Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a company file that shows an old payroll liabilities balance on the balance sheet. This balance was carried over from an old Quickbooks company file when using the Quickbooks condense data utility function. The balance does not show up as an option to pay/adjust under the pay payroll liabilities. I can see in the old Quickbooks file that a portion of the liabilities that make up the balance were entered as expense checks rather than by using the pay payroll liabilities. When the Quickbooks file was condensed a very large journal entry was created, but it is difficult to determine how to adjust that journal entry to remove the incorrect payroll liabilities balance that is showing (edit: jounral entry related to condense function cannot be edited). I'm looking for the best (and easiest) way to correct this issue.

Hi there, @swan12.

I'm here to make sure your books are reporting correctly. Can you clarify what QuickBooks Desktop version you're using? The updated Condense feature provides an option to remove the audit trail which reduces your file size but leaves all the detailed transactions, unlike the traditional File Condense feature which removes transaction detail and creates a consolidated journal entry for data prior to the selected date.

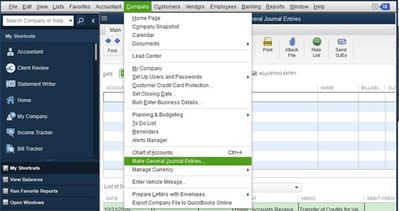

We recommend creating a journal entry to adjust your payroll liabilities. This works best especially if your books are already closed for that specific year.

Here's how:

As always, we suggest reaching out to your accountant before creating any entries. They'll help you with categorizing the transaction accurately.

Let me also add our guide on creating a journal entry in QuickBooks Desktop for more information.

If you need additional references about payroll in the future, please feel free to access our site: Help articles for QuickBooks Desktop Payroll.

If there's anything else that we can do for you, please keep in touch. We're just around to help you.

The current version is Quickbooks Premier 2020, but the condense function was done in 2013 and I'm not sure what version of Quickbooks was used at that time.

The current version is Quickbooks Premier 2020 desktop, but the condense function was run in 2013 and I'm not sure of the Quickbooks version used at that time. I believe that the traditional condense feature was used. The condense feature was run and a new company file was created. Transactions prior to the condense function being run can only be accessed by opening the old Quickbooks company file. If we were to make the necessary corrections in the old company file the corrections would not appear in the new company file. Any adjustments we make in the new Quickbooks company file will not be matched to the correct accounting period - they would affect 2013 rather than the previous periods/years they apply to.

We need to reduce the payroll liabilities in the current Quickbooks company file but I'm not certain what the appropriate offsetting credit entry would be in this situation.

Hello there, swan12.

Before condensing your company file, you should have created a backup copy of your company file. Meanwhile, it doesn't matter what QuickBooks version was used when transferring balances from one account to another.

LieraMarie_A's response should be able to help you enter the adjusting entries. If you're unsure of what accounts to affect with, I'd recommend consulting your accountant. They know what accounts to use to offset the balances. Also, they know what's best for you and your books.

Let us know if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here