Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello Everyone :)

We processed W2's and issued to client.And client came back and saying SSN number is incorrect.How do we correct this in W2 now?

Solved! Go to Solution.

Thanks for posting here, @dubeysai,

I can help you do your W-2 corrections. Please note that the amendment process may differ for every QuickBooks Online Payroll versions.

If you're using QuickBooks Online Payroll Enhanced, you must create and file a W-2c form with the Social Security Administration manually. W-2C form is currently unavailable for this payroll service which is why you need to do it outside the program. See the General Instructions for Forms W-2c and W-3c section in General Instructions for Forms W-2 and W-3.

For QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite and QuickBooks Online Payroll Full Service subscribers, we will be the one to fix it. Our experts will file a W-2C form with the SSA, and mail the W-2c to your employee. You’ll also receive a copy of the amended form.

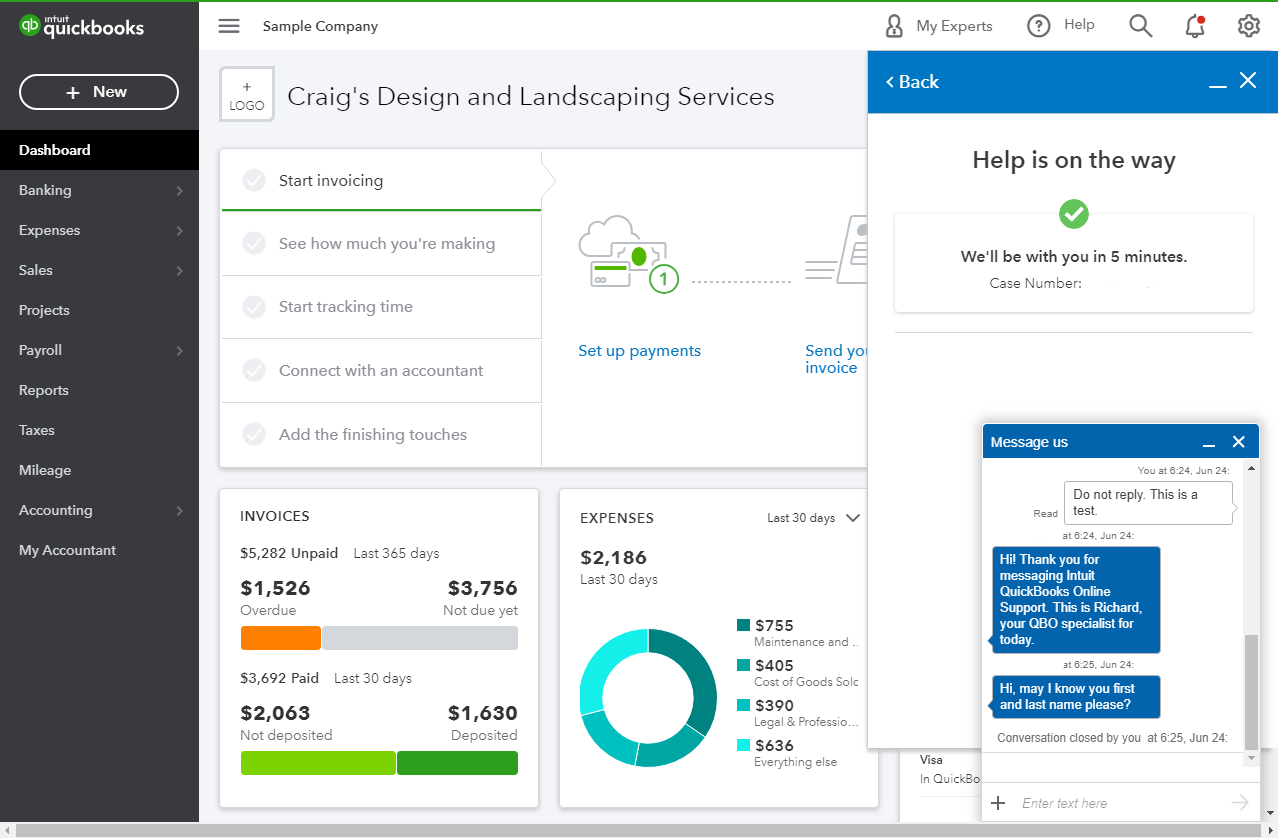

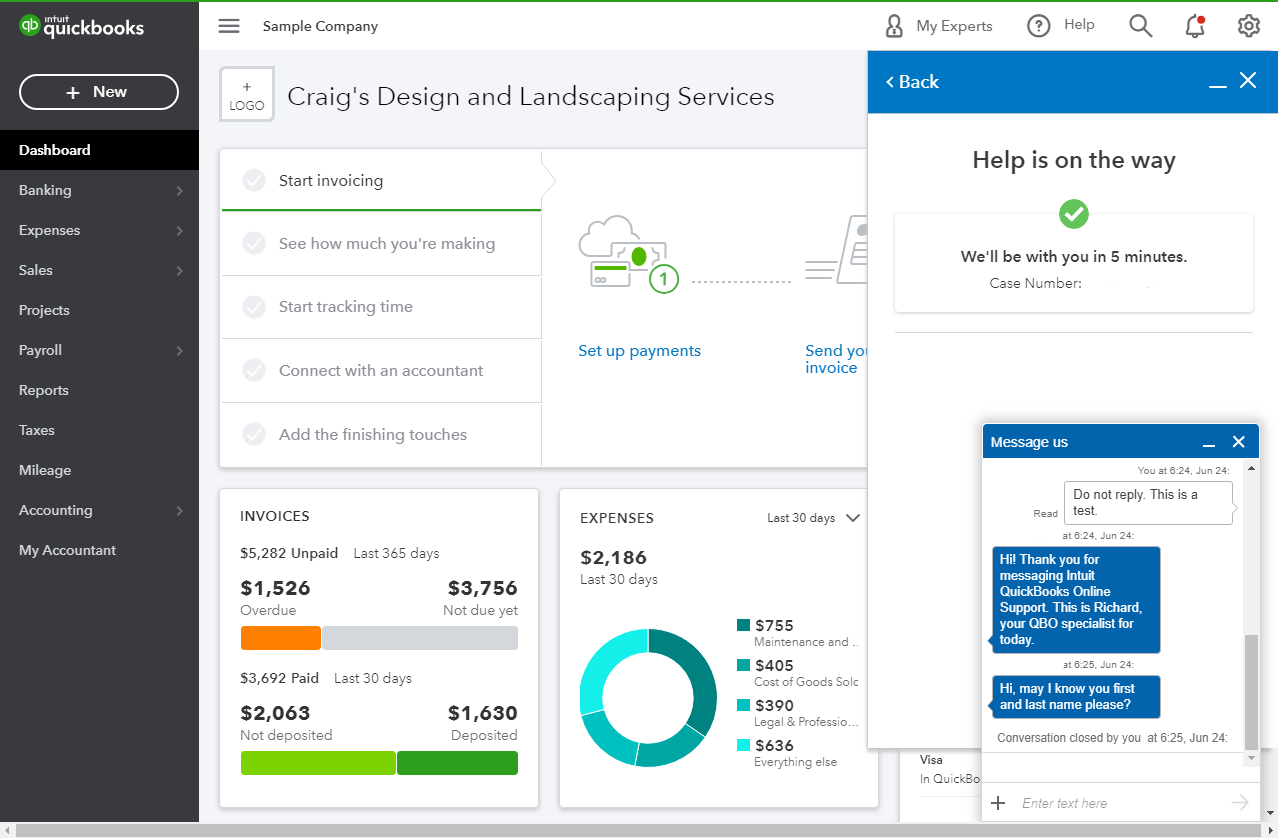

To request a correction, please contact our Support Team. Here are the steps to do that:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

The expert you talk to will let you know approximately when you and your employee should expect to receive the W-2C.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

Let me know if there's anything else I can help you. I'll be right here to assist you with your payroll forms and take care of other concerns in QuickBooks. Have a nice day!

Thanks for posting here, @dubeysai,

I can help you do your W-2 corrections. Please note that the amendment process may differ for every QuickBooks Online Payroll versions.

If you're using QuickBooks Online Payroll Enhanced, you must create and file a W-2c form with the Social Security Administration manually. W-2C form is currently unavailable for this payroll service which is why you need to do it outside the program. See the General Instructions for Forms W-2c and W-3c section in General Instructions for Forms W-2 and W-3.

For QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite and QuickBooks Online Payroll Full Service subscribers, we will be the one to fix it. Our experts will file a W-2C form with the SSA, and mail the W-2c to your employee. You’ll also receive a copy of the amended form.

To request a correction, please contact our Support Team. Here are the steps to do that:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

The expert you talk to will let you know approximately when you and your employee should expect to receive the W-2C.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

Let me know if there's anything else I can help you. I'll be right here to assist you with your payroll forms and take care of other concerns in QuickBooks. Have a nice day!

pls call me at [removed] .

pls call me at [Removed by Moderator]. the tel number associated with the account is [Removed by Moderator] but pls call me at [Removed by Moderator]

pls call me at [removed]

pls call me at [removed]

Hello there, alegria.

I’m here to ensure your concern is taken care of. To provide a timely solution, I need more details about the issue.

What specific process do you need help with? Are you trying to correct the information on your tax forms?

If you meant something else, could you provide more details to help me get on the same page. However, if you still wish to speak with our support team, let me share the steps to get the contact details.

Here’s how:

I’m adding a guide to help you in the future. It contains articles and resources to get acclimated to QBO processes. They’re arranged by topic so you can easily view each one: Get started.

Feel free to visit the Community again if you have other QuickBooks concerns. I’ll get back to make sure you’re taken care of. Have a good one.

I also have in correct social security numbers that need corrected. I first initiated a chat. Which took forever to be told she was on hold with the back office and would email me. I get the email and it states nothing other than a amended W2 needs to be done. The worst part I couldn't even respond to know how to do this. So I called back and I was told that I had to do the form my self. We pay for premium so I am confused as it stated only enhance has to do that themselves. So I am asking with premium service we have you guys file and take care of everything why is this not included to have W2c done and filed?

Thanks for chiming in on this thread, @deborahjtappan.

I'm here to provide some clarifications with your W-2 correction concern.

Who fixes your W-2 depends on your payroll subscription. If you're using Core, Premium, Elite and have the auto pay and file turned on, we file your W-2s for you. Therefore, you’ll need to contact our QuickBooks Payroll Support to request a correction.

Here's how you can reach out to them:

Then, they’ll fix it, file a W-2c form with the SSA, and mail it to your employee. You’ll also receive a copy. Our payroll specialist will let you know approximately when you and your employee should expect to receive the W-2c.

In case you have further questions about W-2, please check out this link: File your W-2 forms.

I'm also adding this article to answer the most commonly asked questions about correcting and amending W2 forms: Fix an incorrect W-2

I want to make sure this is taken care of for you. Please get back to me about how this goes. I'll be right here to continue helping. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here