Welcome, @holly13 and thank you for coming to the QuickBooks Community for assistance. I have some insight on Setting up pre-tax deductions to pass along.

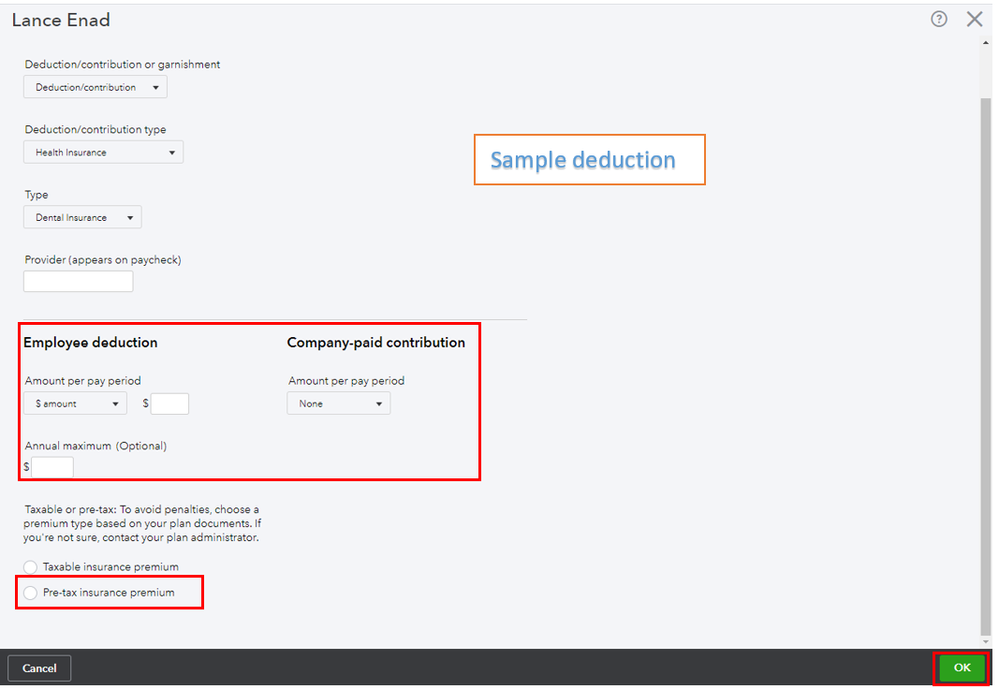

You can set up the deduction directly on the employee's profile. Once a deduction is set up, you won't be able to change whether it is pre-tax or not. Instead, you'll want to remove the old deduction and create a new one that is pre-tax. Let me guide you on how.

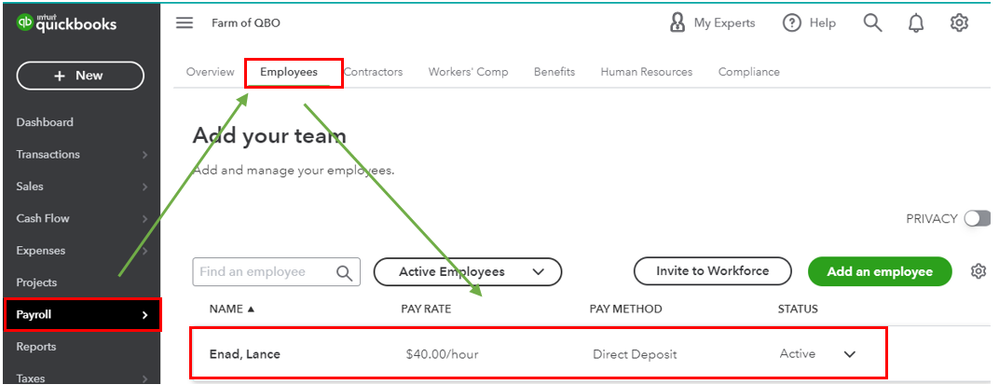

- Go to the Workers menu and select the Employees tab.

- Chose and click the employee's name.

- Click the Edit ✎ (pencil) icon next to the Pay section.

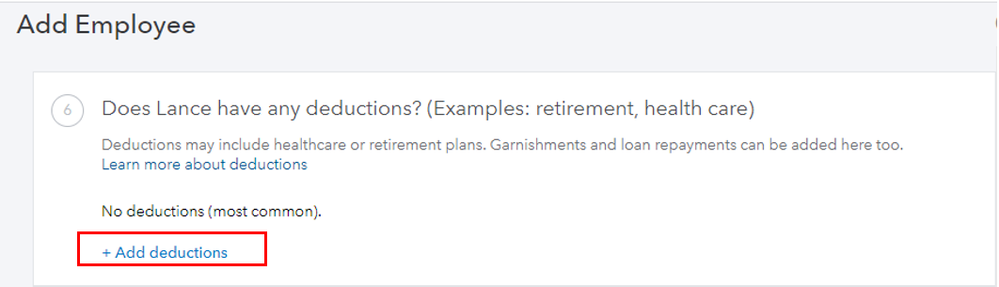

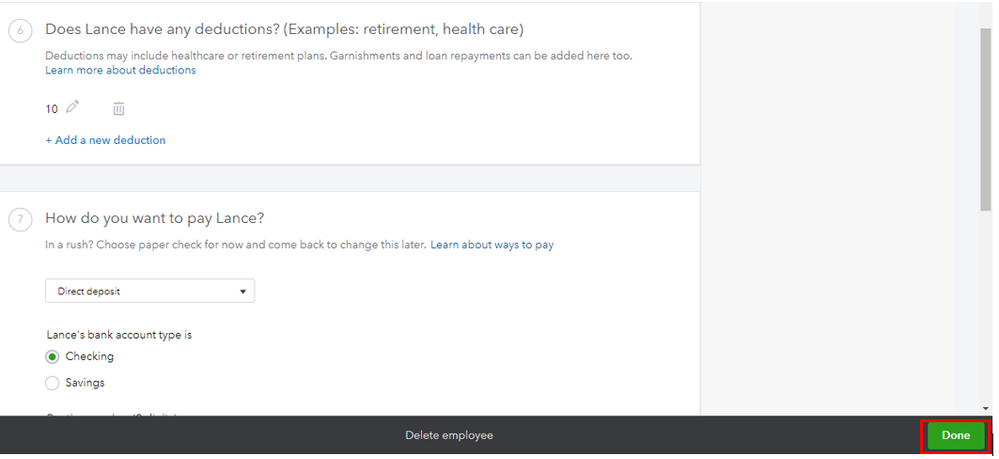

- Go to the, Does this employee have any deduction?

- Click the + Add a new deduction or + Add deductions link.

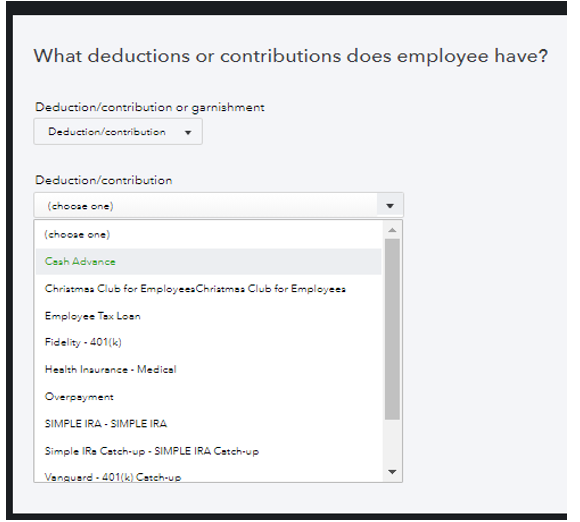

- From the Deductions/contributions ▼ drop-down menu, choose New deduction/contribution.

- Select a Deduction/contribution type from the small arrow ▼ icon.

- Enter the needed information.

- Then click Done once finished.

Here's an article you can read for more details in adding a deduction in QBO: Add or edit a deduction or contribution.

I'd also recommend consulting with a tax adviser or accountant for further guidance. This way, we'll ensure the accuracy of your accounts after recording this.

Once everything is set up, you can already create paychecks for your employees. See this article for more details: Create paychecks in online payroll

Also, do check our Employees and payroll taxes page for reference. From there, you can read great articles and learn some best practices in managing your payroll taxes effectively.

Please know the Community has your back. If you have additional questions or concerns, leave a comment below. I’ll pop right back in to assist further. Have a great rest of the day.