. I want to make sure your concerns are addressed, so I'm going to personally submit feedback to our Product Developers so they can consider this in one of the upcoming updates in QuickBooks Desktop.

If you want to learn more about setting up payroll items within this link.

The Community is always here to have your back. If you have any other questions, feel free to ask. Have a great day!

Candice,

The option to enter a percentage is available. The problem is it's calculating on the gross wages instead of deducting the Section 125 cafeteria plan withholding first. According to the information I printed from IRS.gov, compensation for calculating the Simple IRA doesn't include amounts deferred under a section 125 cafeteria plan.

Thanks

Brenda

Thanks for updating us, @Bbenoit. Happy to chime in here.

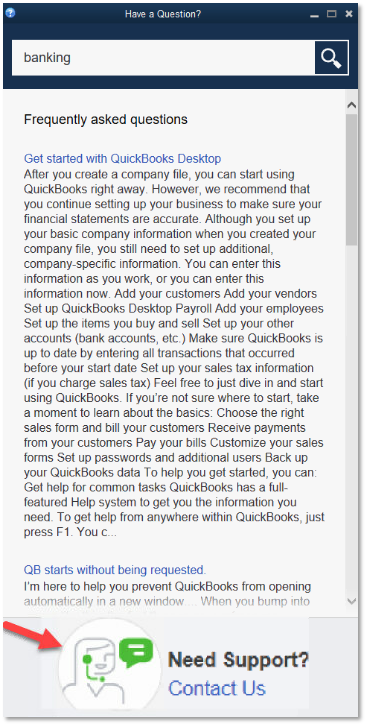

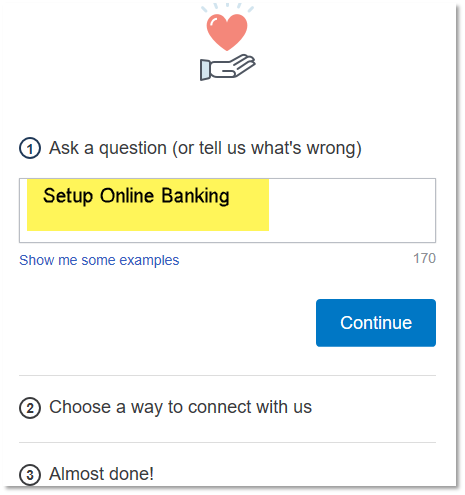

To get you back to business in no time, I suggest reaching out to our QuickBooks Desktop Support Team. They have the tools and resources available to take a closer in-depth look at your situation and provide the best solution. Contacting them is super easy and only takes a few moments. Check it out:

That's it! Please know I'm always available here to lend a helping hand. Wishing you a great week ahead!

Hi BBenoit,

I was having the same problem. Did you resolve the issue? If so, would you kindly share the steps to correct the situation? Thank you!

Liza

Hey Mark,

I was having the same problem as BBenoit. Here is what's happening: The SIMPLE Plan company match for some employees are calculating too high causing over contributions to their accounts. It appears that the SIMPLE match is being calculated based on gross wages and not factoring the pre-tax health insurance deduction. How do I fix the Payroll setup to avoid the company from over contributing its SIMPLE Plan match? Your answer suggested removing employee and company contributions all together. I want to continue to match employee contribution but not over contribute. Thanks.

Liza

Thanks for joining the conversation, @sam2lucky. I understand that you're having the same experience with Bbenoit.

If you're referring to his first post, you can follow the steps provided by my colleague @Mark_R to uncheck the Federal Withholding for your employee Simple IRA and remove the Simple IRA so it won't calculate on the gross pay when running the payroll.

However, if you're referring to the third post about it's calculating on the gross wages instead of deducting the Section 125 cafeteria plan withholding first, I'd suggest you contact the QuickBooks Desktop customer support as they have all the resources to help review your information as to what's causing the issue. They can also create a case to further investigate if the issue isn't resolved.

For future reference, read through this article for additional information: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.) It helps you learn about customizing the retirement plan set up of your company contribution. It also includes links to related topics.

Feel free to message again. We're always delighted to be of your service. Stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here