Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Previously when I entered this information, it did not round up. It allowed me to enter the full figures provided by L&I. It makes no sense to round when entering the information from the rate sheet. Instead, the rounding should occur after the calculation based on the full figures.

I have ten different class codes per employee on each job and have to report the hours for each one separately on every check so how do I do that.

Thanks for joining this thread, Khuddle426.

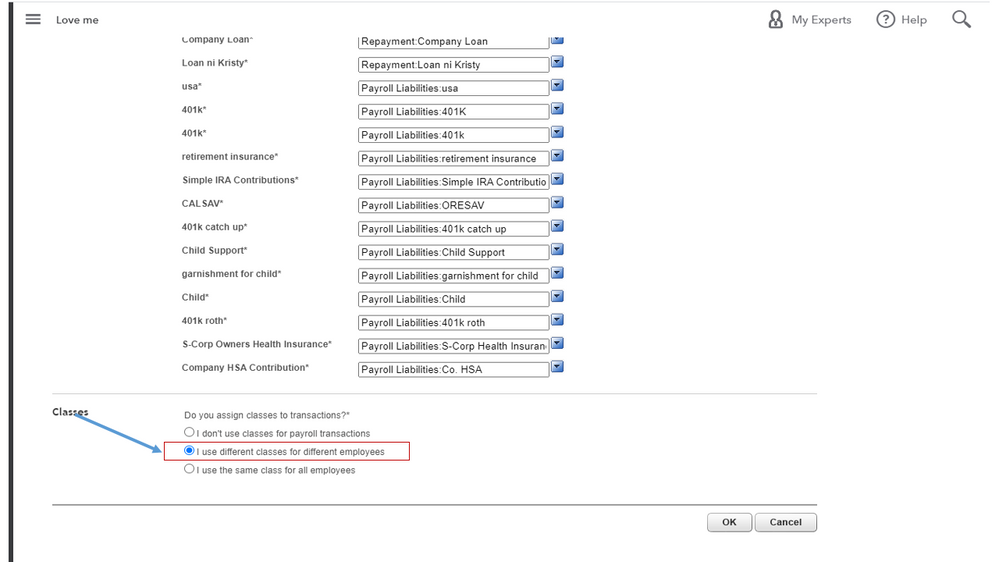

In QBO, you can only assign one class per employee. As a workaround, you’ll have to update the Classes settings and manually add the class code on the paycheck.

Before we proceed, make sure to add them to your account. Here’s an article that will guide you through the process: Create and manage classes in QuickBooks Online.

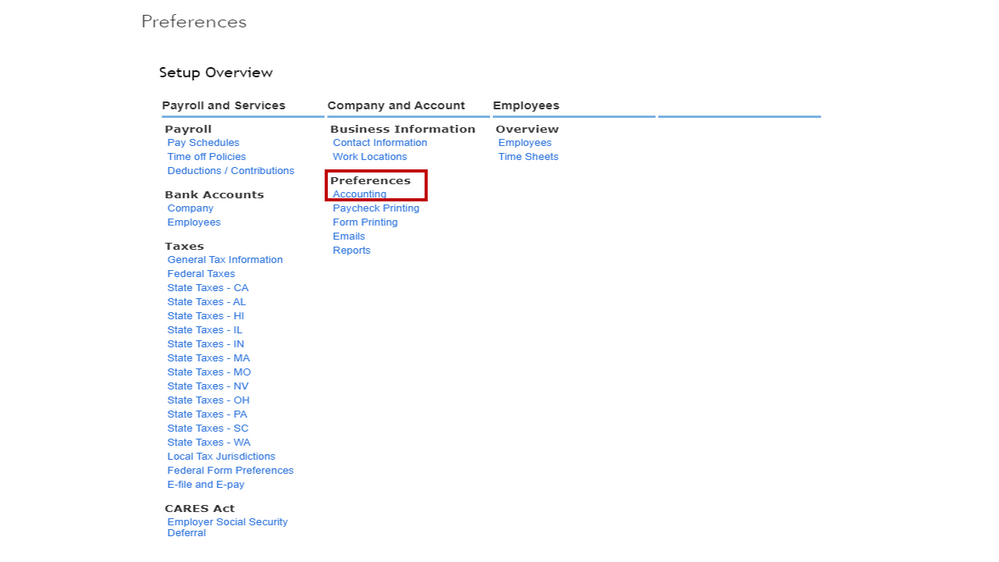

When you’re ready, follow these steps to change your Classes setup. I’ll help make sure the process is a breeze for you.

For additional resources, check out the links below. These resources outline the complete steps on how to perform the following tasks:

Feel free to add a comment below if you have other questions about QuickBooks. I’m more than happy to answer them for you. Have a great weekend ahead.

I had this same problem, I found that if you go to GEAR > PAYROLL SETTINGS > WORKERS COMP >> click on WA Workers Compensation Tax It'll allow you to edit the rates and not automatically round up

This year it wants to change everything to a percentage?? What the heck is going on? Anyone else having this problem?

Hi mombo007,

We haven't received any report with the same issue as yours.

Let's run some steps to isolate why you are prompted to enter the rate as a percentage. To start with, log into your account in an incognito window. Here is a list of keyboard shortcuts to open one:

If it works fine, you can go back to a regular browser and clear its cache. Piled browser history can be the reason for some issues on the page. You may also switch to a different browser like Google Chrome, Mozilla Firefox, Safari, or Microsoft Edge.

If you need more resources on assigning worker compensation, you can check these references:

I'll be around whenever you have payroll concerns.

I am also trying to input the new rates for 2023 and it is wanting a percentage - WA state L&I is a set dollar amount per hour worked. Did you figure this out?

It was really weird. I went into one employee and set it up there. It wants to round up. Go ahead and let it. Then, go back into the payroll settings, click on it and add the other decimals. It still shows on that page as a percentage, but when you go back into the employee to set it up, it is listed correctly.

I didn't try the other browsers because I got it to work this way. Give it a try and see if it works.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here