Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe had 4 existing employees that all agreed to go 1099. I ran their payroll as regular employee vs 1099 just put them as tax exempt.

My accountant said I can't do that! Is there any way to fix the past quarter's & July's payrolls to show they are 1099's or just accept it for what was done and move forward with now listing them correctly as a 1099 vendor?

Thanks for reaching out to us, Trocks36.

For the employee to receive 1099, you must set them as a contractor. It can take some time since you must delete the employee and all of their paychecks before you can make them a contractor. Deleting employees is needed since the system won't allow duplicate names.

Please ensure you have a copy of all their paychecks as a reference when you reenter them for 1099. I'll show you how.

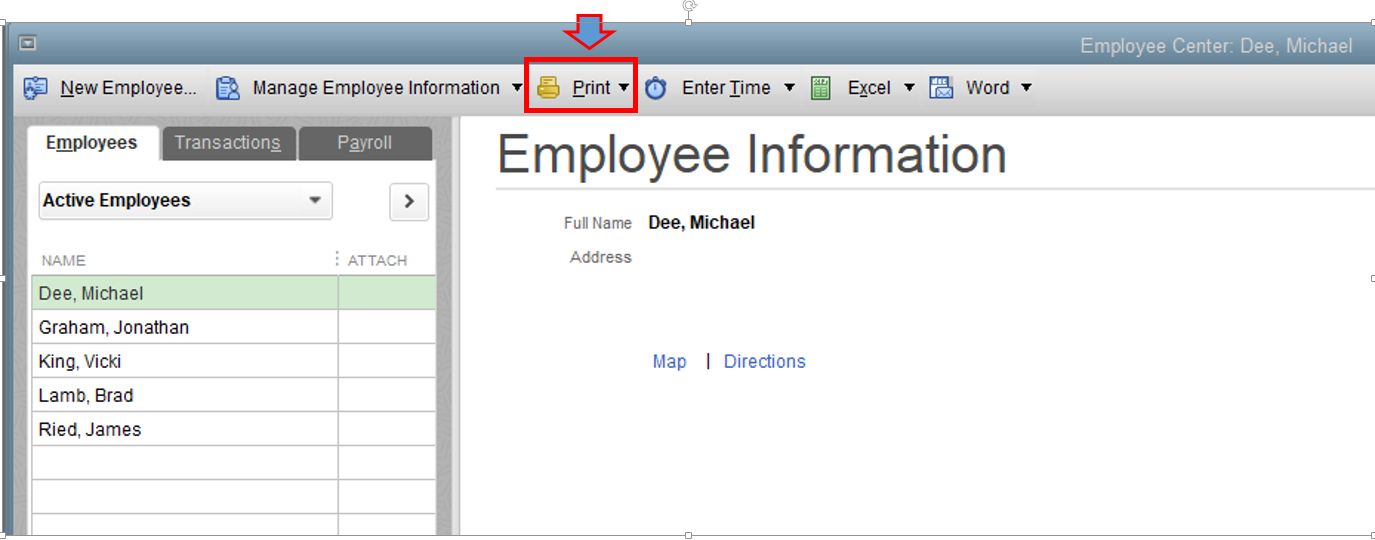

Once done, open each paycheck and delete it. Afterward, delete your employee profile by following these steps below:

After that, you can read this article for a complete guide on setting up contractors in QuickBooks Desktop: Set up contractors and track them for 1099s in QuickBooks.

For future reference, check out this resource to learn how to prepare and file 1099s: Create and file 1099s with QuickBooks Desktop.

Let me know if you have further questions or concerns with 1099. I'll be here to help you.

I had the reverse scenario, our guy went from 1099 to going on payroll. I simply added an * or something to his old name (in the 1099 vendor name) to make it different and added him as a new employee with the correct name. It works just fine. Nothing is mixed up and the payroll company is able to do his 1099 for the part of the year that applies and his payroll currently.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here