Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI just received word from our bank that the SBA has forgiven our PPP loan in full! When I received the loan, I recorded it as an Other Current Liability. Now I am confused as to the best way to remove the liability. I assume I would credit an income account, and since we are a nonprofit (church), there is no tax ramification. Therefore, my 2nd question has to do with timing. The money was received and used in last FY (ending 6/30/20), so should I record the income/loan forgiveness on 6/30 and reprint my YE reports? Or would it be better to record in this month (Oct)?

You're in the right place to get the answers that you're looking for, @MistyC!

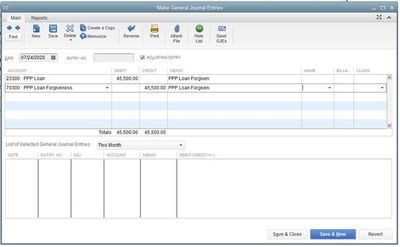

After your lender determines how much of the loan is forgiven, you can transfer the forgiven amount. You'll have to create a journal entry to debit the PPP Loan account for the amount forgiven, and credit the new PPP Loan Forgiveness account or sub-account for the amount of expenses to total the forgiven amount. First, let's create a new account to record the use of the PPP loan funds.

Then, follow the steps below on how to create the journal entry:

However, I'd still recommend seeking professional advice from your accountant about this. They can help you properly handle this type of scenario. With regard to the date of recording, we'll have to follow the constructive receipt rule defined by the IRS, which suggests that we'll need to record the date you receive the funds. You can also clarify this to your accountant. If you don't have one, not to worry! I can help run a search to find an accountant.

Here's how:

I’m adding a guide that covers all the information about loan forgiveness including factors to help reduce the forgivable amount: PPP Loan Forgiveness.

Feel free to visit the Community again if you need help with QuickBooks. We're always here to help. Have a great day ahead.

I see no help with handling the question asked but it needs to be answered. I ask the same question, how do I correctly handle PPP loan forgiveness in QBooks? I originally set up a short term liability account showing amount owed in 2020. That amount has now been forgiven so, how to handle it. I use common sense here soooo I figure I need an account similar to something like what would be used if a business was given a grant. I saw where some accountant wannabe said to use Other Income. No way, income to me means that the tax lady is licking her lips hoping for part of it during tax time and that’s not the case. Maybe an equity account of some sort, increasing the value of the company due to the infused funds. We used most of the funds for payroll, keeping people at work, but the accounting system doesn’t care about that. Those funds went out as payroll expense but really what happened is equity of the company increased by the infusion of cash. Anybody with any sense got any ideas and please don’t tell me to contact an accountant at, this should be pretty easy for accounting types

Hello,

Can you please tell me what reports I could use for the 2nd loan?

I can provide the PPP report you need, PCE2.

Simply follow these steps and run the statement that you need:

In case you want to save the report on your company file, you can memorize it. Check out this article to learn more about the process: Create, access and modify memorized reports.

I'm adding this link for additional information: Use reports to apply for a Paycheck Protection Program loan.

Stay in touch with me if there's anything else you need by commenting below. I'm always around to help if you have additional query about PPP loan.

This worked perfectly for me.

However, I forgot to add the PPP Forgiveness account into some of my custom reports, so that took me a few minutes to figure out why the numbers were off.

Just an FYI for anyone else doing this.

This does not answer my question. I don't need to know how to book a journal entry or suggestions for getting help from an accountant.

Thank you for posting here in the Community, @Wolermon.

Can you share with me details of the issue you're having? I may be able to assist you or provide insights into what may be happening and come up with a solution.

You can click the Reply button below to add more details.

I'm looking forward to hearing from you soon! Take care and have a wonderful day!

I am sorry, this is the 1st time I am posting a question and was confused by whether this answer was in direct reply to my own question. I see that it WAS NOT. I am asking how to set up an account in the equity section of the balance sheet for non taxable income. This is where I will put the amount that has been forgiven for the PPP loan. I do not need advice on how to book an entry or whether this is the proper accounting treatment. I merely need to know how to set up this account in the equity section of the balance sheet. Thank you,...

I can help you with that, Wolermon.

The forgiveness of PPP loan proceeds are be recorded as other income in QuickBooks. You can follow the steps below in setting up the account to track the funds.

In QuickBooks Desktop:

In QuickBooks Online:

In addition, here are some references that you can read to learn more about the Paycheck Protection Program loan forgiveness works in the program:

If you have further questions about PPP, please don't hesitate to tag me in your comments and posts. Looking forward to assisting you again.

I agree the forgiveness should not be recorded as other income! Did anyone ever give you an answer on how to record as equity?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here