So glad to have you as a part of the Intuit Family, @kingslodg.

Managing a business is busy enough without the tax filling aspect involved. QuickBooks is designed to make accounting and tax filling faster and easier. I’d be delighted to share some information on how tax filling works in QuickBooks Self-Employed.

For starters, QuickBooks Self-Employed is an online solution for the self-employed individual to manage and categorize your self-employed business finances through an online account. Each QuickBooks Self-Employed account can only be used to support one self-employed individual or self-employed business and can only generate one Schedule C when filing the annual tax return (1040).

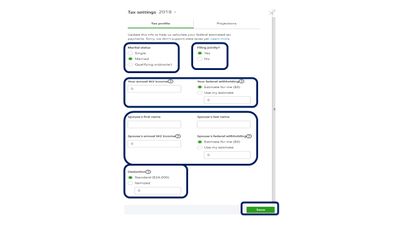

In addition to categorizing your transactions, you’ll also need to tell QuickBooks what your tax situation is by filling out the Tax Profile. Do you have W2 income or any other income? If you’re filling your taxes jointly with your spouse, make sure to enter her information in the Tax Profile setting. The Tax Profile (located from the gear icon) helps us calculate your taxes based on your tax bracket.

To help you prepare for the prepare for the tax filling, here’s a step-by-step instructions: Guide to Filing Taxes for the Self-Employed.

For additional insights, you may check out these articles:

Be sure to visit QuickBooks’ tax tools and the tips in our tax guides, filing will be a breeze as well: https://community.intuit.com/browse/quickbooks-self-employed-year-end.

Feel free to click the Reply button if you have other questions about QuickBooks Self-Employed. I’m always here to lend a hand.