Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I get the form to prefill the State with ID number to print when I do 1099 forms. I live in Wisconsin so it is mandatory. Thank you.

Solved! Go to Solution.

Hi @Lynndr1,

Currently, there isn't an option to automatically pre-fill your 1099 Misc forms with the State ID number.

With this, you'll have to manually enter them when you prepare and file your 1099 Misc form. Here's how:

Once done, you can now prepare and file your 1099 Misc form including your state ID number.

For your reference, I've included a screenshot below and a guide in preparing and filing your 1099 Misc form.

Please let me know if you have any other questions about 1099s in the comment section below. I'll be always around to help you out.

Hi @Lynndr1,

Currently, there isn't an option to automatically pre-fill your 1099 Misc forms with the State ID number.

With this, you'll have to manually enter them when you prepare and file your 1099 Misc form. Here's how:

Once done, you can now prepare and file your 1099 Misc form including your state ID number.

For your reference, I've included a screenshot below and a guide in preparing and filing your 1099 Misc form.

Please let me know if you have any other questions about 1099s in the comment section below. I'll be always around to help you out.

Thank you for the information.

Thank you for the helpful information.

I understand there is no prefill for box 17, but how do I track employee state tax that I will withhold?

Thank you for your help!

Thanks for joining this thread, khite.

I'm here to help guide you on how to track your employee's state tax in QuickBooks Desktop.

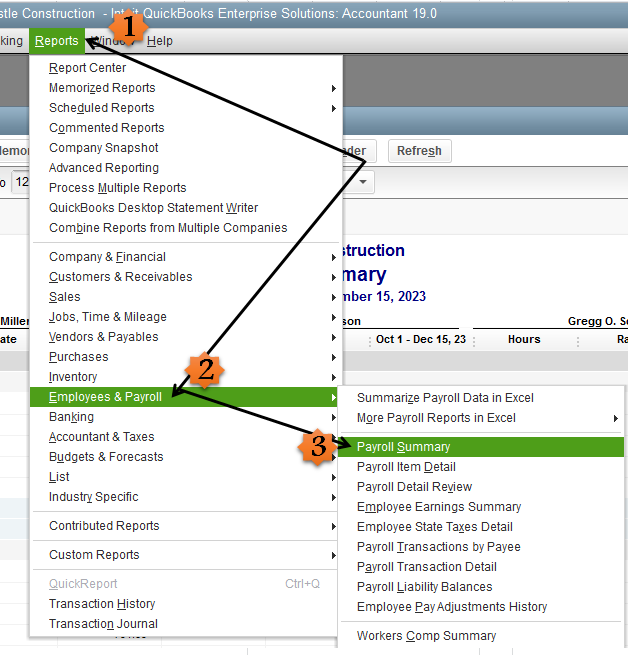

To track your employee's state tax, you can pull up the Payroll Summary report. It shows your employee's payroll transaction, including taxes information.

Here's how;

For additional reference, you may want to check these articles:

Please know that you're always welcome to post if you have any other questions about the 1099 Misc forms or payroll taxes. The Community team will always here to help. Have a good day ahead.

So I add them as an employee and not a vendor?

Hello there, @khite,

I'll share some insights about the differences between an employee and a vendor.

An employee is someone you pay with paychecks, withhold taxes, and give a W-2 form at the end of the year. He/she completes each of the following forms:

For more information, please read through this article: Employees Overview. You can also check out the IRS guidelines about an employee category.

On the other hand, a vendor is someone that you pay money to, such as utility, landlord or subcontractor, who does work for you. Please see this article for more details: Vendors Overview.

Before setting up a 1099 vendor in the program, please visit the IRS guidelines to see if your vendor falls under the Independent Contractor category.

This will get the information you need for today, @khite.

If I can be of further assistance, please let me know. I'll gladly help. Cheers!

Hello! and thank you for helping me.

This is a Contract Employee has been for sometime.

She has asked me to take State Taxes out for her, I have checked with the State and I have the deposit portion all situated. My question is this. How do I do this in Quickbooks? Because it will be a wash for us.... do I need to add a fee item - income and expense? Do I add her as an employee or just leave her a vendor a allocate her check accordingly.

Thank you again, Kathleen

Thanks for getting back to us, @khite.

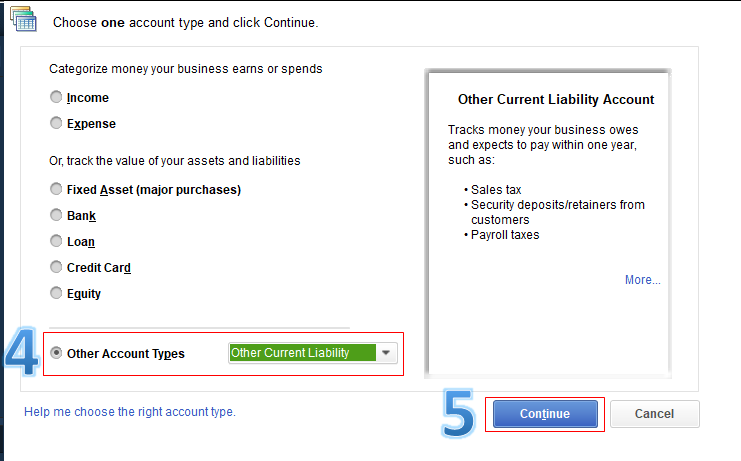

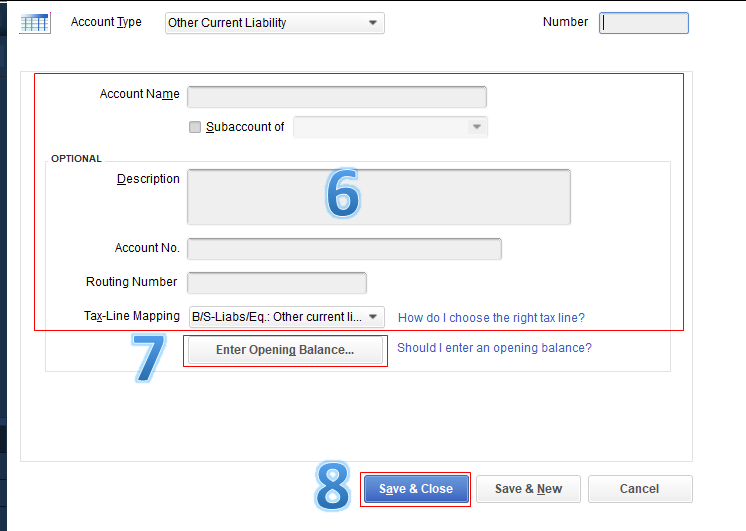

You can set up your contract employee as a vendor. Then, create an Other Current Liability account to track the money you paid for state taxes when creating a check. However, I'd still suggest consulting your accountant to confirm which account you'll use to ensure your books and taxes are accurate.

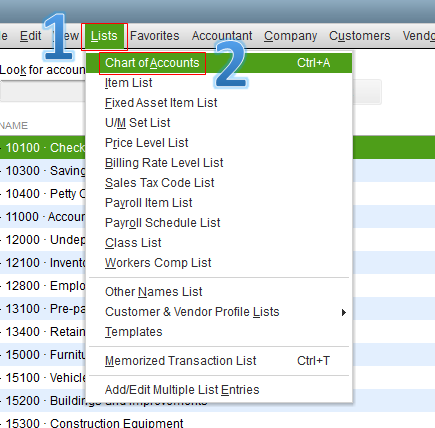

Here's how to add an account:

You can check out this article for more information: Chart of Accounts.

Then, make sure to turn on the 1099-MISC feature by performing the steps provided by JonPril_L above. Once done, you can set him/her up as a vendor. Here's how:

For more information, here's a great article you can refer to: Set Up A 1099 Vendor and Print Forms.

This will get you going, @khite.

I'm here anytime you have other concerns. Have a good day.

Thank you for all the responses. I understand Quickbooks quite well but I was trying to find out if there was a way to have the 1099 prefill the Tax ID box and state letters of WI. From my understanding there are two states that are required to prefill that information on the 1099 forms with Wisconsin being one of them. I have had to do corrections for the last 2 years because I forgot about manually putting this information in. It seems like this is something that has to be done manually.

Thanks for getting back to us, @Lynndr1.

Wisconsin and New Jersey are the two states that require their withholding ID on the 1099-MISC Form. At this time, setting QuickBooks to pre-fill the information is unavailable.

Refer to this article to know more: Form 1099-MISC for New Jersey and Wisconsin.

In the meantime, you have to manually enter the WI withholding ID on every form to avoid penalties. Rest assured, I’m taking note of this and passing it along here on my end.

While we continue to make your experience with us even better, I recommend checking the newest features of QuickBooks Desktop by following the steps below:

That should do it. Let me know if you have any other concerns. I’m always here to help. Have a good one!

Hi! I thought I would find a solution here. Unfortunately, I enter our WI Withholding account into each 1099 form, as you advised and illustrated, however, the number is not printing into the "Account number (see instructions)" field. Is there another work-around?

Hello @muravich! Thanks for reaching out to the Community about your 1099 form. Since those steps didn't work for you, I'd suggest contacting support directly. That way they can look with you in your account and figure out why that field isn't populating. Here are those steps:

If you have any other questions, don't hesitate to reply to this chat. All of us here in the Community are happy to help. :)

Wisconsin-When I'm entering state & Payer's State No. in "Verify you 1099 info" to print on my 1099-NEC, that field outlines in red and does not print Box 6. What am I doing incorrectly?

How do I enter on every form?

Enter the WI State ID number without the dashes and it should print

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here