Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn QBDT Premier Plus Contractors Ed, 2024,

I need to record a fraudulent transaction in which we tried to purchase a tool on FB market place and was scammed = we paid the money, but never got the tool.

Can we follow the same procedure to write this off as a bad debt?

I created an Expense Account, called Bad Debt.

But, it's not a Customer, it's a "Vendor" (I use this term lightly)

What are the steps to record a Bad Debt created by a Vendor, as opposed to a Customer, please?

PLEASE don't tell me to ask my accountant! I need an answer from this community - this IS the Q & A forum, is it not?

Thanks in advance for any insight you can give me.

Solved! Go to Solution.

Yikes, sorry for the loss. Technically, it's not a bad debt expense. That applies to uncollectible receivables. It's certainly a legitimate expense and should probably be recorded as 'Fraud Expense' or something similar. It's really up to you what operating expense account you want to use. Whatever expense account that, assign that to the bill used to pay the "vendor" and you should be all set.

Thanks for dropping by the Community forum. I see you want to record a fraudulent transaction in QuickBooks Desktop. I'll share information and guidelines to help you successfully record this transaction.

When invoices you send in QuickBooks Desktop become uncollectible, you need to record them as a bad debt and write them off. Here's a step-by-step guide:

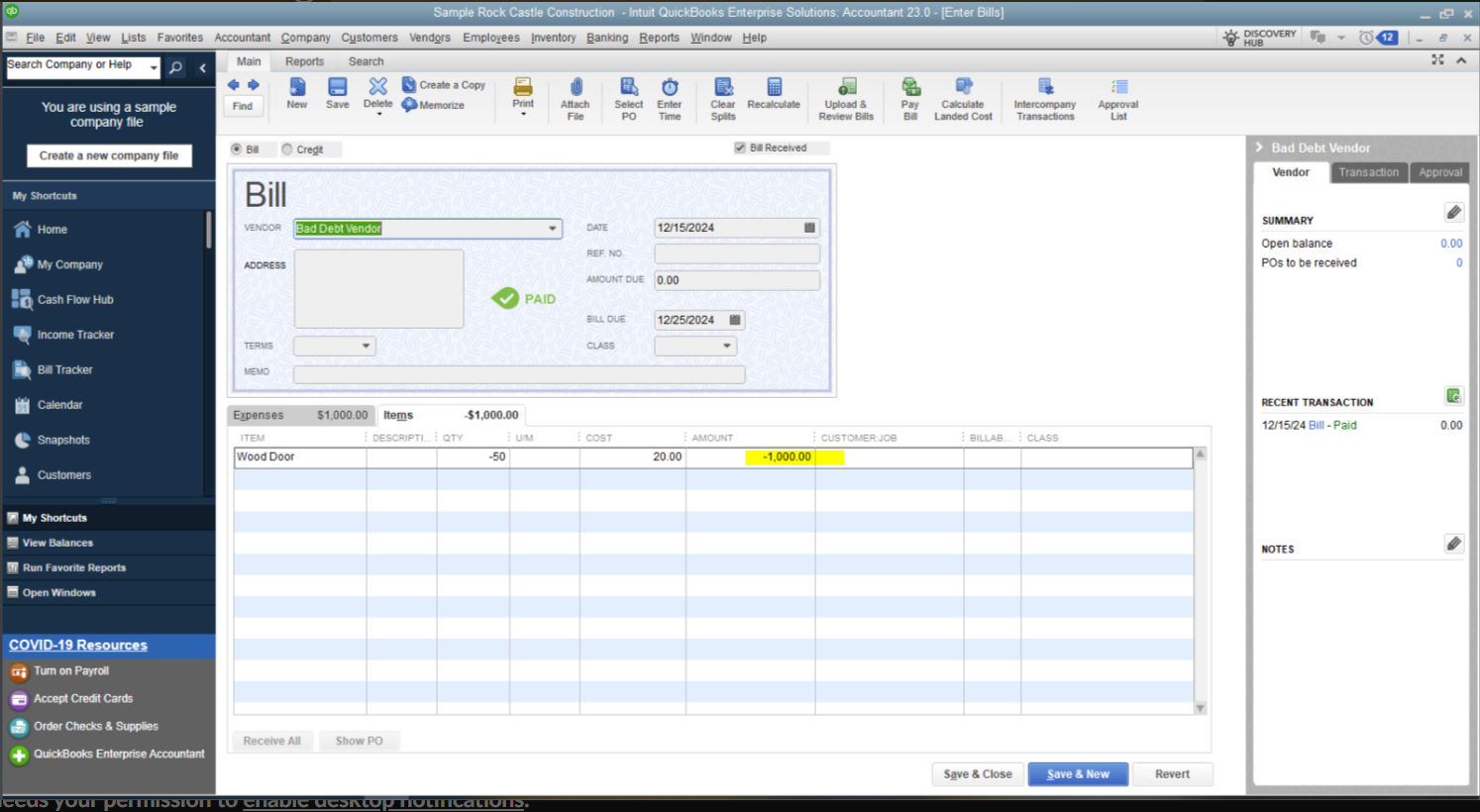

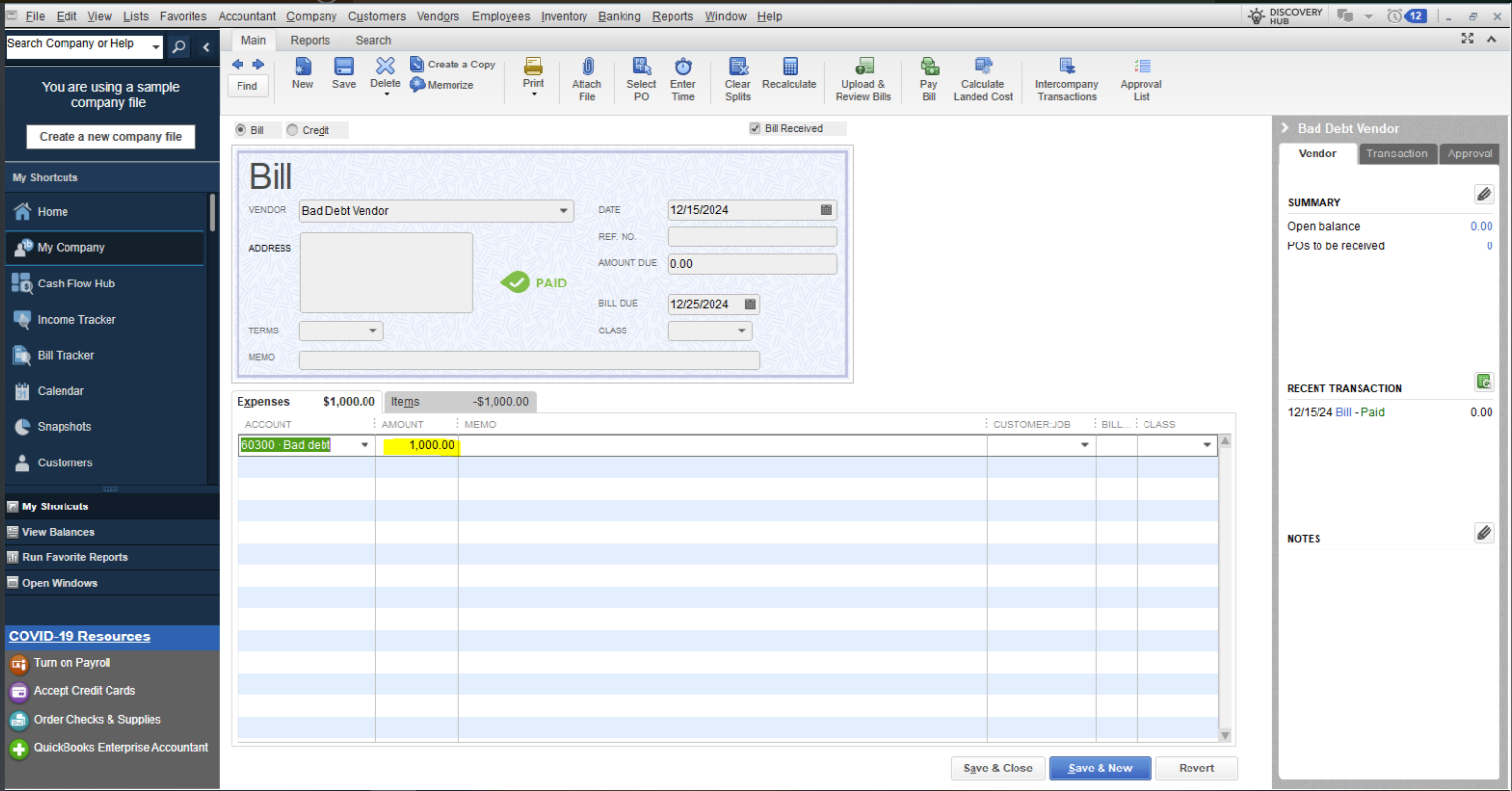

First, ensure you have an Expense Account for Bad Debt (which you've already created). Then, create an Expense/Check:

I'm adding these articles you can use in the future:

By following these steps, you can offset the items in the inventory you haven't received. If you have more questions about managing your transactions, post them here in the forum. I'll be sure to answer them ASAP! Have a great day ahead!

Yikes, sorry for the loss. Technically, it's not a bad debt expense. That applies to uncollectible receivables. It's certainly a legitimate expense and should probably be recorded as 'Fraud Expense' or something similar. It's really up to you what operating expense account you want to use. Whatever expense account that, assign that to the bill used to pay the "vendor" and you should be all set.

JamesAndrewM:

Thanks for trying to help, but I'm not convinced this is the correct solution.

We don't track inventory at all, at any rate.

Best,

Rainflurry,

Thanks for the reply to this question. I appreciate the clear cut solutions you always present here.

Best,

Victoriah

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here