Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIs the tax payment marked as paid manually, thewell?

If so, you can delete it on the prior tax history page. Here's how:

Once done, the federal tax amount will appear on your Pay Taxes page.

Here's an article about paying taxes in QuickBooks: Pay and file payroll taxes online.

Let me know if you have other concerns, I'll be glad to help.

Unfortunately I do not have a drop down menu next to Edit for some reason.

Hello there, @thewell.

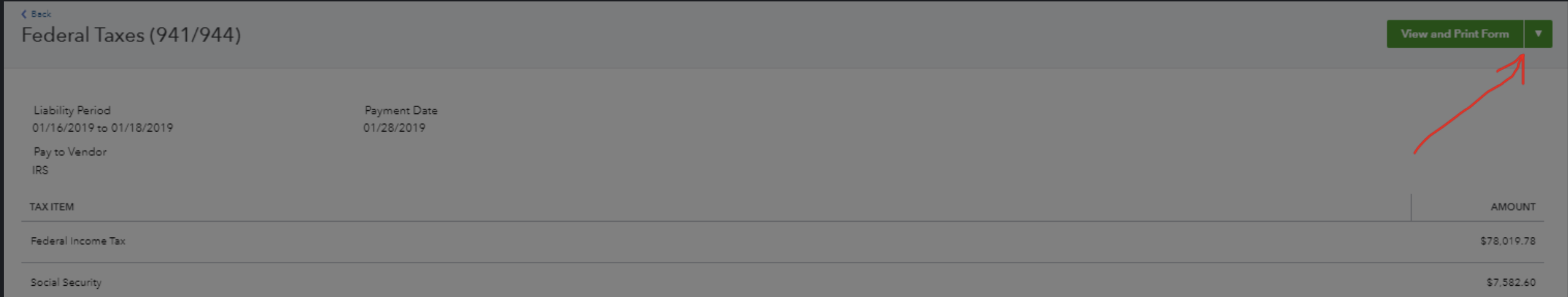

To delete, there should be a drop-down at the top left of the screen when you open the Federal Tax payment. I have attached a picture to show you where you can select, and then click Delete.

Let me know if you have issues finding this! If you can include a screenshot of what you're seeing, that would be helpful in determining the next steps.

Yep, I did not have that drop down available to me. Their system marked it as paid when they attempted to make an electronic payment. That payment did not go through so Quickbooks customer support had to mark it as unpaid on my behalf.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here