Thanks for checking this out in the Community. Allow me to answer your questions about tracking expenses in QBO, kndzpntnr.

Bill is normally used if you already receive an item or service that will be paid at a later date. On the other hand, an expense is recorded in QBO if the fund was sent at the time of the purchase. In other words, the transaction was paid at the same time you received the goods or services.

Additional details about their differences and similarities are discussed in these articles:

If you already received the items but will be paid later, then you are correct in using a bill. Although, I would still recommend reaching out to your accountant for additional advice on this matter.

With regards to your second question, you are also correct in just marking the bill as closed when the payment is already made. The connected account will not be deducted since you are only recording the payment in the program. Use these steps on how to record bill payments that are sent outside of QBO:

- Open the bill that you already paid.

- Click Mark as paid.

- Select the right account in the Bank/Credit account field.

- Uncheck the box for Print later, then type in the reference or transaction number.

- Choose Save and close or Save and new.

If you're using Online Banking, you can also match the bill payment once it's already downloaded in QBO. Here's how:

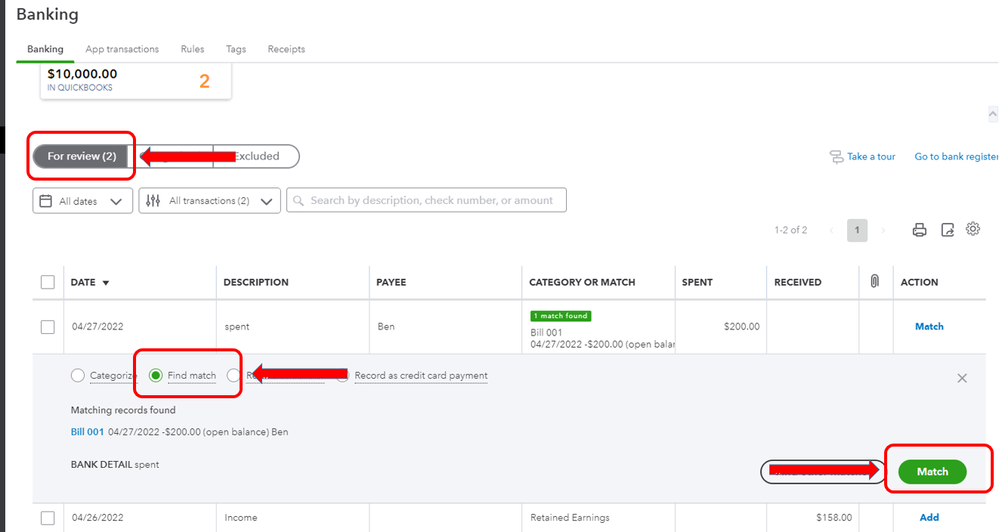

- Go to the Transactions menu and proceed to the Banking tab.

- Look for the bill payment under the For review tab.

- Click Find match and look for the bill.

- Select Save or Match.

Here's an article for more details about this option: Categorize and Match Online Bank Transactions in QuickBooks Online.

Let me know if that's all the information you need about recording bills and expenses in QBO. I'd be glad to get back here if you have follow-up questions.