Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How can I update my QB Pro Desktop 2020 version?

(in a simple way)

Hello, BSDUSA.

I'll lay down a guide to help you update your QuickBooks 2020 to the 2023 edition in the simplest way possible.

The simplest way to update your QuickBooks 2020 version to the 2023 edition is to buy the Desktop subscription here: https://quickbooks.intuit.com/desktop/.

After purchasing, we'll want to use the Upgrade Tool in the 2020 version to process the update, with the company file included.

Here are the steps to access the Upgrade Tool:

If you need more details about the upgrade process, we can take a look at this article as a guide: Upgrade QuickBooks Desktop Pro, Premier, or Enterprise.

You might be wondering about your financial data and numbers after updating. We can run some reports to check the entries. I'll add this article if you need help: Understand reports.

Feel free to drop by here if you have concerns about the update or upgrade process. Do you have any questions about the functions and features in the 2023 edition? Let me know and I'll share some details with you.

Thank you very much for your prompt response

But we are evaluating the option of buying the QuickBooks Desktop Enterprise Silver version, 2023, at Office Depot, since they offer a direct download. We have two questions:

1_ This version includes a payroll subscription for one year ?

2_ What do you think about it?

I remind you that I use QuickBooks Desktop Pro 2020

Hello there, @BSDUSA. Thanks for getting back here in the Community.

The QuickBooks Desktop Enterprise (QBES) Silver version is valid for the first 12 months starting from the purchase date. When this ends, your credit/debit card account on file will automatically be charged on a monthly or annual basis at the then-current fee for the product and plan you’ve chosen until you cancel.

Also, in the QBES Silver version, there are fees that will be applied when adding a Standard Enhanced Payroll subscription. For more information, check out this article: QuickBooks Desktop pricing.

When you're ready to purchase the program, you can reach out to our Sales team. They can provide additional information about this and help you throughout the process.

To learn more about the QBES subscription, feel free to browse this page: Frequently Asked Questions.

In case you have any other QuickBooks concerns or queries. Please don't hesitate to reply below. Have a good one and stay safe.

You should consider buying a QBD 2023 Gold subscription to have Payroll features instead of Silver. I also don't recommend buying a new license from a reseller like Office Depot. Once you run into problems with the license, they won't help you at all. Consider buying it through an authorized partner (QSP) and you will also get up to 20% discount perpetual on renewal.

Good afternoon

We have had a problem in QuickBooks.

A part of the bills was deconfigured and does not allow them to be edited, we do not know if it was with the updates we made from QuickBooks Desktop Pro 2020 to QuickBooks Desktop Pro 2023 /.

Thank you for coming back to this thread, @BSDUSA.

Can you share which part of your bill this issue occurs? It would be better if you attach a screenshot so we can better see how to fix it.

Since you mentioned this happens after your update, I recommend performing verify and rebuild on your data. To find out if there's an issue in your company file and fix them.

Let's first verify your company data.

Next, Rebuild your company file data.

To learn more about the QBDT 2023 update, you can read this article: Firm of the Future: New and improved features in QuickBooks Desktop 2023.

Click the Reply button if you have additional questions about managing your QBDT account. I'll be happy to assist you. Have a blissful day, and stay safe.

Good afternoon

We did the entire process that he sent us and we had no solution, we consider that it got worse .

We did the process as recommended on Friday and Verify Results came out then the repair was done and supposedly some files were repaired as I show you in the attached reports.

When checking QuickBooks in Pay Bill, many files from previous years appeared (As I show you in the images).

Hello there, @BSDUSA.

Let me provide additional troubleshooting steps so you can edit a bill in QuickBooks Desktop.

I suggest we can delete and recreate the bill to check if it is damaged. Before making the changes, I'd recommend creating a backup copy of the company file. Once done, recreate the same bill.

If the issue persists, try one more troubleshooting step, the QuickBooks Tool Hub. This tool can help fix common errors within QuickBooks Desktop. Here's how to download, install, and use the Tool Hub:

Please refer to this article to see how QuickBooks Desktop offers a wide variety of built-in financial reports that provide different perspectives on how your business is working: Customize company and financial reports.

Additionally, I recommend checking out our A/P workflow to help stay on top of your payables and cash flow.

You can always count on me if you need a hand with managing your vendor expenses. I'm looking forward to assisting you again.

The bill does not allow editing or deletion.

Also more than hundreds of errors were generated in bills.

We have tried the other procedure and have really had no results.

Thanks for the prompt response, BSDUSA. Let me make it up to you by making sure you get the best help available so this gets sorted out immediately.

To address this issue right away, I recommend contacting our Technical Support Team since the Community is a public forum, and we'll need to collect some personal information to pull up your account. They can perform a screen-sharing session to investigate this behavior further.

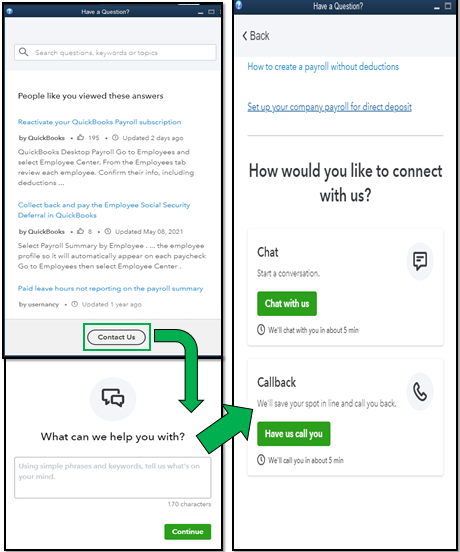

Here’s how to get in touch with our representatives:

You can also see this article for more details, and be sure to check their support hours to know when agents are available: Contact QuickBooks Desktop Support.

Additionally, check out this resource where you can access our self-help articles: QuickBooks Desktop guide. These resources contain topics that will guide you on efficiently handling your taxes, payroll, account information, banking tasks, sales or expenses-related activities, and so on.

I'm always around to lend a hand if you need more help with managing your data or anything else related to QuickBooks. Stay safe!

Thank you so much. On 2 occasions, technical support, I work on the case, but so far no solution, (I feel very frustrated)

Good afternoon

How can I enter QuickBooks as an administrator?

I'm here to guide you on how you can enter an administrator in QuickBooks, BSDUSA.

Administrator supports the smooth running of offices by carrying out clerical tasks and projects. Aside from that, they manage the day-to-day operations of IT systems to ensure that the systems run effectively. They also work with IT managers to make sure that the computer system provides sufficient computing power to deliver the desired level of business performance.

Once you're logged in, you can set up a user as an administrator. Here's how:

For more information and steps with the process, you can go through this article for more details: Set Up QuickBooks Desktop Administrator And Password.

In addition, I've added this article that will serve you as a guide on how to add, edit and troubleshoot user login and restrictions: QuickBooks Desktop Users And Restrictions.

You can always get back to us if you have any concerns about administrators. Remember, we're here to make sure we got you covered.

Good morning

What to do when the opening balance does not match the bank statement ? (Attached image)

Note : This happened because we had problems with the QuicKBooks database . The QuickBooks technicians trying to fix the problem misaligned several values in the accounting , this is one of them . ( There is is a difference )

Thanks for keeping us posted about your concerns in this thread, @BSDUSA.

I'll help you fix your opening balance so you can proceed with reconciling your account in QuickBooks Desktop (QBDT).

To start, let's check first if any discrepancy occurs caused by the issue you had encountered previously. We can do so by running various reports such as Reconcile Discrepancy, Audit Trail, and Previous Reconciliation reports. After that, we begin correcting these discrepancies by performing various fixes.

There are two ways to fix this. First, you can undo the previous reconciliation and redo it to correct the transactions entered:

Another way around it, you can ignore the discrepancy and let QuickBooks enter an offsetting adjustment for you. To complete the reconciliation procedure, choose Enter Adjustment. Then, QuickBooks will automatically create a Journal Entry under Reconciliation Discrepancies, a unique expense account in your Chart of Accounts.

Additionally, I'm adding this article for your reference about fixing opening balances: Fix beginning balance issues in QuickBooks Desktop.

Let me know if you have more queries about opening balances or the reconciliation process in QBDT. I'm always here to help. Have a great day!

Good afternoon

We are having problems doing Backup (files are damaged)

My question is this :

What is the difference between making a Backup or a portable company file? (Can I consider this last one as a Backup in case of a problem in QuickBooks?)

We are also subscribed to the QuickBooks online automatic backup platform. Is this enough to keep a safe copy of our files in case of a problem with quickBooks?

Can you please tell me where you were able to purchase QBDT 2023 Pro? Thank you!!

I tried to do just this. There is no option to upgrade to Desktop 2023. Can you please assist me in getting QBDT 2023 Pro to upgrade to? Thank you!!

Have you tried to call Sales team directly? If you hit the wall, I can help to obtain the license.

Yes I have hit a wall. No one wants to let me upgrade to this version. I greatly appreciate all assistance!

Click on my profile name and you will find our website address to send an email to.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here