Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey there, mrichardson.

Thanks for bringing your question forward here in the Community. I'm here to point you in the right direction regarding your question about the payroll journal entry in your QuickBooks Online account.

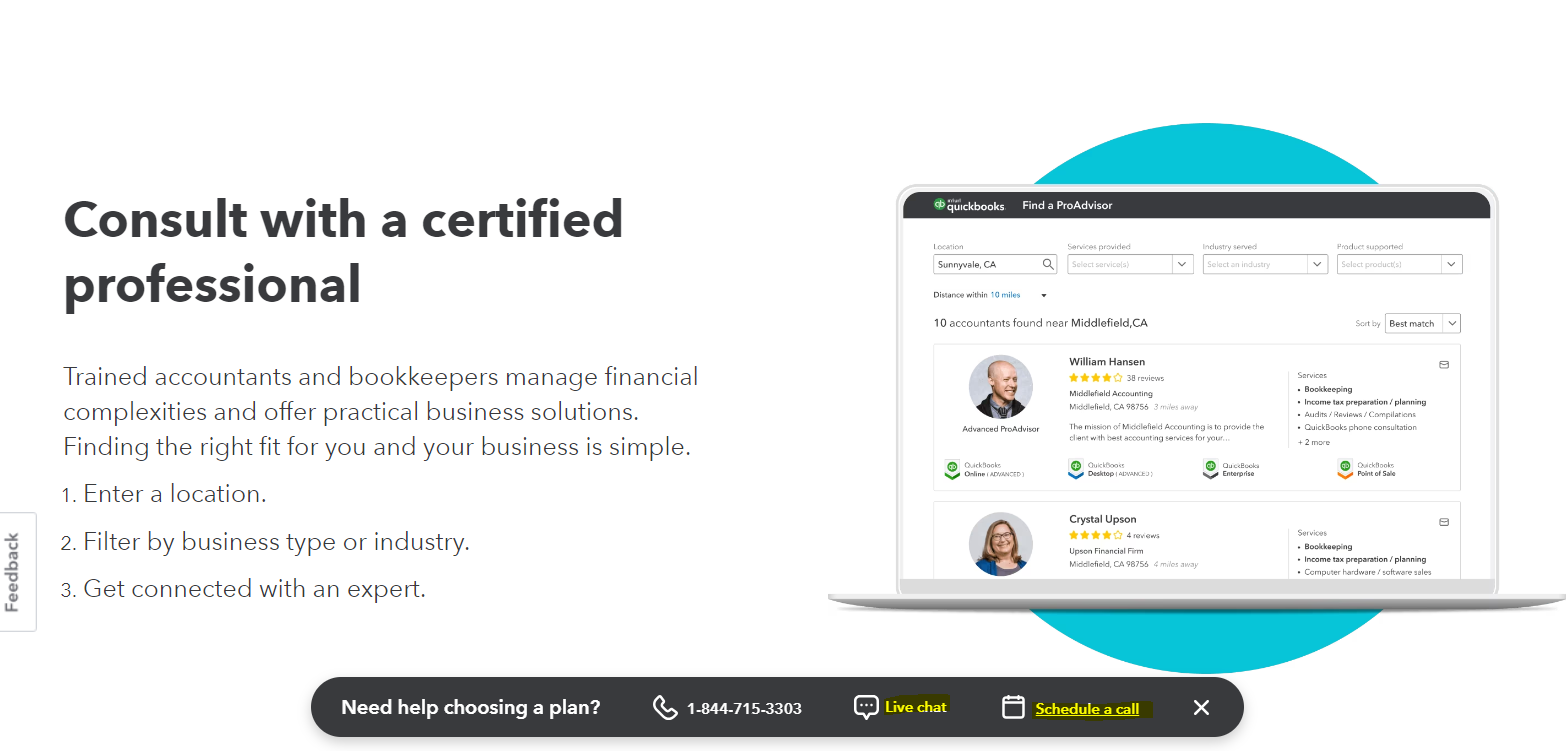

In this instance, I recommend reaching out to your accountant for the best advice on what the other side of the entry should be. A professional accountant will be able to advise of the next steps based on your unique business setup and workflows. If you don't currently have an accountant, you can find one specifically trained in QuickBooks in your area by searching here: Find a ProAdvisor

After finding out what the entry should be and you still need assistance with how to enter it please don't hesitate to reach back out. I'll be here to help in any way that I can.

I reached out to a pro advisor but they have not responded

I reached out to a pro advisor and I am yet to hear back.

Let's make sure you'll be able to correctly record a payroll journal entry, Richardson.

Once you're on the Find A QuickBooks ProAdvisor page, you'll have to enter your city or zip code to find a ProAdvisor near you. After that, it should show up the list of certified professionals that you can reach out to. In case you didn't receive a reply, try searching for another one from the list. This way, you'll be able to get the help that you need when entering the payroll journal entry.

However, if you encounter issues when looking for a pro advisor or if you're still unable to get one, you can click on our support channel so they can help you locate one of the best. I've added a screenshot for reference. Please note, that I've highlighted the hyperlink in yellow:

Beyond that, learn how you can access some of the useful information needed for your business and payroll. Go through this article for more details: Run Payroll Reports.

If in case you need additional assistance when locating an accountant or pro advisor, let us know so we can get back to you and address your concerns as quickly as possible. Have a great day ahead!

It depends on what fringe benefits are associated with the imputed pay. Can you provide some more info?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here