It's my priority to ensure you're able to reimburse your employee, Nurses.

Let's set up a reimbursement pay type for an employee in QuickBooks Online. I'll show you how.

- Go to the Payroll menu and then select Employees.

- Locate the name of the employee you'd like to reimburse.

- On the How much do you pay [employee's name] section, click Add additional pay types.

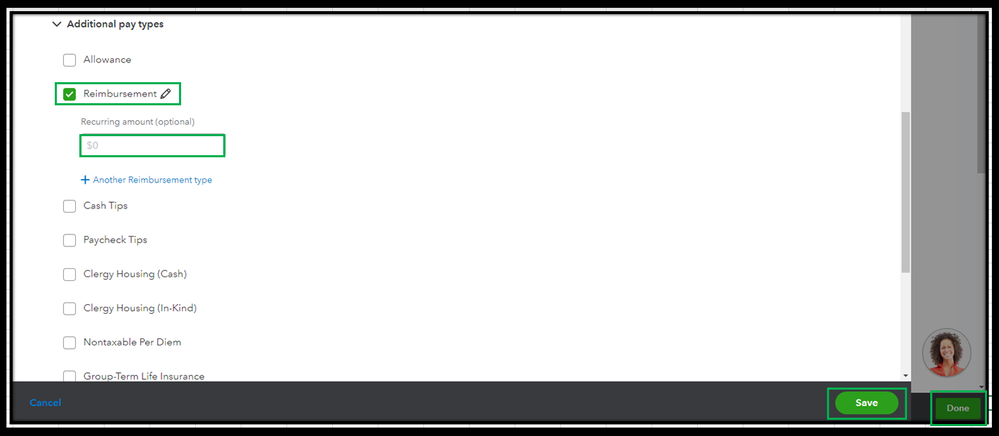

- Scroll down to Additional pay types, then select Reimbursement.

- Add the amount.

- Click Save, then Done.

For more details about the process, please see this article: Create a Reimbursement Pay Type.

Also, please keep in mind that the amounts paid as reimbursements aren't subject to any taxes. With this, I'd suggest seeking advice from an accountant to ensure the W-2s and other forms are correct at year-end.

Additionally, I'd recommend running payroll reports in QuickBooks Online. This helps you view useful information about your business and employees.

I'm only a post away if you need more help in reimbursing your employees, Nurses. It's always my pleasure to help you out again. Keep safe!