Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

This is mostly for my understanding.

My QBO has (4) payroll liability accounts set up. These (4) accounts are sub accounts of "Payroll Liabilities" which I see totals the (4) liability accounts. The accounts are as follows:

You are on the right track here, just need a little light shed on the process.

When you run your payroll, QBO will debit the payroll tax expense and credit the liability. This records your expense when you are incurring it rather than waiting until you pay it. When you are ready to pay the taxes, you will debit the related liability account and credit your cash account. So when you pay your Federal 941 taxes you should debit the Payroll Liabilities - Federal 941.

If you are using the same QB to run payroll and pay taxes, the accounts should be adjusted accordingly. I think the confusion you are having is what is an expense and what is a liability. Remember, the bulk of your tax payments are from the employee and have already been expensed as payroll. That is why these amounts are held in liability account until the payments clear them. But, every employer has additional taxes as they match FICA. Additionally, there are other 'taxes' like UI that cost the employer amounts over the gross payroll. These are typically added as an expense to the payroll tax account. Some just include these amounts in the general payroll expense account along with wages, but I prefer to break it out to 'Payroll:Wages' which is gross payroll, and 'Payroll:Taxes' which are additional amounts paid by the employer (Not withheld from paycheck). As with most items in QB the setup is based on the preferences of you and/or your bookkeeper.

So, each time you pay a payroll tax (during the payroll period), the liability account for 941 will zero out. But then you get a quarterly amount because, in theory, the 941 was underpaid, and this quarterly payment makes up for what is ACTUALLY owed. This quarterly payment can't come out of the liability account because there is nothing in it (in theory). So is this a payroll tax EXPENSE? That's what make sense, but I just wanted to see if someone knew for sure.

Thanks!

Hi there, Shell-Bookkeeping.

Payroll taxes are already part of the gross pay-payroll expense. Check out these guide articles for more details:

Visit us again in the Community if you have other questions.

cards and not make them mandatory.

Payroll cards are reloadable debit cards that are funded with employee wages each pay period. Employers that opt to use such cards can save on the cost of printing and mailing paychecks. Employees who don't have bank accounts may also benefit from pay cards, because workers can use the cards to pay bills and avoid check-cashing fees.

The biggest federal issue with payroll cards is that businesses can't mandate that the funds be redeemed at a specific financial institution, said Richard Greenberg, an attorney with Jackson Lewis in New York City. Such a mandate would violate the Electronic Fund Transfer Act (EFTA), which covers direct deposits and payroll cards.

When you pay your quarterly payroll taxes if you are using QBO payroll, you go to Taxes on the left side, then select Payroll Taxes at the top tab. There should be a green button there that says "Pay taxes". Use this button when paying your quarterly payroll taxes. Select from the list which of your quarterly payroll taxes you are paying (or do each, one at a time), then create payment. If your company bank account from which you pay payroll taxes is linked in Quickbooks, you can pay electronically direct to the tax agency. If not, you will not have that option, and you will enter a manual payment there. Quickbooks does the rest of the work for you to enter the payroll tax transaction if your payroll settings are set up correctly. But if you are entering a manual payment, keep in mind you will either need to physically mail your check to the agency, or pay electronically online on the agency's website. If you are entering the check in Quickbooks Online, you can enter it in either a taxes paid expense (if on cash basis) or on accounts payable for the agency you paid.

Employee Tax is pointed to a Liability account when running payroll and when the check is sent to the tax agency it is written against that same account - Understood. Employer Tax is pointed to an Expense account when running payroll - Understood. But when sending payment to the tax agency what account is offset? What about pointing it to AP at the time of the PR run and them writing it against the Expense account when paid?

I am still confused, please help me here. The payroll liability acct only records payments sent. For that reason when running my balance report, the account is showing a negative balance as I am overpaying taxes which is not true. QB processes my payroll and automatically reports to the payroll liabilities acct.

When I go to my banking I match my payment with the liability acct. I know I am missing something here, my brain is so exhausted. Please someone help I need to get this balance sheet corrected.

I got you covered, roccokathy.

The negative numbers showing on the accounts indicate that there is a credit balance that made the company paid more than the expected amount. This can be fixed by creating a Journal Entry to credit the accounts affected. This way, the balance will be zeroed out.

Before doing so, I recommend reaching out to your accountant so they can guide you on which accounts to choose.

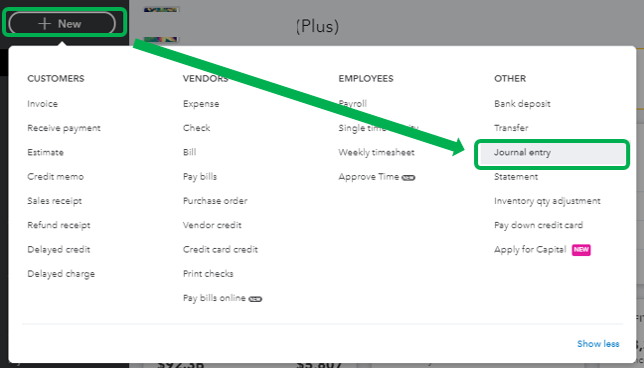

Here's how to create a journal entry:

I've got a visual guide on Understanding the Balance Sheet: Asset, Liability,; and Equity. This contains helpful information about managing the balance sheets in QBO.

You might also want to check out these articles that can give some insight into reconciling process:

I want to make sure that you're able to get back to running your business as soon as possible. I'll be back around shortly.

I was more unsure when the taxes paid by the biz were posted to the tax expense account. The answer above is when payroll is run. So the entire 941 check should be out of the liability account. If they are posting it to the expense account, that is creating too much payroll tax expense, correct?

To answer your question, yes, posting the taxes paid by the business to the expense account will increase your payroll tax expense, @heazim1.

To fix the negative credit balance on the payroll liability account, will need to make sure the payroll items are associated with the correct accounts. Here's how:

Once you're done, open your payroll liability account's register on the Chart of Accounts page. From there, you should only be seeing liability checks and paychecks. In case there are non-payroll transactions included, you'll have to categorize them to the correct account.

Also, you'll want to run and customize payroll reports to get a closer look at your business' finances and employees. To help you go through the process, you can check out this article: Run payroll reports.

If there's anything else you need or you have other payroll concerns and questions about paying taxes in QuickBooks Online Payroll (QBOP), I'm always ready to help. Take care, @heazim1.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here