I'll help you record the EFT payment you received and its back charge credit, Psfnaz.

If you have already created an invoice, you can receive the payment in full amount.

Then deposit this payment to Undeposited funds.

To deposit the amount, follow the steps outlined below:

- Click + New.

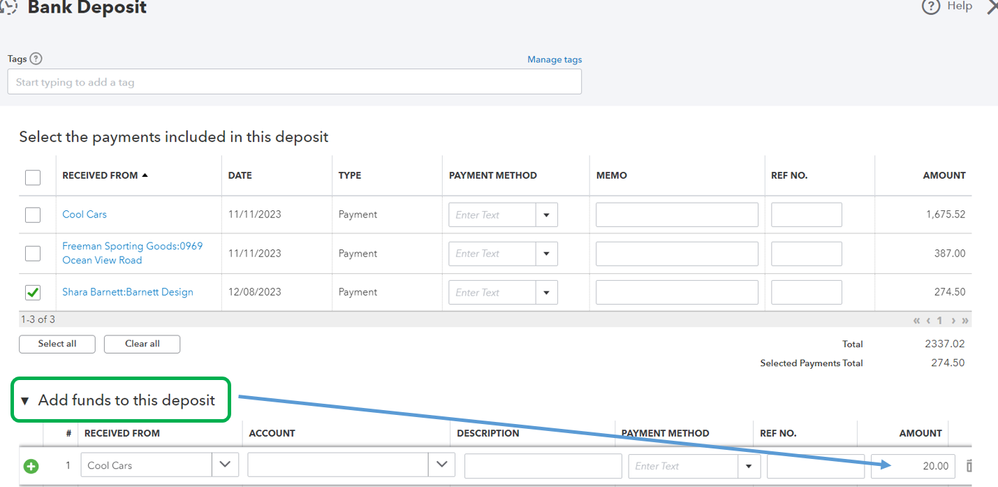

- Select Bank Deposit.

- From the Account ▼ dropdown, choose the account you want to put the money into

- Select the checkbox for each transaction you want to combine.

- Make sure the total of the selected transactions matches your deposit slip. Use your deposit slip as a reference.

- Under the Add funds to this deposit section, enter the amount of the back charge.

- Hit Save and close or Save and new.

Once done, make sure to match the correct amount.

In addition, to make sure the amounts match your bank statement, review your account to ensure your bank and credit card statements are accurate. You can also go over in this article for reference: Reconcile An Account In QuickBooks Online.

Let me know if you have further concerns when recording the back charge. As always, we're always right here to assist you at any time of the day.