Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

We have an employee who received third party sick pay. We are responsible for reporting this income. On the W3 is it correct to include the amount of the sick pay in box 1 with the total wages as well as put it on line 13? No FIT was withheld for line 14.

Thank you!

I'd like to explain about third party sick pay, TME1104.

This is a payment that your employee receives from a third-party, aside from the employer. How you record it depends on who will submit the tax payments for employee paid taxes and who will file the tax form.

Box 1 is for wages, tips, and other compensation. The program adds the total from the W-2 forms included in the interview. While in Box 13, you'll have to enter the information. To verify if you can add the amount of the pay in both boxes, please refer to the General Instructions for Forms W-2 and W-3.

I'll also share some articles about W-3 and third party sick pay for better guidance:

If you have other questions, please don't hesitate to get back to this thread.

I have read that tax form and many others for that matter. I cannot find where it states the answer to my question anywhere. I have also read the threads you have suggested. Hence, my question on here.

Hey there, @TME1104.

Allow me to chime in about your W-3 forms.

According to the track and submit taxable third party sick pay article, the amount should already be included in the W-3 if you've followed all the correct steps. Meaning the W-3 form should reflect your taxes correctly. If you don't see this, I recommend reaching out to your accountant for further assistance.

Thanks for being part of the QuickBooks family, wishing you a successful business week!

I am trying to enter the 3rd party sick pay to amend a W-2 already submitted and as per your instructions on Creating an Additional PR item, there isn't a dropdown for Payroll Item List. Also when creating a deduction item I don't see Payroll Item List on the dropdown.

Thanks for joining us here in the Community, @AG20.

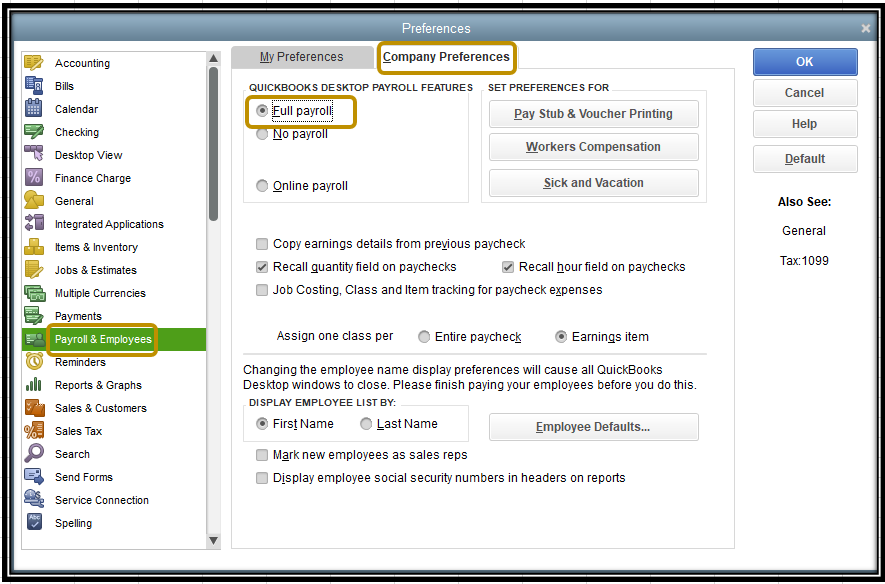

If you have the No Payroll set up on your preferences, this can be the reason the Payroll Item List option isn't available. Let's make sure to select the Full Payroll to make the functionality visible.

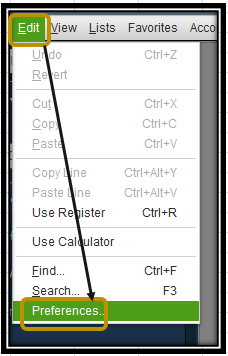

To do that:

Once done, creating a new payroll item in QuickBooks Desktop can be made from the clicking on the List button at the top, and selecting the Payroll Item List option.

Please take these steps below to achieve this goal:

To give you complete details about entering the 3rd party sick pay in QuickBooks Desktop, please check out this link: Track and submit taxable third-party sick pay.

However, if you the option to select the payroll item list isn't available, I recommend updating your QuickBooks to the latest release. This refresh all the updates made on your data.

Here's how:

For more details about updating QuickBooks desktop, please refer to this link: Update QuickBooks Desktop to the latest release

I got your back if you have any other questions. It's my pleasure to help you out. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here